included in topic

The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

The broadcast data is provided by Greeks.live Data Lab and Deribit official website.

【Weekly review】

Influenced by El Salvador's official adoption of Bitcoin as a legal tender, the market's preference for Bitcoin has increased. Bitcoin stood firm at $52,000, but there was little market reaction. The trading volume of put options this week exceeded 2,600, and they were mainly at-the-value put options near $50,000.

【Market Heat】

【Market Heat】

The above parameters are the indicators used by individuals to observe the market heat. For details, please refer to the previous article "Coin Valuation Indicators: Reddit Fans Currency Price Ratio"

The above parameters are the indicators used by individuals to observe the market heat. For details, please refer to the previous article "Coin Valuation Indicators: Reddit Fans Currency Price Ratio"

【BTC Options】

【Historical Volatility】

【Historical Volatility】

10d 50%

30d 60%

90d 74%

1Y 78%

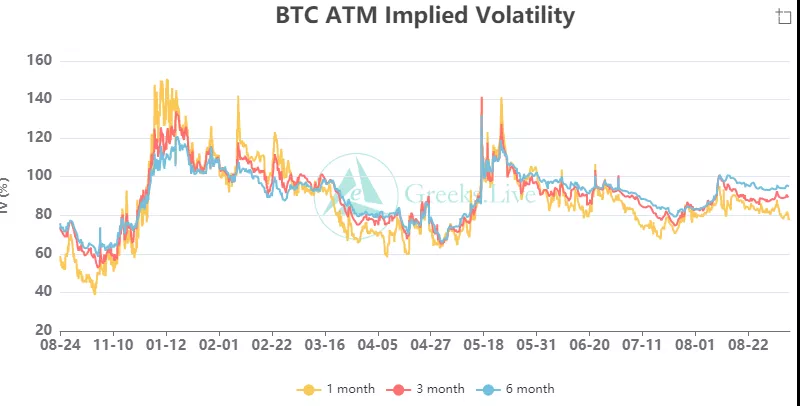

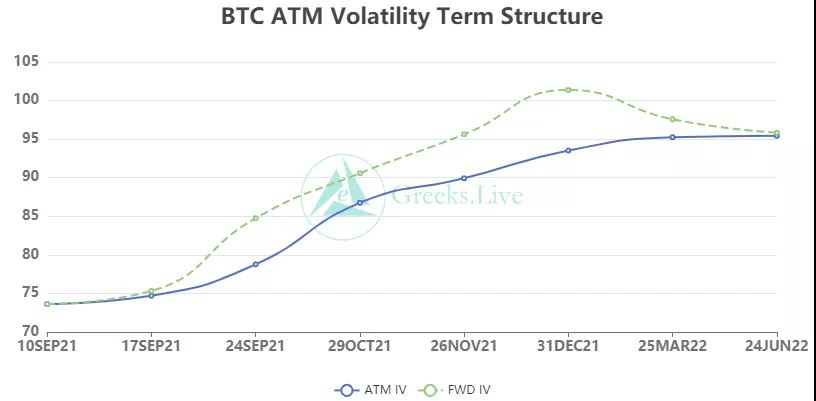

【IV】

Implied volatility for each normalized term:

Implied volatility for each normalized term:

9/6 :1m 83%, 3m 92%, 6m 95%,DVol 91%

Bitcoin stood firm at $52,000 and broke through the sideways area of $50,000. The main reason may be that El Salvador officially adopted Bitcoin as a legal tender, and the market's preference for Bitcoin has increased. IV is relatively stable, and even drops slightly in the ultra-short term.

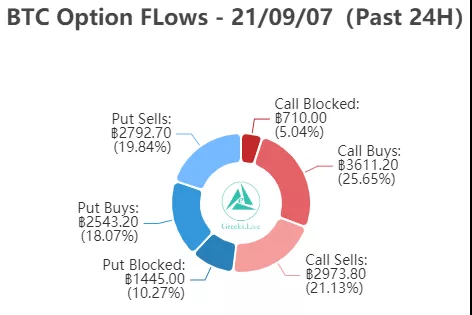

【Option Flows&Bulk Transaction】

Judging from the Option Flows data, the Bitcoin options market is rare and balanced. The most traded in the market is the bearish price of 50,000 US dollars that week, more than 600 contracts were traded, and the turnover rate reached 100%. The market did not respond much to breaking through the sideways zone of 50,000 US dollars, and the most painful point was still at 49,000 US dollars.

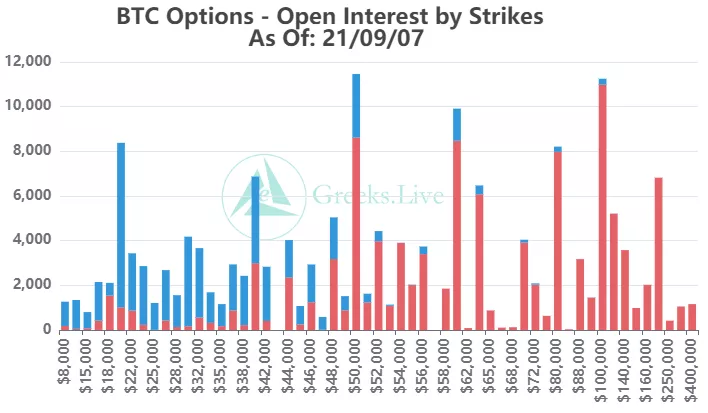

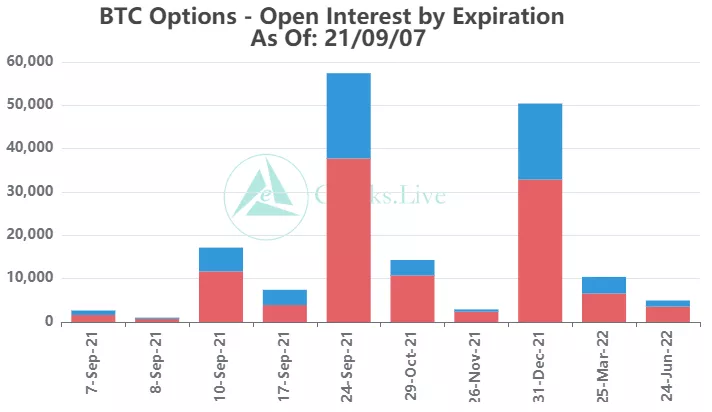

【Option position distribution】

The September option position is about 57,000 coins, of which the call option is about 38,000 coins.

【ETH Options】

【Historical Volatility】

【Historical Volatility】

10d 88%

30d 83%

90d 89%

1Y 109%

【IV】

Each standardized period IV:

Each standardized period IV:

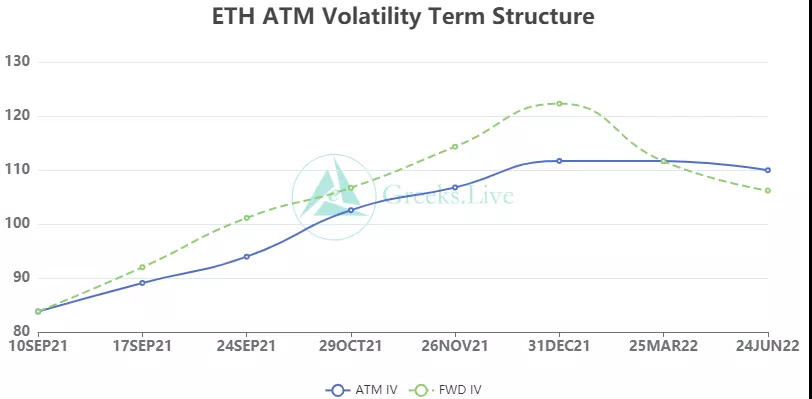

9/6 :1m 101%,3m 109%,6m 112%,DVol 109%

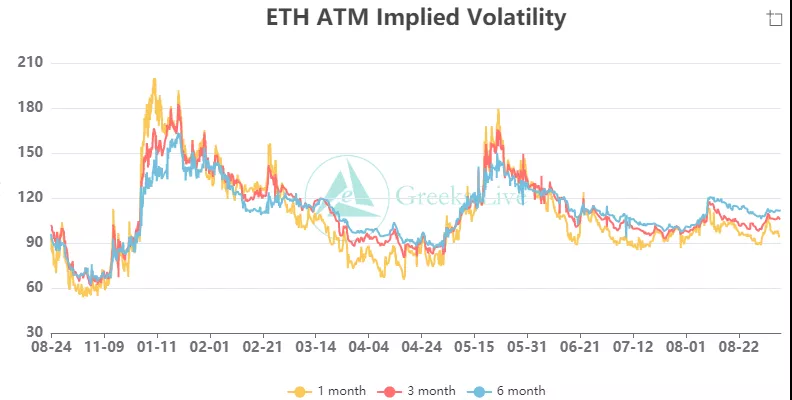

Ethereum continues to oscillate at $3,900, and the transaction is still low. The market is relatively stable, RV continues to decline, and IV changes little. If Bitcoin can maintain its current trend, it is only a matter of time before Ethereum breaks out of its previous high.

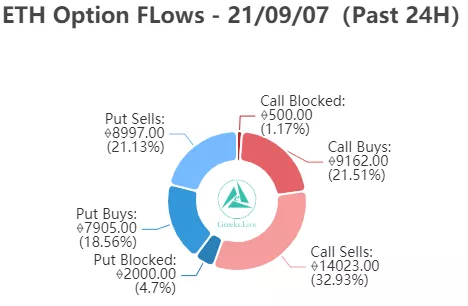

【Option Flows&Bulk Transaction】

From the perspective of Option Flows, the distribution of market transactions is relatively balanced, there are fewer large transactions, and the transaction volume of selling calls is slightly higher. It has not been a few days since the trend of Ethereum has been stable, but the overall transaction seems to have been sideways for several weeks.

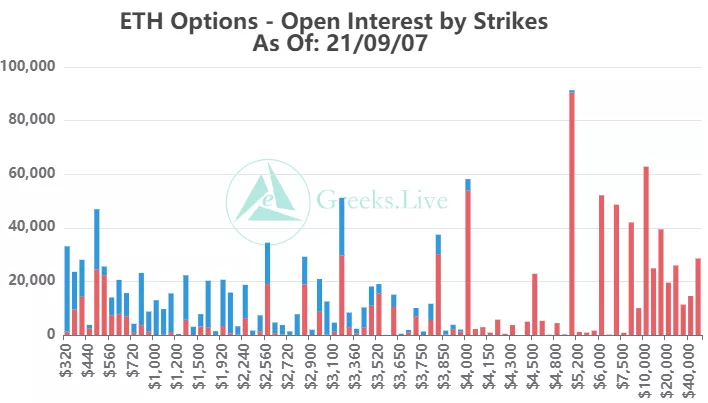

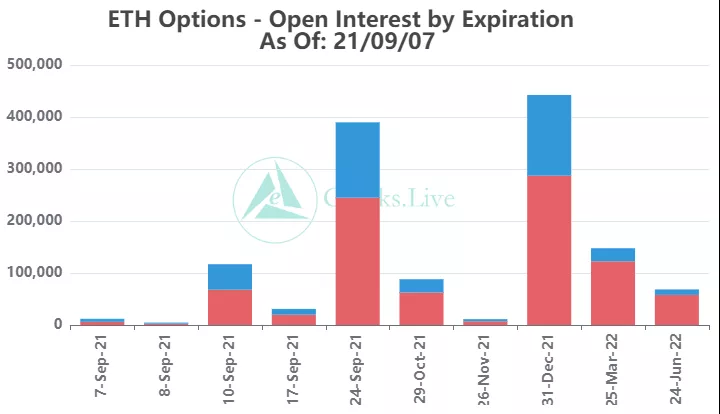

【Option position distribution】

【Option position distribution】