This article comes fromDecrypt, original author: Jeff Benson

Odaily Translator | Nian Yin Si Tang

Summary:

This article comes from

, original author: Jeff Benson

Odaily Translator | Nian Yin Si Tangsecondary titleSummary:

- DeFi is a rapidly growing area of the cryptocurrency industry.

- While the number of cryptocurrency attacks and fraud incidents has decreased, DeFi-related hacks have increased.

Decentralized finance (DeFi) is going through a period of continued growth,

According to data from DeFi Pulse

, the value of locked assets in DeFi agreements is nearly 80 billion US dollars, which is only 10% lower than the peak in May.

The more money there is, the more problems follow.

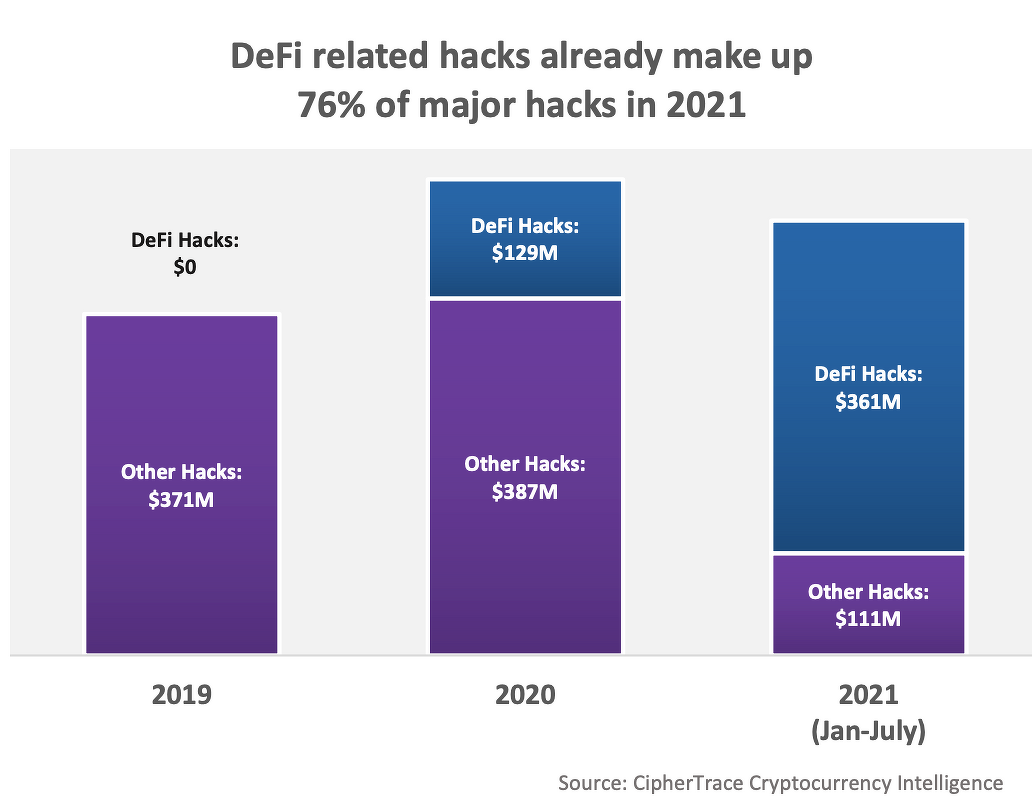

DeFi-related hacks and fraud have cost protocols and their users $474 million in the first seven months of this year, according to a new report from blockchain intelligence firm CipherTrace. CipherTrace pointed out in a report at the beginning of this year that due to the enhanced security systems of various participants in the encryption market, the losses caused by cryptocurrency theft, hacking and fraud incidents in 2020 have dropped by 57%, and the loss has dropped to 1.9 billion. US dollars ($4.5 billion in 2019), but at the same time, criminal activity in the "DeFi" space is continuing to grow, with related hacks increasing by 270% this year.

From the perspective of cryptocurrency advocates, DeFi protocols allow individuals to make their own decisions about how to dispose of their assets while avoiding intermediary fees.

But there are risks, too, as CipherTrace's report shows. External attacks cost various DeFi protocols $361 million in crypto assets. The Rug pull (withdrawal of a large amount of liquidity, causing smashing) project itself deceived investors and ran away with money, causing losses to users of 113 million US dollars.

It’s the $361 million figure that worries CipherTrace most, but it’s worth noting that DeFi tokens and DeFi’s reserve currency, Ethereum, are worth even more now than they were half a year ago.

The price of Ethereum has soared above $3,100, up more than 200% since the beginning of the year, as has Compound, a popular lending project in the DeFi space. The price of Uniswap’s governance token UNI has risen by more than 400%.Despite this, DeFi attacks are still increasing relatively.According to CipherTrace, 76% of all cryptocurrency hacks occurred in the DeFi space. What’s more, “DeFi-related fraud accounted for 54% of major crypto fraud incidents, compared to just 3% of the full-year total last year.”

Most attacks against DeFi protocols use flash loans. Attackers use the funds borrowed from flash loans to arbitrage, and then repay the loan in a single transaction.