The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Brief Comment】

【Brief Comment】

【Market Heat】

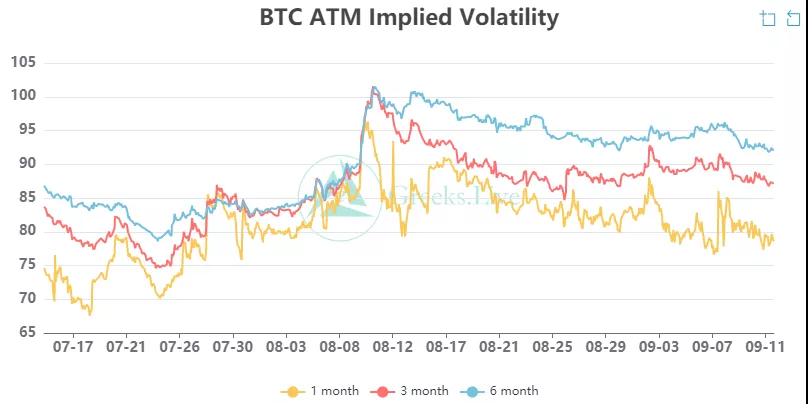

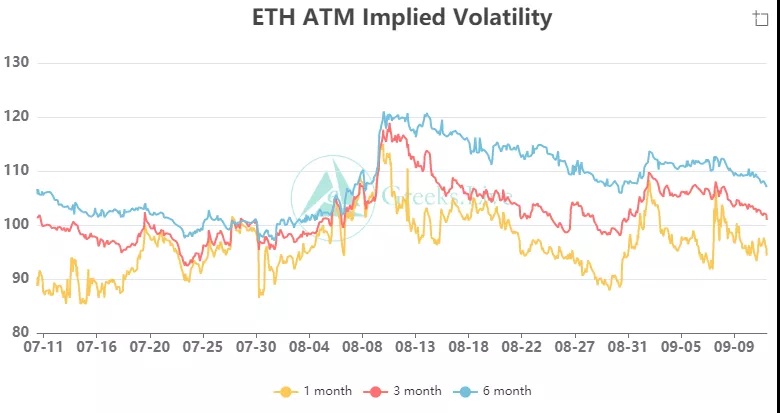

At the beginning of this week, Bitcoin broke through $50,000 like a rainbow, but as mentioned in the broadcast, the main period IV did not see a significant rise, and there was no obvious follow-up trend when breaking through the key points. Instead, a large number of call options were sold in large volumes. At the same time, Ethereum has remained below $4,000 for many days, and the bullish selling power is strong. On the 7th, BTC experienced a sharp drop of 10,000 dollars, and the IV only rose slightly. After that, the price went down, and the IV has also been falling.

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "

The above parameters are indicators used by individuals to observe the market heat. For details, please refer to the previous article "Currency Valuation Indicator: Reddit Followers Token Price Ratio》

【BTC Options】

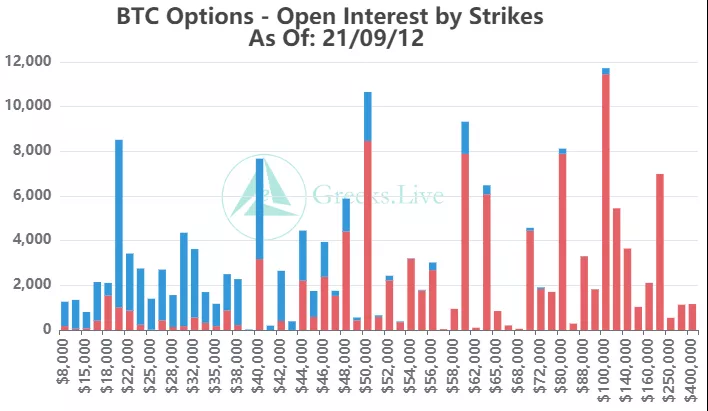

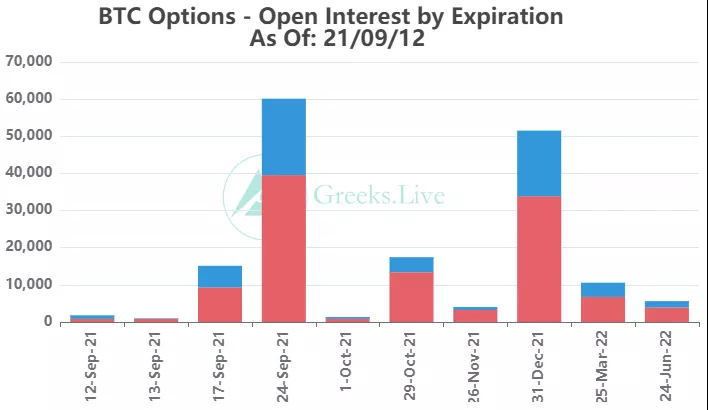

The open interest of options is 169,000, worth 7.6 billion US dollars, and the trading volume of options is 7,000.

【Historical Volatility】

10d 82%

30d 69%

90d 73%

1Y 79%

【IV】

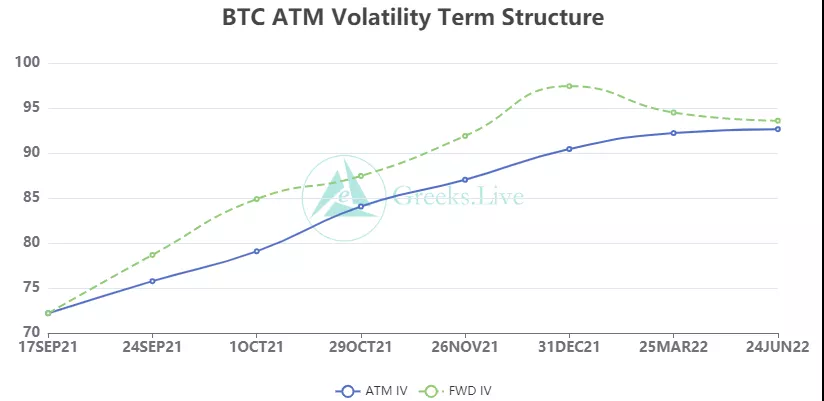

Implied volatility for each normalized term:

【Historical Volatility】

9/11:1m 82%, 3m 90%, 6m 93%,DVol 90%

Today: 1m 82%, 3m 89%, 6m 92%, DVol 90%

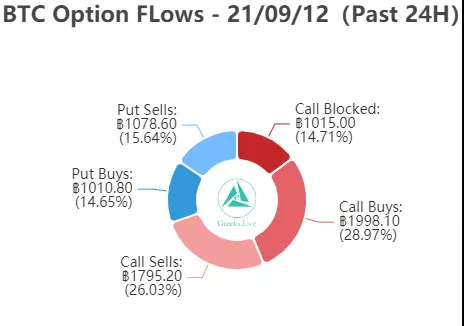

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

【Option position distribution】

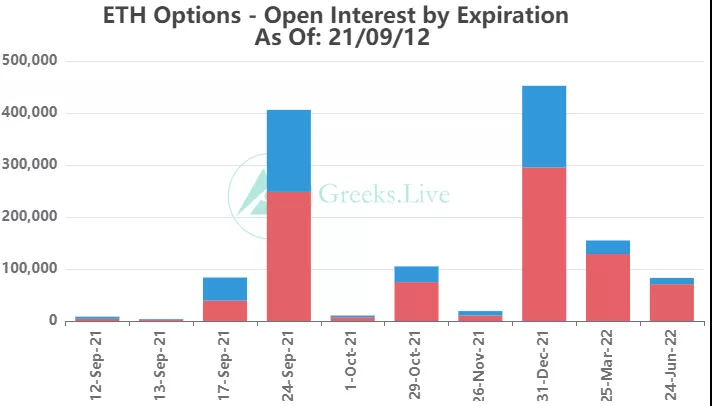

The open interest of Ethereum options is 1.33 million, worth 4.4 billion US dollars, and the trading volume is 40,000.

【ETH Options】

The open interest of Ethereum options is 1.33 million, worth 4.4 billion US dollars, and the trading volume is 40,000.

【Historical Volatility】

10d 117%

30d 91%

90d 93%

1Y 108%

【IV】

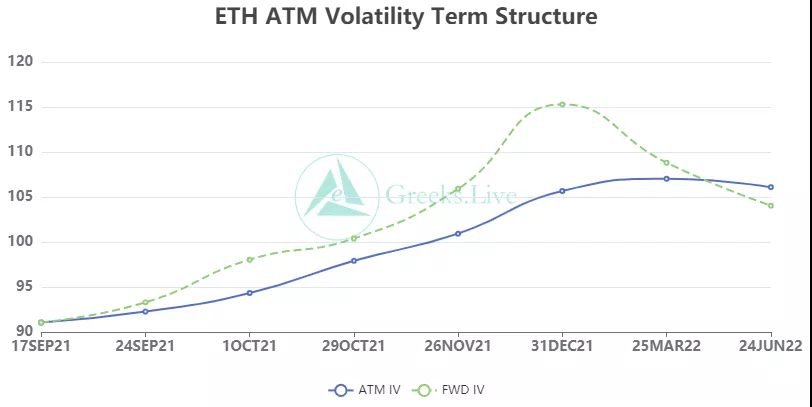

Each standardized period IV:

【Historical Volatility】

9/11:1m 97%,3m 106%,6m 109%,DVol 103%

Today: 1m 97%, 3m 104%, 6m 107%, DVol 105%

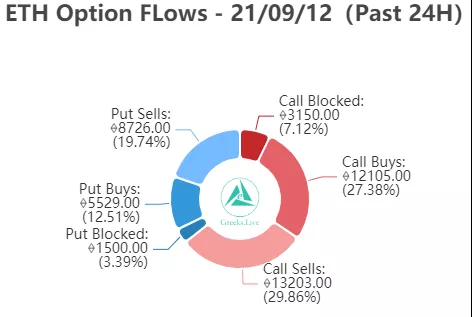

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

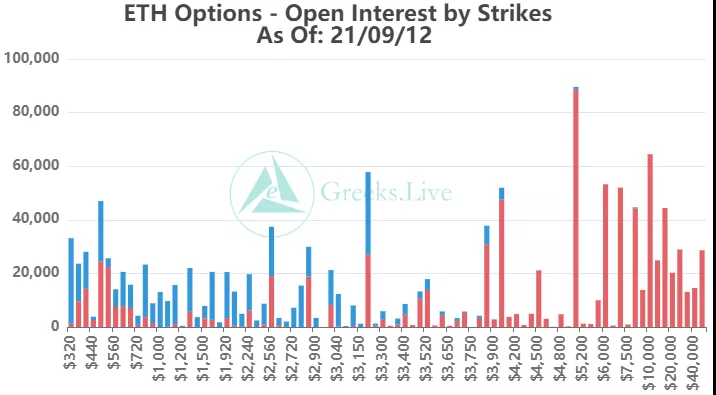

【Option position distribution】

From the perspective of Option Flows, the trading volume on the 7th hit a new high in three months. There were more call options sold on the day, and the follow-up transactions have always been more call options. However, the total trading volume of call options and put options is not much different. Generally speaking, there are more shallow out-of-the-money transactions this week, and there is no obvious market most of the time. In addition, many large transactions were concluded near the delivery, focusing on ultra-long-dated call options, which will be deeply out-of-the-money calls next year, with the highest strike price as high as $30,000.