Beginning in October 2020, Bitcoin's monthly line has been positive for six consecutive days. This kind of rise is rare in the history of Bitcoin, even in the traditional financial world. What is driving the continuous rise of Bitcoin?

"Tesla's high-profile entry, how high will Bitcoin rise in 2021? ""Tesla's high-profile entry, how high will Bitcoin rise in 2021? "The article predicts that the price of BTC is expected to reach 50,000-60,000 US dollars in April (the price of Bitcoin was between 30,000 US dollars and 40,000 US dollars at the time), and analyzes in detail the main factors that promote the continuous rise of BTC, including: the new crown epidemic, the central bank’s massive Release of water (mainly in the United States), grayscale holdings increase, DeFi lock-up, Bitcoin halving effect, etc.

core point of view

core point of view

1. The Bitcoin market can be divided into three main stages since February this year: the rising trend stage, the long-short stalemate stage, and the mid-term major correction stage.

2. The encryption market is transitioning from being dominated by institutions to the influx of retail investors. This influx of retail investors is different from pure hype, and it also reflects the trend of the rise of community-based forces.

3. As Tesla put Bitcoin into its balance sheet and accepted Bitcoin payments, the traditional financial market continued to accept Bitcoin, which also contributed to the BTC long-short stalemate.

4. Due to (2) and (3), the government has tightened regulation on the encryption market.

5. The Indian epidemic and the second round of economic stimulus plan in the United States have become major variables affecting the Bitcoin and encryption markets, and will prolong the duration of this round of bull market.

6. The price prediction model based on the "four-year halving" cycle may become invalid, but the deep economic cycle of Bitcoin is still valid.

first level title

Dismantling the three stages that Bitcoin has experienced since February this year

With the development of blockchain technology and the rise of DeFi, Bitcoin has gradually entered the traditional financial market, and there are more and more factors affecting Bitcoin. The game between all parties, one ebbs and another, and the final result of the market game is comprehensively displayed in the market performance . Through the analysis of market conditions, we can divide different market stages, and then explore the main market forces and trend changes in different stages.

The figure below shows the six waves of ups and downs that we have roughly divided:

The first round of big rise is roughly from January 28 to February 21; the first callback time is roughly from February 22 to February 28; the second round of rise is from March 1 to March 13; The second round of callbacks is from March 14th to March 25th; the third round of rises is from March 26th to April 13th, and the third round of callbacks is from April 14th to April 25th.

This article believes that the main force of the first round of promotion is mainly based on institutions, the main force of the second round of promotion is the sign of the influx of retail investors, and the third round of promotion is mainly driven by news stimulation; the first callback The main reason behind this is the selling pressure of institutions. The second callback was supposed to start with the U.S. stock market, but it was broken by a series of good news. The third callback showed that retail investors were unable to push up Bitcoin, and institutions continued to sell pressure. , The market has a callback under the influence of bad news.

According to the above division, and further divided from the perspective of trend market, the first round of rise, the first callback and the second round of rise can actually be regarded as the trend rising stage; the third round of rise can actually be regarded as a larger rebound market, so the first round of rise The second correction and the third round of rise can be regarded as the market stalemate stage; the third round of major correction is actually the final outbreak of the second round of correction, a long overdue correction, and can be regarded as a mid-term correction stage.

Uptrend stage: from institution-based to retail investors

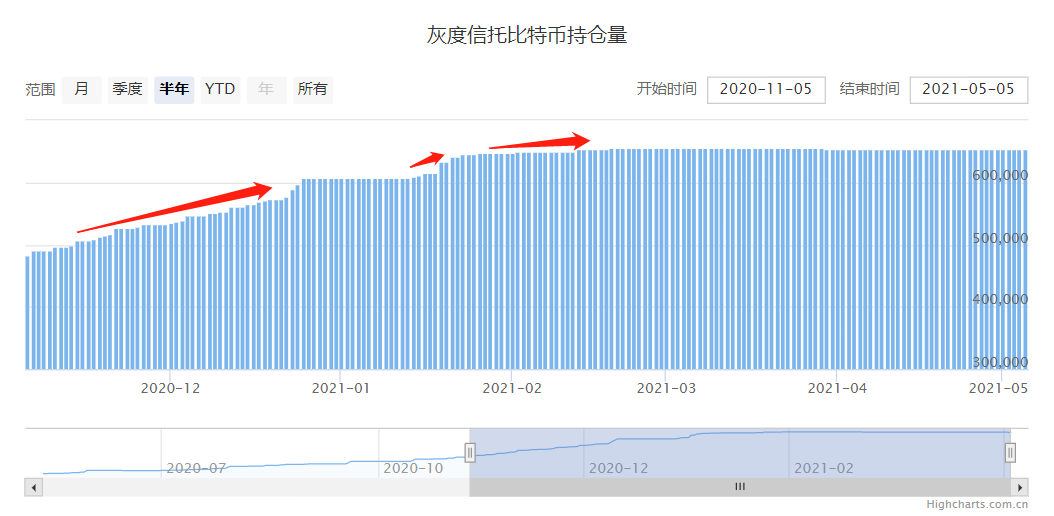

In 2020, Bitcoin has soared from a low of around US$4,000 at the beginning of the year, and by the end of the year, BTC had already approached the US$30,000 mark. During this period, institutions are undoubtedly the most important driving force for the rise of Bitcoin, and Grayscale can be called the weathervane of the market.

According to statistics, as of January 6, 2021, the number of Bitcoins held by Grayscale Fund reached 606,800. 70% and 77%. The buyers behind Grayscale Fund are mostly encrypted asset lending companies, hedge funds, mutual funds, private wealth companies, consulting firms, family offices, etc.

By January 28, the number of BTC held by Grayscale was 647,287.99, and by February 21, the number of BTC held by Grayscale was 655,465; since February 22, Grayscale has hardly increased its holdings. The number of BTC is 653381.35 (Note: The decrease is mainly due to the deduction of management fees by Grayscale).

Source: Highcharts.com.cn

It can be seen from the data that the increase in Grayscale's holdings is the largest in 2020. There are obvious signs of increasing holdings at the end of January 2020, and it has gradually slowed down since February. From the end of February, it has basically stopped increasing holdings. Signs of the field have weakened significantly.

At around 20:00 on February 8, Beijing time, according to Bloomberg News, Tesla stated that it has invested a total of US$1.5 billion in Bitcoin, which has become a landmark event that stimulates retail investors to enter the market. Musk not only started to support Bitcoin in terms of speech, but also started to act, which has a strong appeal to many of his fans. Musk is like a standard bearer. . On February 11, 2021, Canadian asset management company Purpose Investments Inc. obtained approval from the Ontario Securities Commission (OSC) to issue a bitcoin exchange-traded fund (ETF), and listed on the Toronto Stock Exchange on February 18, local time. trade. Bitcoin ETF tracks the price of Bitcoin. Buying a Bitcoin ETF is equivalent to indirectly investing in Bitcoin. There is no difference in income, but unlike GBTC, there is a premium, and there is no need to be responsible for cumbersome issues such as custody, which greatly reduces investment. Security and compliance thresholds for investors to enter the encryption market. The approval of Canada's first Bitcoin ETF can be said to provide convenient channels and tools for retail investors to enter the market.

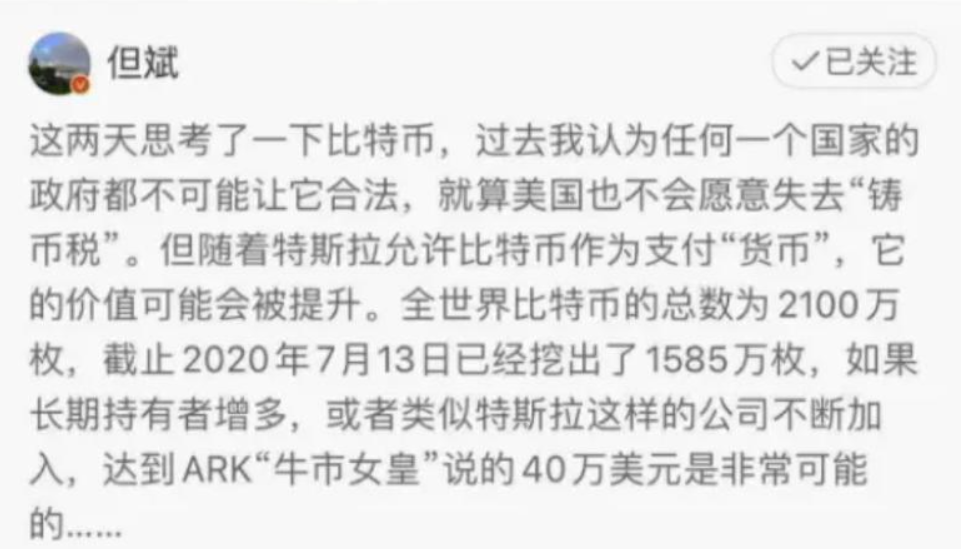

On February 18, Dan Bin, a well-known figure in the Chinese investment community, revealed on Weibo that he bought 1% of the Bitcoin ETF fund, and said: Although it is a bit late, but if you figure it out, you will practice it! Of course, I bought less, I hope to maintain my curiosity about new things!

If Tesla acts as the standard bearer for retail investors to enter the market, and the Bitcoin ETF provides convenient entry tools for retail investors, then the historic economic stimulus plan in the United States provides sufficient ammunition for the army of retail investors.

If Tesla acts as the standard bearer for retail investors to enter the market, and the Bitcoin ETF provides convenient entry tools for retail investors, then the historic economic stimulus plan in the United States provides sufficient ammunition for the army of retail investors.

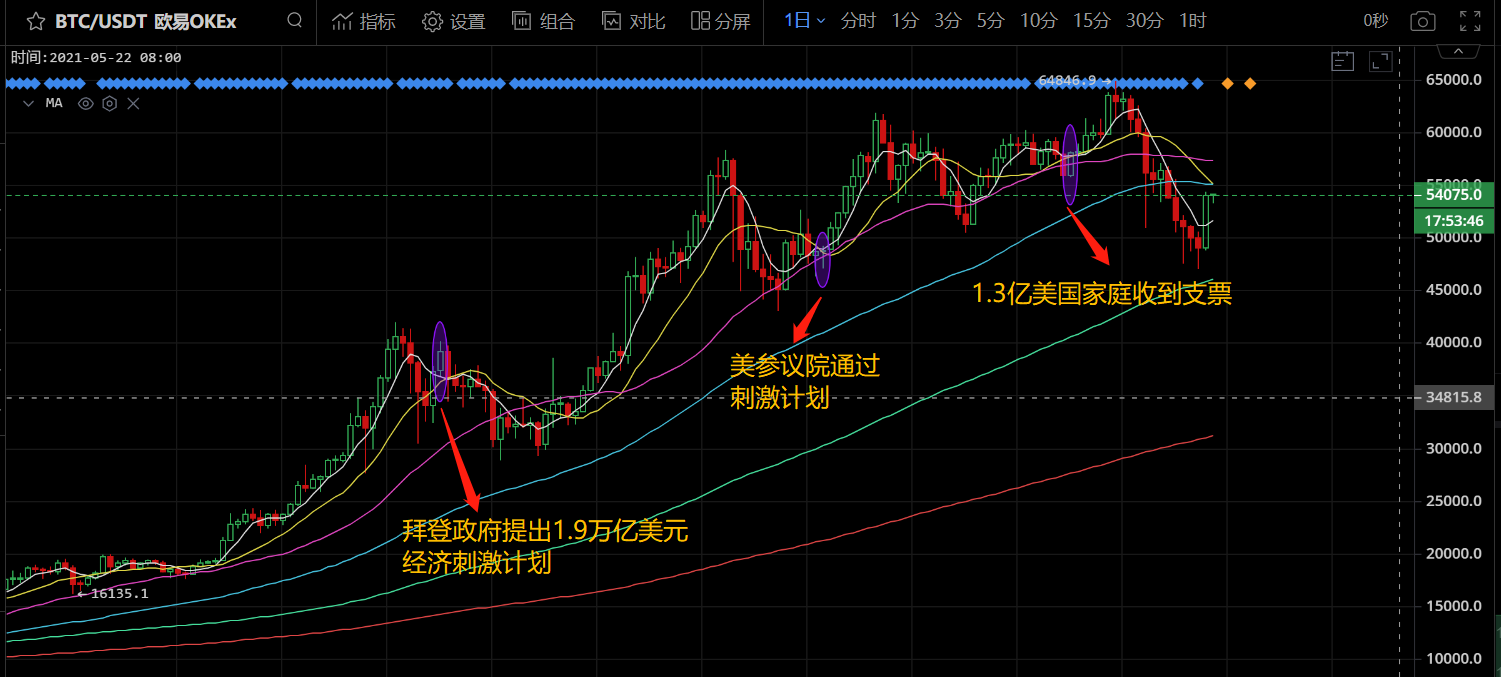

On January 14, U.S. President Joe Biden, who has not yet taken office, proposed a so-called "historic" $1.9 trillion economic stimulus plan, the main content of which is to directly distribute $1,400 to eligible Americans, as well as Minimum wage raised to $15 an hour. The final plan is to distribute $1,400 in subsidies directly to eligible Americans. On March 6, local time in the United States, the U.S. Senate passed the $1.9 trillion new crown rescue bill with 50 votes in favor and 49 votes against. By April 7, more than 130 million households had received checks distributed under the stimulus package.

The flood of U.S. dollar liquidity has greatly boosted the global financial asset bubble, and Bitcoin, as the best-performing asset this year, has a more obvious boosting effect. We have also marked important time nodes for the implementation of the US economic stimulus plan on the Bitcoin market chart.

On March 6, local time in the United States, the U.S. Senate passed the $1.9 trillion new crown rescue bill with 50 votes in favor and 49 votes against, and then American residents received relief funds one after another. Cryptocurrency trading platform Gemini recently released a newThe State of Cryptocurrency in the U.S. Report, and the relevant information also shows the phenomenon of a large influx of retail investors. Its report shows that during 2021, cryptocurrency investors across the country will significantly expand and diversify, with as many as 63% of respondents admitting to being curious about cryptocurrencies; Gemini estimates that nearly 14% of the U.S. population (2120 million adults) now own cryptocurrency.

That is to say, in the voice of Musk, many retail investors took the money issued by the U.S. government and entered the market through compliant exchanges such as Bitcoin ETF or Coinbase with a lower threshold; Arrival, institutions aggressively arbitrage sell-offs after a round of sharp rise in Bitcoin, and the market thus completes the relay from institutions to retail investors.

It is worth noting that this time the influx of retail investors reflects a trend of rising community forces, not just simple hype.

Whether it is the "Game Station" incident in the traditional financial market, the skyrocketing Dogecoin in the encrypted market, or the recent popular pet coins such as SHIB (Shiba Inucoin), we have seen a trend of decentralization and development through these phenomena. Anti-elite community power, which includes celebrities such as Elon Musk, Carole Baskin, Mark Cuban, Genne Simmons, Snoop Dogg, and organizations such as Wall Street Bets and SatoshiStreetBets. This kind of power has always existed, but the new crown epidemic has exacerbated the profound economic and social contradictions in the world. At the same time, the rise of DeFi has provided ordinary people with more investment channels and choices. we are at《SHIB (Shiba Inucoin), an interesting community experiment"There is a more in-depth discussion in this article, please click to read.

Market stalemate: BTC makes great strides towards the traditional financial market

The March 14-March 25 pullback should have been a relatively larger pullback. From the perspective of the technical chart, Bitcoin has been positive for six consecutive days; from the perspective of long-short strength, the influx of retail investors is actually relatively weak under the pressure of institutional selling, and it is difficult to form support; from a macro perspective, this callback of Bitcoin In fact, it is in sync with US stocks (especially the Nasdaq), which is mainly due to the impact of the Fed's interest rate hike and economic recovery expectations, and funds have begun to shift from online to offline.

However, under a series of positive stimuli, Bitcoin was abruptly pulled up, thus forming a relatively long period of trend stalemate. Specifically, this is mainly directly benefited from three big benefits that happened one after another.

The first thing: On March 24, Tesla announced on the US official website that it supports Bitcoin payments. Subsequently, Musk also confirmed and added on Twitter, "Tesla can now be purchased with Bitcoin. Tesla only uses internal and open source software to directly run Bitcoin nodes. Bitcoin paid to Tesla will be in Bitcoin is retained rather than converted into legal tender. Bitcoin payment function will be provided outside the United States later this year." The demonstration effect of Tesla's acceptance of Bitcoin payment is obvious, and then many companies and institutions, large and small, accept Bitcoin payment , This move makes Bitcoin a big step into the traditional business environment.

The second thing: On March 28, White House press secretary Jen Psaki said that US President Biden will publish a new 3 trillion economic recovery plan bill on March 31, and the second bill will be announced in April . The United States continues to spend a lot of money, which fundamentally boosts market confidence.

The third thing: On March 29, Visa Inc stated that it will allow the use of the cryptocurrency USDC to settle transactions on its payment network, and has launched a pilot program with the payment and encryption platform Crypto.com, and plans to do so later this year It is time to offer this option to more partners. This news is also greatly beneficial to BTC, thus pushing Bitcoin to further increase in volume.

The mid-term big correction: the deep reason behind the "418" plunge

On April 16, according to OKEx market data, BTC began to fall from around $63,524, and fell sharply to $50,900 on April 18. According to statistics, at 12:00 on April 18, within one hour, the entire network of the contract market had a total liquidation of 3.96 billion US dollars. The amount of liquidation in the crypto market on that day exceeded the sum of 312 and 313 in 2020. Most of the currencies in the encryption market fell accordingly, and the bulls were bloodbathed. In the next few days, BTC continued to fall, falling as low as $46,988, touching the mid-term trend line of MA120. The cumulative decline of this major correction was about 26%.

Among the consecutive declines in BTC, the plunge on April 18 was the most tragic. The direct cause was mainly three major rumors: the U.S. Treasury Department will accuse several financial institutions of using cryptocurrencies for money laundering, Coinbase insiders dumped stocks after listing, and Turkey banned Bitcoin payment. All three rumors were disproved that day. But the "418" plunge was really just due to rumors of manslaughter? Why did the market not rebound, but continue to plummet?

Looking back at these three rumors, in fact, except for rumor 2, rumors 1 and 3 are not completely speculative, but indicate that the government is tightening the supervision of the encryption market. Next, we will look at the impact of US regulatory policies on the encryption market in combination with market performance.

On April 16, White House Press Secretary Jen Psaki said at a press conference on Thursday, In terms of regulating cryptocurrencies, Biden agrees with U.S. Treasury Secretary Yellen's views on regulating cryptocurrencies. Yellen called on lawmakers to "reduce" the use of cryptocurrencies during her nomination hearings in January, saying: "I think we really need to look at ways to reduce the use of cryptocurrencies and make sure that money isn't being laundered through those channels." That is to say, the White House and the Treasury Department have reached an agreement to"Reduce the use of cryptocurrencies", will also take action on the regulation of cryptocurrency money laundering.

From the perspective of market performance, on April 13, BTC rose sharply and broke through the previous high, and then stepped back in the next two days, which basically showed signs of further breakthrough. However, starting from April 16, affected by the speech of the White House, BTC continued to fall until 4 On the 18th it plummeted. On April 20, according to sources, the Biden administration is developing a legislative framework for the fast-growing crypto assets. Market performance also continued to be weak due to pessimistic expectations for the White House’s cryptocurrency statement on April 16.

On April 23, BTC continued to plummet, which was further related to stricter regulation. The US Securities and Exchange Commission said: It is difficult to ban Bitcoin, the regulatory goal is to prohibit the use of encrypted assets for illegal purposes, and the Bitcoin ETF can be re-examined. China's inter-ministerial joint meeting on dealing with illegal fund-raising also stated on April 23: Pay close attention to new risks under the banner of virtual currency. The governor of the Central Bank of Turkey said on April 23 that the Ministry of Finance plans to announce new cryptocurrency regulations within two weeks and that the government will not completely ban cryptocurrencies.

Through this series of events, it can be seen that after the rapid development of the encryption market, a large number of retail investors have poured in. From the perspective of financial supervision and defending the status of the traditional financial market, many governments have begun to implement or consider strict supervision of the encryption market. The market has expressed pessimistic expectations for stricter regulation, which is also the main reason for the "418" plunge of Bitcoin, and stricter regulation will also become a major trend and variable in the future of the encryption market.

Bitcoin under the big changes, the "life" is better

"Tesla's high-profile entry, how high will Bitcoin rise in 2021? ""Tesla's high-profile entry, how high will Bitcoin rise in 2021? "An article predicted that:

Compared with Bitcoin, institutions have significantly increased their investment interest in Ethereum and other investments, and have shown a tendency to diversify the allocation of encrypted assets; the bull market was dominated by Bitcoin in the early stage, and the next stage will be dominated by Ethereum and its ecology; due to the performance limitations of Ethereum, Competitive public chains will enjoy the value spillover bonus of Ethereum. In the process of Bitcoin's rise, the early stage was dominated by institutional investors such as Grayscale; after February, DeFi became the main force influencing the rise of BTC. BTC price is expected to reach $50,000-60,000 in April.

However, the world is always full of variables, which has fundamentally affected our previous predictions. This major change is mainly concentrated in: the outbreak of the new crown epidemic in India has made the inflection point of the global new crown epidemic full of variables; the second round of economic stimulus policies in the United States gradually Surfaced, will have a profound impact on the global economy and Bitcoin.

India's "epidemic"

On April 27, Chongqing reported a confirmed case imported from India. April 28, academician of the Chinese Academy of EngineeringZhang BoliAt the 13th Healthy China Forum, he said that the overall epidemic situation in the world is not over yet. We originally estimated that after the widespread vaccination by the end of this year, it may gradually level off or be basically controlled. Be alert, the mutation has affected the effect of the vaccine, so we say, this battle is not over yet.

image description

Source: People's Daily Online

The most frightening aspect of this outbreak in India is the "off-season outbreak". Such a large outbreak of the virus in India's hot season means two things-first, the virus has mutated to high temperature resistance, which can spread and produce symptoms in midsummer; second, even if there are antibodies, it may not help, cities such as Mumbai and Delhi The antibody detection rate of the residents is very high, but they are vulnerable to the mutated virus. The fire ignited by the double-mutant virus in India has already started and is likely to spread globally. Previous predictions about the development of the epidemic may be overturned and rebuilt.

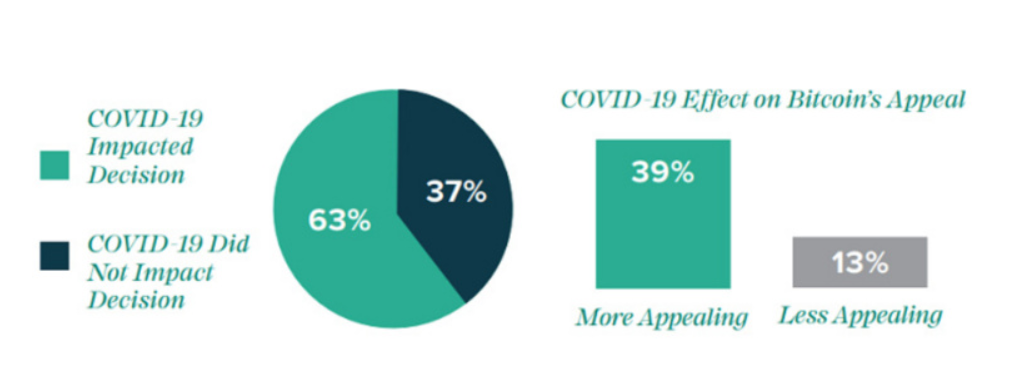

Grayscale stated in the report "The Great Wealth Transfer Promotes BTC to Become a Mainstream Investment Target": Among the surveyed Bitcoin investment respondents, 63% said that their decision to invest in Bitcoin was due to the impact of the new crown virus epidemic. It is foreseeable that if the epidemic in India spreads to the world, the rise cycle of BTC will be greatly extended under the influence of the new crown epidemic.

The second round of large-scale water release in the United States is coming

Looking at the other side of the ocean, the prevention and control of the epidemic in the United States is not as good as expected, and its government has once again frantically printed money to release water.

On March 31, the Biden administration of the United States announced a new round of stimulus plan of up to 2.3 trillion "American Jobs Plan". A $1.8 trillion "American Family Plan." The "American Jobs Plan" is mainly to create employment opportunities for the people through investment in infrastructure, and the "American Family Plan" can be said to directly benefit American families.

If the second round of economic stimulus plan is implemented, the cash flow in the hands of the American people will be more abundant, which may prompt a larger influx of retail investors into the encryption market.

At the same time, the second round of economic stimulus in the United States includes taxation of the rich, which will to some extent lead to the sale of encrypted assets by the rich. U.S. investors in crypto assets, which have rallied about 80 percent since December, are already at risk of capital gains taxes if they sell cryptocurrencies after holding them for more than a year. At the same time, the IRS has also stepped up taxation on the sale of crypto assets. Some analysts believe that U.S. President Biden plans to nearly double the capital gains tax for the rich, prompting rich people holding encrypted assets to sell and exacerbating the decline in BTC.Tax increase news brokeFinally, we observed that the GBTC premium rate reached -16.7%, a new high in the near future, the GBTC selling pressure on the US stock market has increased significantly, which shows that institutional investors are indeed increasing their selling due to the negative impact.

We have studied the impact of the first round of the US economic stimulus plan on the market in more detail above. If the second round of the US economic stimulus plan is implemented, it will have a greater impact on the encryption market.

Bitcoin price prediction model adapted to the background of the new era

In 2020, major macro changes have largely led to the outbreak of DeFi; the current outbreak of the new crown epidemic in India and the promotion of the second round of fiscal stimulus plans in the United States will undoubtedly continue to have a profound and huge impact on the encryption market. The iron law of Bitcoin's "four-year halving" may be broken for the first time, and many Bitcoin price prediction models based on it have faced the risk of invalidation.

The cyclical law of "four-year halving" is weakening

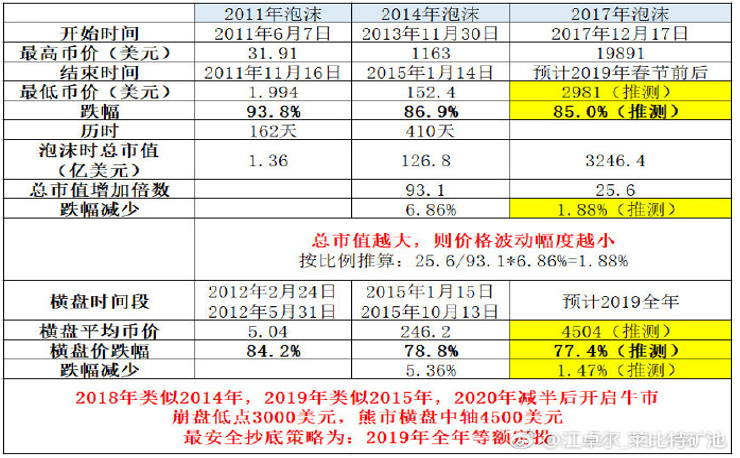

image description

Source: Jiang Zhuoer Weibo

image description

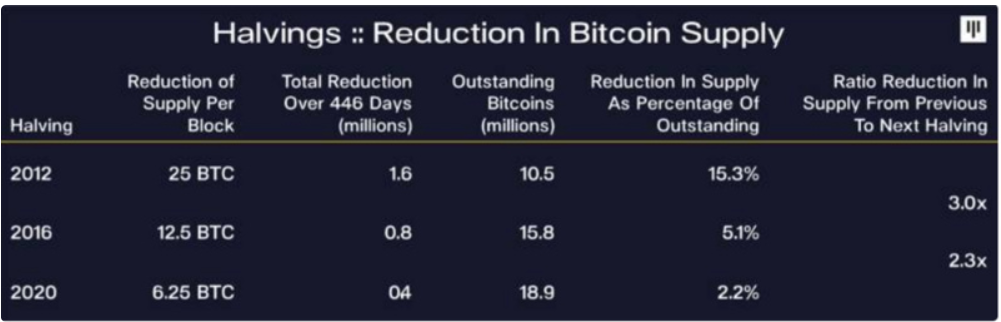

text

The first Bitcoin block reward was halved, accounting for 15% of the total supply; the second Bitcoin block reward was halved, and the supply was only one-third of the first halving. This phenomenon is very interesting , because the impact of this halving on the price increase is exactly one-third. If this trend of change is extrapolated to the Bitcoin block reward halving event in 2020, then: the reduction in Bitcoin supply this time is only 40% of that in 2016. If this relationship holds true, it means that the price of Bitcoin will also rise by 40% of the previous rate. Based on this, Pantera Capital calculates that Bitcoin will reach a peak price of $115,212 in August 2021.

By introducing the above two forecasting models, it can be found that the second price forecasting model is more "scientific" than the first price forecasting model. However, these two price prediction models are essentially "experiences" based on past price performance and timelines. Experience is experience after all, not the essential law of the development of things. Under the influence of this epidemic, these "experiences" may become invalid. In fact, under the influence of the epidemic, both Jiang Zhuoer and Pantera Capital have made adjustments to the duration of the bull market and the peak value of BTC, which has essentially declared that the previous price prediction models of the two have failed.

"Inventory cycle" can better explain the bitcoin market

At present, more and more people realize that this round of bull market will be long and slow. Some believe that the market is currently in the early stages, and others believe that it is currently in the middle or late stages, etc., but such predictions are mostly based on experience and perception, and lack a more systematic theory for guidance.

"Demystifying the Economic Principles Behind Bitcoin's Bull-bear Conversion""Demystifying the Economic Principles Behind Bitcoin's Bull-bear Conversion"A price prediction model about the Bitcoin cycle is proposed in the article. The article believes that Satoshi Nakamoto also followed the "inventory cycle" when designing the Bitcoin halving time. This price prediction model is still able to predict and explain the price and development of Bitcoin well.

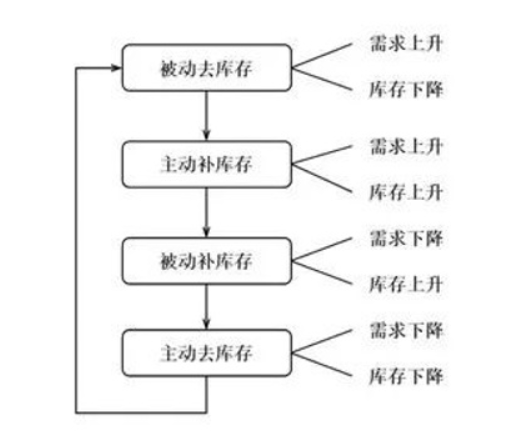

The inventory cycle, also known as the Kitchin cycle, is a short economic cycle in capitalism, usually 3-5 years. The internal basis of the Kitchin cycle is that the demand shock of commodities is passive and external, while the supply adjustment is active and internal. Therefore, the different changes in demand and supply (inventory) form four cyclical stages: passive removal Inventory, active inventory replenishment, passive inventory replenishment and active destocking. In the bull-bear conversion process of Bitcoin, these four cyclical stages are also met.

Bitcoin is essentially a digital commodity (Note: Bitcoin is also considered a commodity in the official statements of many economic powers), and it should not be affected by the traditional inventory cycle, but the production of Bitcoin The mining machine of this commodity is an entity, which is bound to be affected by the inventory cycle. The Bitcoin network is essentially maintained and operated by mining machines providing computing power, which is one of the most important reasons why Bitcoin is affected by the inventory cycle. From the perspective of mining, under normal circumstances, the relationship between the price development of Bitcoin and the inventory cycle is as follows:

When the market demand for Bitcoin increases, the price begins to rise, and the increase in mining profits stimulates the influx of more miners. The miners' inventory has no time to respond, so the sales increase and they passively destock.

The market demand for Bitcoin has expanded significantly, the price has risen significantly, and the mining income has become more lucrative. Miners are expected to start to actively increase their inventory.

Bitcoin market demand began to weaken, prices stagflated and fell, mining profits decreased, miners had no time to shrink production, and sales fell, resulting in a passive increase in inventory.

The market demand for Bitcoin has shrunk further, prices have fallen, and mining profits have further decreased. Miners have negative expectations and actively reduce inventory.

Judging from the inventory introduced above, the "four-year halving" cycle phenomenon in this round of Bitcoin bull market is bound to be broken. From the demand side, under the impact of the new crown epidemic, the digitalization process has been greatly accelerated. Bitcoin has been recognized by more and more institutions. Young people have also shown great interest in Bitcoin. The demand for Bitcoin is unprecedentedly strong, which greatly boosted the The price of Bitcoin is rising; according to the normal cycle development, as the price of Bitcoin rises, mining profits will rise rapidly, and the market demand for Bitcoin mining machines will be very strong. It is reasonable that many miners will flood in. Under the influence, the production of Bitcoin mining machines is seriously insufficient. From the perspective of the bull market cycle, we are in the stage of actively replenishing inventory.

Combined with the outbreak of the epidemic in India discussed above, the "American Family Plan" planned by the Biden administration, the continued rapid development of DeFi, and the continuous entry of institutional investors, the growth rate of Bitcoin's demand side is still greater than that of inventory replenishment. speed. Therefore, this article believes that it is still in the relatively early stage of the mid-term bull market.