included in topic

The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Weekly review】

【Market Heat】

【Market Heat】

The settlement price of Bitcoin yesterday was 52,355 US dollars, the price ratio of Reddit fans was 70, and the annualized growth rate of fans compounded in seven days was 39%

【BTC Options】

The above parameters are the indicators used by individuals to observe the market heat. For details, please refer to the previous article "Coin Valuation Indicators: Reddit Fans Currency Price Ratio"

【BTC Options】

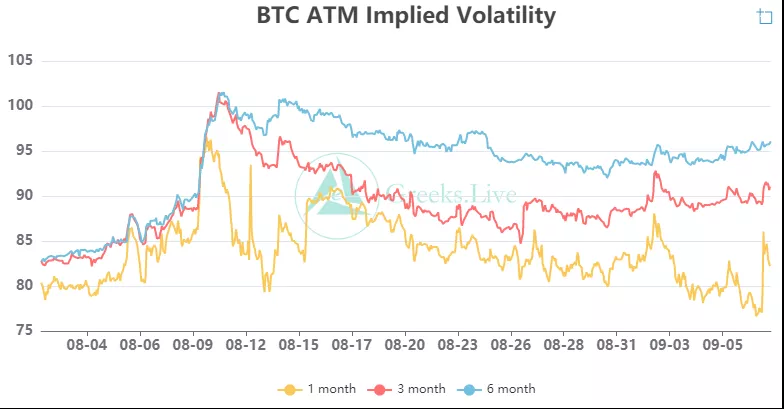

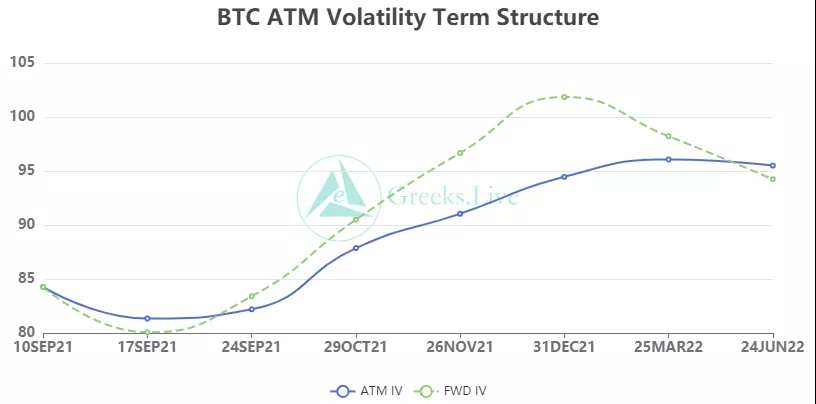

Implied volatility for each normalized term:

【Historical Volatility】

10d 82%

30d 71%

90d 77%

1Y 79%

【IV】

Implied volatility for each normalized term:

Today: 1m 86%, 3m 92%, 6m 96%, DVol 95%

9/7 :1m 83%, 3m 92%, 6m 95%,DVol 92%

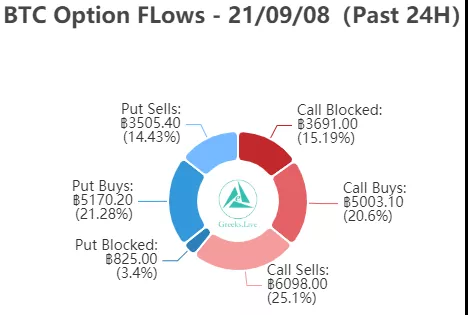

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

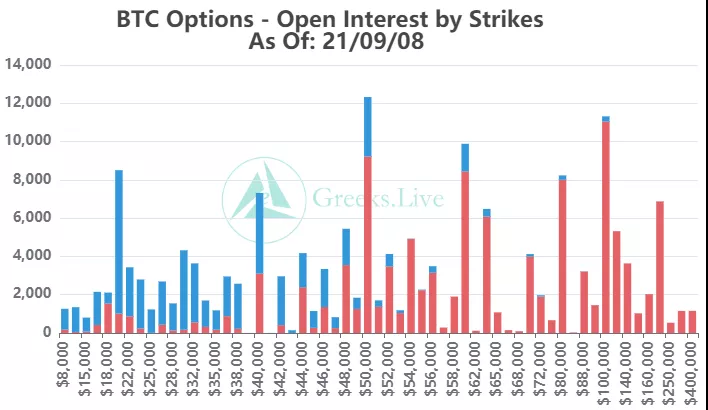

【Option position distribution】

【Option position distribution】

【ETH Options】

【ETH Options】

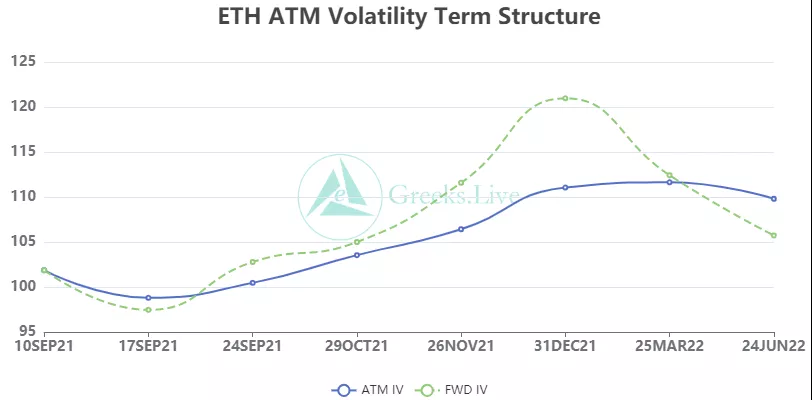

Each standardized period IV:

【Historical Volatility】

10d 115%

30d 91%

90d 94%

1Y 109%

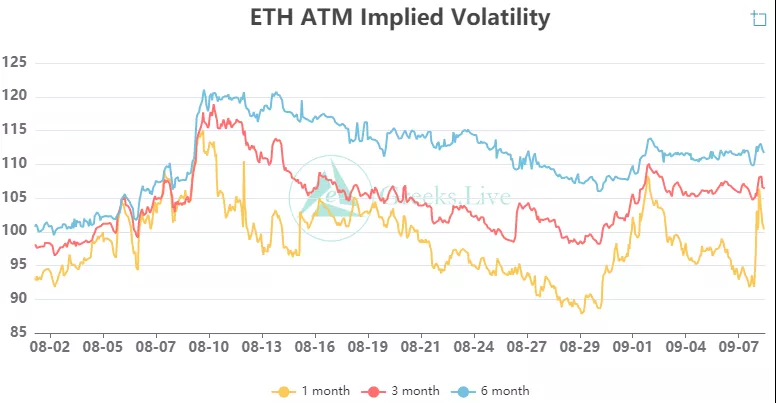

【IV】

Each standardized period IV:

Today: 1m 102%, 3m 109%, 6m 112%, DVol 109%

9/7 :1m 100%,3m 109%,6m 112%,DVol 107%

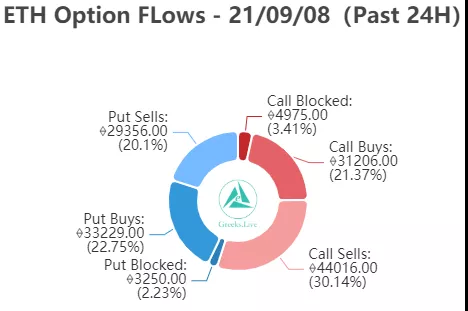

【Option Flows&Bulk Transaction】

【Option Flows&Bulk Transaction】

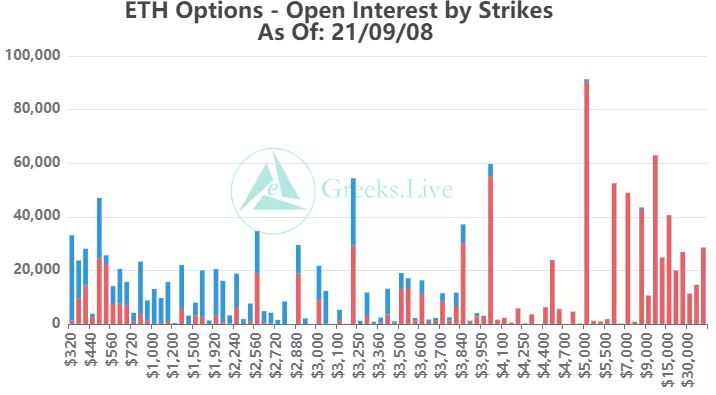

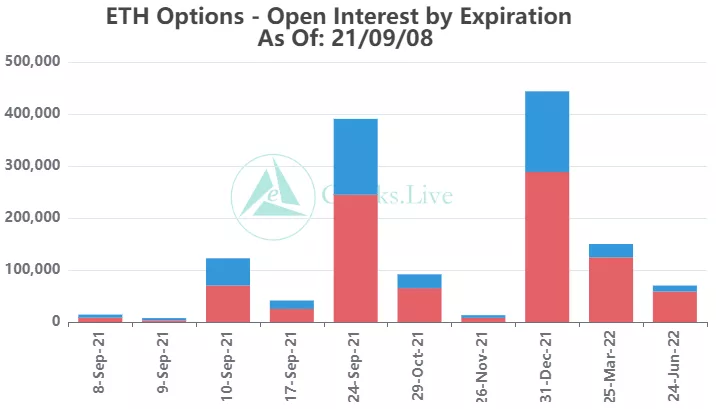

【Option position distribution】

【Option position distribution】

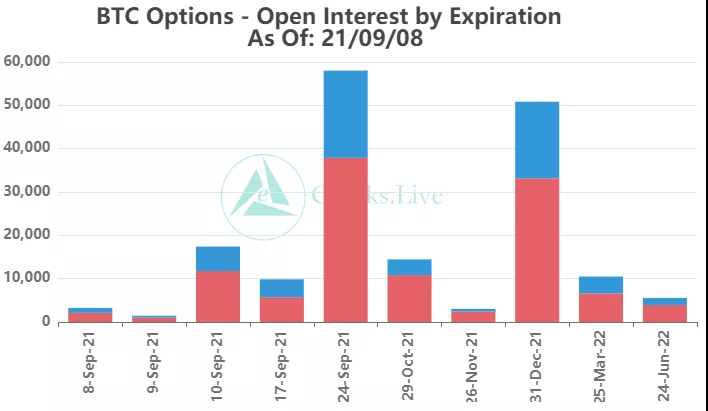

The September option position is about 390,000 coins, of which the call option position is about 245,000 coins, and the position data has not changed much.