The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

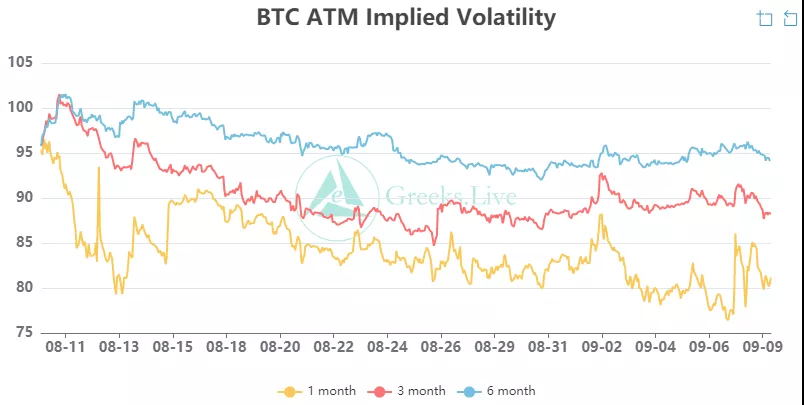

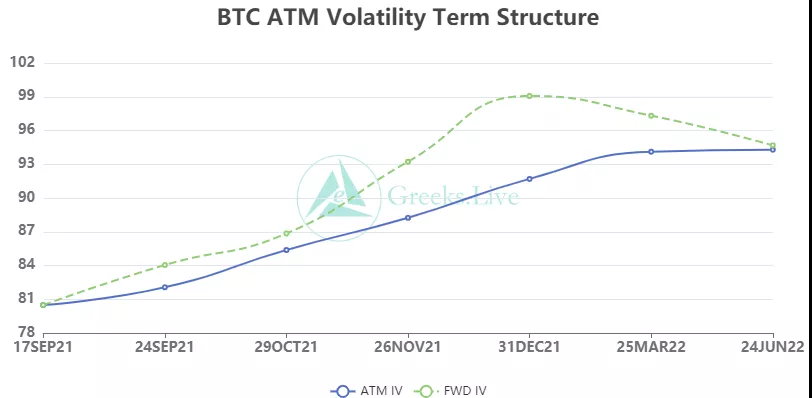

The market reacted little to this round of decline, and the decline slowed down. The IVs of the main periods all fell, and even the IVs of several periods were lower than before the decline. The trading volume of ultra-short-term options has dropped significantly, buyers are not enthusiastic, and the market is in a strong wait-and-see mood.

【Market Heat】

【Market Heat】

The settlement price of Bitcoin yesterday was 45,303 US dollars, the price ratio of Reddit fans was 73, and the annualized growth rate of fans compounded in seven days was 44%

The above parameters are the indicators used by individuals to observe the market heat. For details, please refer to the previous article "Coin Valuation Indicators: Reddit Fans Currency Price Ratio"

【BTC Options】

【Historical Volatility】

【Historical Volatility】

10d 83%

30d 71%

90d 73%

1Y 79%

【IV】

Implied volatility for each normalized term:

Implied volatility for each normalized term:

9/8 :1m 86%, 3m 92%, 6m 96%,DVol 95%

Bitcoin's decline has eased, and it oscillates around $46,000, but the shock center is constantly declining. The market has not yet reached the point where it will stop falling, and it is currently closing at $45,700. RV rose from 50% to 63%. The IV of short-term and short-term put options rose significantly, but the overall IV was relatively stable, and the medium- and long-term IV even dropped slightly compared to the previous few days.

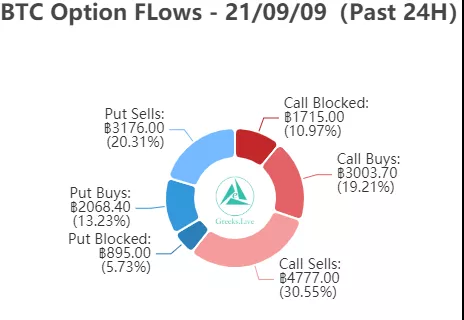

【Option Flows&Bulk Transaction】

According to the Option Flows data, the proportion of selling call options has risen to 30%. The huge market has not increased the IV, and the buyer has no willingness to trade, and the wait-and-see mood is strong. The larger transaction comes from short-to-medium-term shallow out-of-the-money options, but the transaction of ultra-short-term options has dropped a lot, and the delivery is about to enter, and the whole market is waiting and watching.

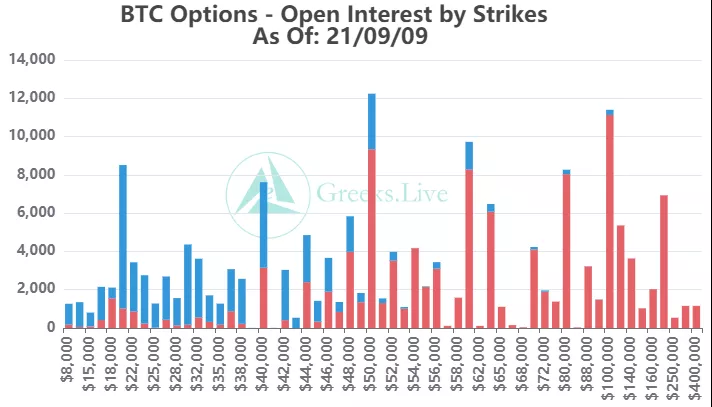

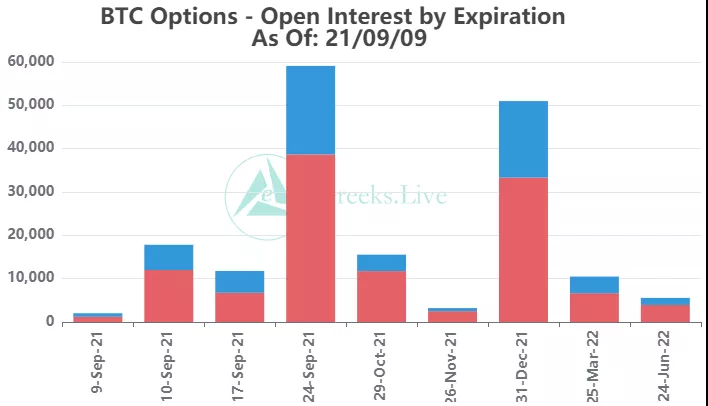

【Option position distribution】

The September option position is about 59,000 coins, of which the call option is about 39,000 coins.

【ETH Options】

【Historical Volatility】

【Historical Volatility】

10d 115%

30d 91%

90d 94%

1Y 109%

【IV】

Each standardized period IV:

Each standardized period IV:

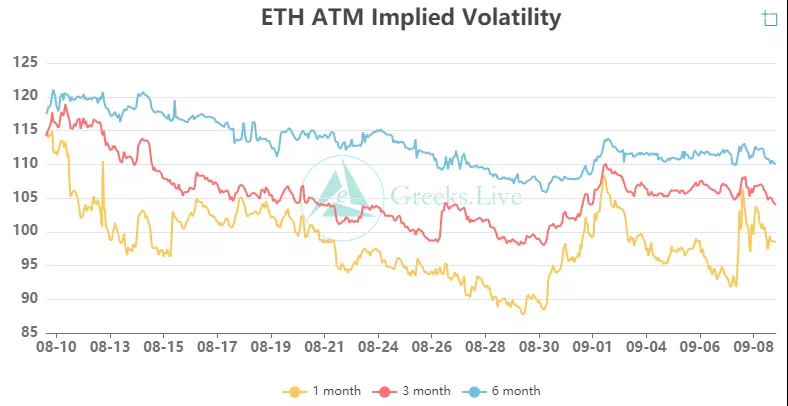

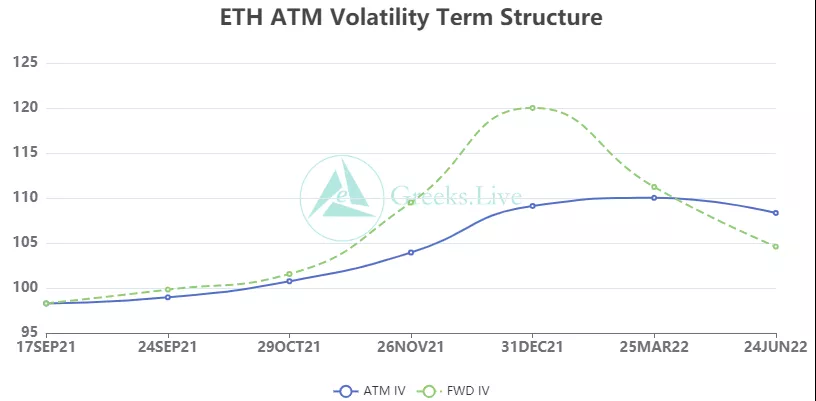

9/8 :1m 102%,3m 109%,6m 112%,DVol 109%

The decline of Ethereum was not as violent as that of Bitcoin. After the sharp drop at 22 o'clock the day before yesterday, it has been trading sideways around $3,450, and the price is still significantly higher than last month. The market preference is shifting to put options, the par value IV has not changed much, the out-of-value call price is declining, and the short-to-medium term Skew has been positively biased. According to the data in the options market, the market has little expectation for a rebound.

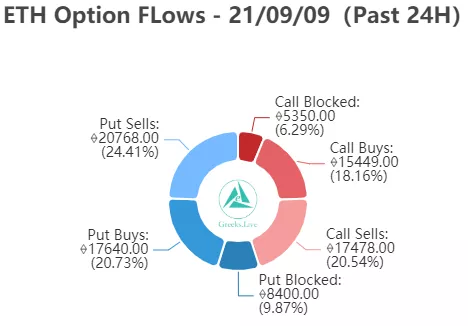

【Option Flows&Bulk Transaction】

From the perspective of Option Flows, after yesterday's trading explosion ended, the trading volume of call options dropped significantly, and the proportion of puts increased by 10%. Out-of-the-money put options that expire within one month are more popular, but there are fewer ultra-short-term transactions. This is a clear change from yesterday's ultra-short-term average market, and the market is on the sidelines.

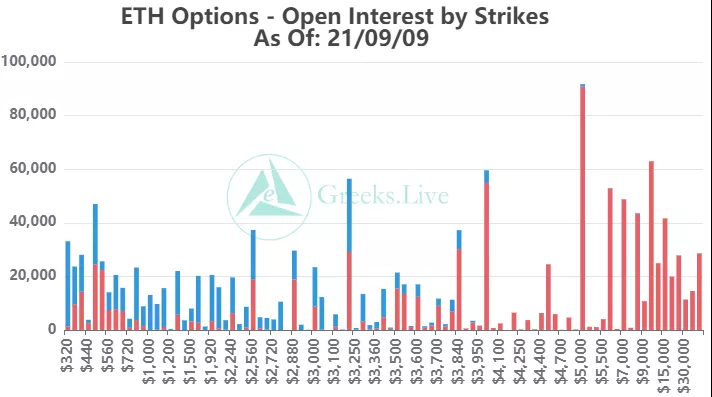

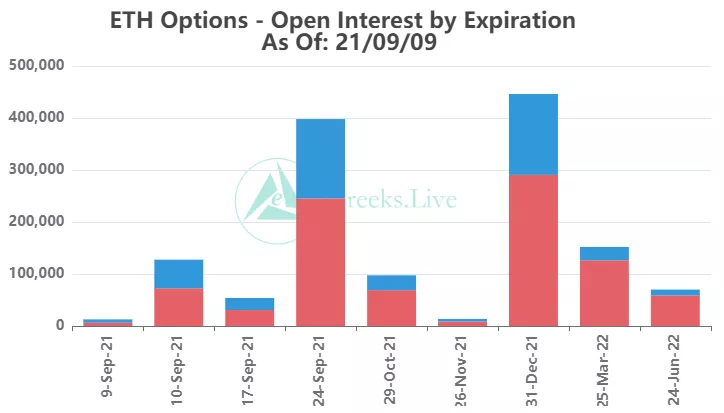

【Option position distribution】

【Option position distribution】