If you want to find a keyword to describe the development of the encryption world in the past year, DeFi will undoubtedly be a hot candidate.

As of April 29th, Beijing time, the total value of assets locked in the DeFi protocol on the Ethereum chain alone has exceeded 87 billion US dollars.

As one of the most important infrastructures in DeFi Lego, stablecoins have played a role that cannot be ignored in this round of DeFi explosion, and its track itself is also experiencing rapid development in this wave .

From fiat currency-collateralized stablecoins issued by centralized institutions such as USDT and USDC, to encrypted asset over-collateralized stablecoins generated by contracts such as DAI, to algorithmic stablecoins such as AMPL and FEI that try to rely on market behavior to achieve price adjustment, The stablecoin track has gone through several iterations. However, as far as the current stage is concerned, it seems that every generation of products still has problems, large and small.

Fiat currency-backed stablecoins such as USDT and USDC currently occupy the largest market share, but such stablecoins are often issued by a single centralized institution, and there are inevitable single-point risks. Historical facts have also proven that although there has been no abuse, the issuers of such stablecoins (Tether, Circle, etc.) do have the authority to blacklist certain addresses.

The over-collateralized stablecoin generated through smart contracts may be a relatively ideal solution in the current market, but it is only relatively speaking. Leaving aside whether the inefficient use of funds behind the over-collateralized model is a problem, looking around the over-collateralized stablecoins on the market, they can be roughly divided into two situations: MakerDAO (DAI) receipts, due to the early start, liquidity Fortunately, DAI has maintained a good anchoring performance for a long time. However, there are also some criticisms around MakerDAO that the oracle machine is too centralized and the liquidation mechanism is not flexible enough. Especially the latter. During the 3.12 black swan incident last year, MakerDAO sold $8.32 million worth of ETH collateral at zero price due to the failure of the liquidation mechanism; as for some other emerging over-collateralized stablecoins, due to poor liquidity, the market Moderating effects are weak and prices tend to remain underwater.

Then, the market ushered in the explosion period of algorithmic stablecoins. One of the directions that such projects want to improve is the inefficient use of funds caused by the over-collateralization mentioned above. However, whether it is the originator project AMPL, or the later Basis, Frax, and FEI, the actual results have proved that abandoning collateral support at the current stage and relying solely on market behavior for adjustment is still too idealistic. What's more serious is that due to the unreasonable design of some early projects, the currency price can easily fall into a death spiral under panic, and "algorithmic stable currency = unstable" has gradually become a "consensus".

Fortunately, innovations in stablecoins in the industry never stop.At 22:00 on April 29, Beijing time, a "Collateralized Rebasable Stablecoin" called Standard Protocol will be listed on Uniswap, and will be listed on centralized exchanges such as Gate and Kucoin at 22:40 .

secondary title

Why is the Standard Protocol different?

First of all, let's go back to Standard's positioning of itself - the flexible supply of stablecoins with hybrid mortgages. This description is a bit of a mouthful at first, but it is not difficult to understand. Specifically,Standard Protocol is a new stablecoin project that combines mortgage support and algorithm adjustment (elastic supply).

In Standard Protocol’s view, the DeFi world is still in its early stages, and market conditions are not yet mature. Removing the support of collateral prematurely will make it difficult for stablecoins to effectively perform the core function of “stability”. At this stage, the underlying collateral support is still necessary. At the same time, Standard also believes that relying on market functions to adjust the anchoring situation proposed by the algorithmic stablecoin project is indeed a breakthrough innovation.

This idea of Standard Protocol falls on the design of its products. Due to the integration of the dual concept of "mortgage + algorithm", the stable currency MTR of Standard Protocol will be different from some existing over-collateralized stable coins and algorithms in terms of operating mechanism. Stablecoin projects have some similarities.From the author's personal understanding, the Standard Protocol is somewhat like a cross-chain version of MakerDAO with an algorithm adjustment mechanism added, and at the same time, some creativity has been made to solve the latter's problems such as the partial centralization of the oracle machine and the poor effect of the liquidation mechanism. Improve.

Here four key words appear in sequence,Algorithm adjustment, cross-chain, oracle, liquidation, the following will explain these four keywords in turn, hoping to restore the appearance of Standard Protocol as accurately as possible for everyone.

(1) Algorithm adjustment

Unlike many other algorithmic stablecoins, the elastic supply mechanism of the Standard Protocol does not operate in a fixed cycle, but will be on standby as a line of defense, and will intervene only after the MTR price has de-anchored to a certain extent .

Specifically, when the price of MTR is well anchored, Standard Protocol is a static over-collateralized stablecoin similar to MakerDAO. The community will determine the specific token issuance ratio of MTR through governance (the reciprocal of the mortgage rate ).When the price of MTR starts to break from the anchor and exceeds a certain threshold, the elastic supply mechanism of the Standard Protocol will automatically start to operate. At this time, the system will intervene to adjust the token issuance ratio of MTR to push the price of MTR back to the normal level. After recovering to a certain level, Standard Protocol will return to the static over-collateralization model again.

Abstract descriptions may not be easy to understand, for example. If the threshold value is "± 0.05" (it is only an assumption in the article, and the specific participation is subject to the actual product), when the price of MTR is between 0.95 and 1.05 US dollars, Standard Protocol is theoretically a static over-collateralized stable currency (there are also Other non-algorithmic functions can adjust the price, which will be discussed in the AMM section below), but when the MTR price falls below $0.95, the Standard Protocol algorithm will forcibly adjust the token issuance ratio. Health will deposit new collateral, and these additional collateral will adjust the supply and demand relationship of MTR and push its price back to the anchor level. Conversely, the same is true when the price unanchors upwards.

(2) Cross-chain

The cross-chain property of Standard Protocol is relatively best understood, and the project built on the basis of Polkadot can naturally apply the latter's cross-chain financial property. Previously, Standard Protocol has successfully obtained the Grant from the Web3 Foundation, and has also reached cooperation with a number of high-quality projects in the Polkadot ecosystem, such as Plasm, Patract, and Litentry.

According to the roadmap plan, Standard Protocol will be connected to the Kusama and Polkadot mainnets as parallel chains in the future, and in the longer-term plan, the project will also be deployed to other ecosystems such as Cosmos.

Unlike some stablecoin projects currently on the market that can only use tokens in a single ecosystem for collateral, with the integration of more new ecosystems, it is not ruled out that the collateral categories of the Standard Protocol will span multiple blockchains and multiple blockchains in the future. ecology.

(3) Oracle

The oracle is a major focus of all product modules of Standard Protocol.

Standard Protocol believes that the accuracy of oracle machine information is crucial for stablecoin projects, because it will directly affect the health of the mortgage rate and subsequent liquidation execution. However, the oracle machines of most stablecoin projects currently on the market are too centralized, the price feeding end is not open to everyone, and there is a lack of a decentralized ecosystem reward mechanism.

To solve this problem,Standard Protocol has built a brand new oracle module, and will reserve 10% of the governance token STND for oracle incentives.

There are two special features of the Standard Protocol oracle machine: one is that the price feeder is completely released, and anyone is free to provide quotations to the Standard Protocol, but at the same time, the role of the verifier who is responsible for verifying the accuracy of the price will go through strict Screening requirements include but are not limited to real identity KYC and locking a large number of STND tokens; the second is that Standard Protocol has created a fully decentralized reward mechanism, which is custom-built based on Substrate. Coins are issued to honest validators and price feeders.

(4) Clearing mechanism

Standard Protocol's original DEX-type liquidation mechanism may be the biggest highlight of the project.

For over-collateralized stablecoins, the liquidation mechanism is the last barrier to prevent bad debts and ensure the smooth operation of the system. However, the auction-type liquidation adopted by the early over-collateralized stablecoins is not ideal in practice. As mentioned above, in the 3.12 Black Swan incident last year, MakerDAO had auctioned $8.32 million worth of tokens at zero price due to the failure of the liquidation mechanism. ETH collateral, MakerDAO itself has realized that this mechanism is indeed not ideal. Recently, the project has initiated a vote in the community to upgrade the liquidation mechanism 2.0, which will change from the English auction (from low to high) to the Dutch auction (call from high to low).

Standard Protocol’s approach is more thorough. Instead of using an auction mechanism for liquidation, the project has designed a dedicated AMM DEX. When there is a bad mortgage debt, in order to avoid bad debts, the collateral of the debt will automatically flow into the DEX Users can purchase these collaterals at a certain discount, which in theory will achieve a far more efficient liquidation execution than the auction mechanism.

For example, if the unit price of ETH is $1,500, staking 1 ETH in the Standard Protocol can generate 1,000 MTR (the mortgage rate is 150%). If the liquidation rate specified by the system is 120%, then when the ETH price drops to 1,200 USD, the 1 ETH will automatically flow into the ETH-MTR pool in the DEX. At this time, the total amount of MTR in the pool remains unchanged, and the amount of ETH +1. In theory, the ETH in the pool has a certain discount compared to the outside, and the potential arbitrage space will Encourage users to buy ETH in the pool, and then complete the liquidation, and gradually promote the ETH in the pool to return to normal levels.

It should be noted that in the above example, the price of ETH in the pool will be discounted according to the amount of new inflow of ETH (collateral), and if you want to ensure that the liquidation is completed effectively, the lowest level of discount must also be able to cover Initially, the user mortgages 1 ETH to generate 1000 MTR, that is, the discounted ETH price should not be lower than 1000 MTR, which requires that the larger the amount of funds in the DEX pool, the better. In order to achieve this, Standard Protocol allows users to freely participate in market making. The DEX will always remain open. When there is no bad collateral exile, it is almost the same as Uniswap. Users who provide liquidity for the pool will also get similar to Uniswap. Coin's Liter (LTR) token.

Another great function of the DEX is that,Since the stablecoins in the pool only have MTR, when the MTR price breaks down but does not reach the threshold of algorithm intervention, the DEX can become an effective arbitrage tool to adjust the MTR anchoring status.secondary title

Online trading is coming soon, what is the token economic model of Standard Protocol?

The previous article briefly analyzed the product structure of Standard Protocol. Careful friends may find that there are three different types of tokens in this project. In order to distinguish the differences between the three, we will briefly review the token economy of Standard Protocol Model.

The three tokens in the Standard Protocol ecosystem are Meter (MTR), Liter (LTR), and Standard (STND):

Meter (MTR) is a stable currency generated by over-collateralization of encrypted assets. Similar to DAI, its target price will be maintained at the level of $1. If it is weak, there will be a large de-anchor. Standard Protocol will actively adjust through the algorithm mechanism.

Liter (LTR) is a liquidity token in the AMM DEX designed by Standard Protocol for liquidation scenarios (it will also run during non-liquidation periods), representing the rights and rewards of the DEX liquidity provider.

Standard (STND) is the governance token of Standard Protocol, which can be used to pay protocol fees, obtain pledged equity rewards, and participate in protocol governance.

Tonight at 21:00, Standard Protocol will be officially launched on Uniswap, and will be listed on centralized exchanges such as Gate and Kucoin at 22:40. From the point of view of market sentiment, the market pays a lot of attention to Standard Protocol. Since the Gate IEO application was launched at 22:00 yesterday, as of 9:00 this morning, it has raised 673 times in just over ten hours.

It should be noted that all the tokens mentioned here refer to the governance token STND of Standard Protocol (token contract address: 0x9040e237C3bF18347bb00957Dc22167D0f2b999d).

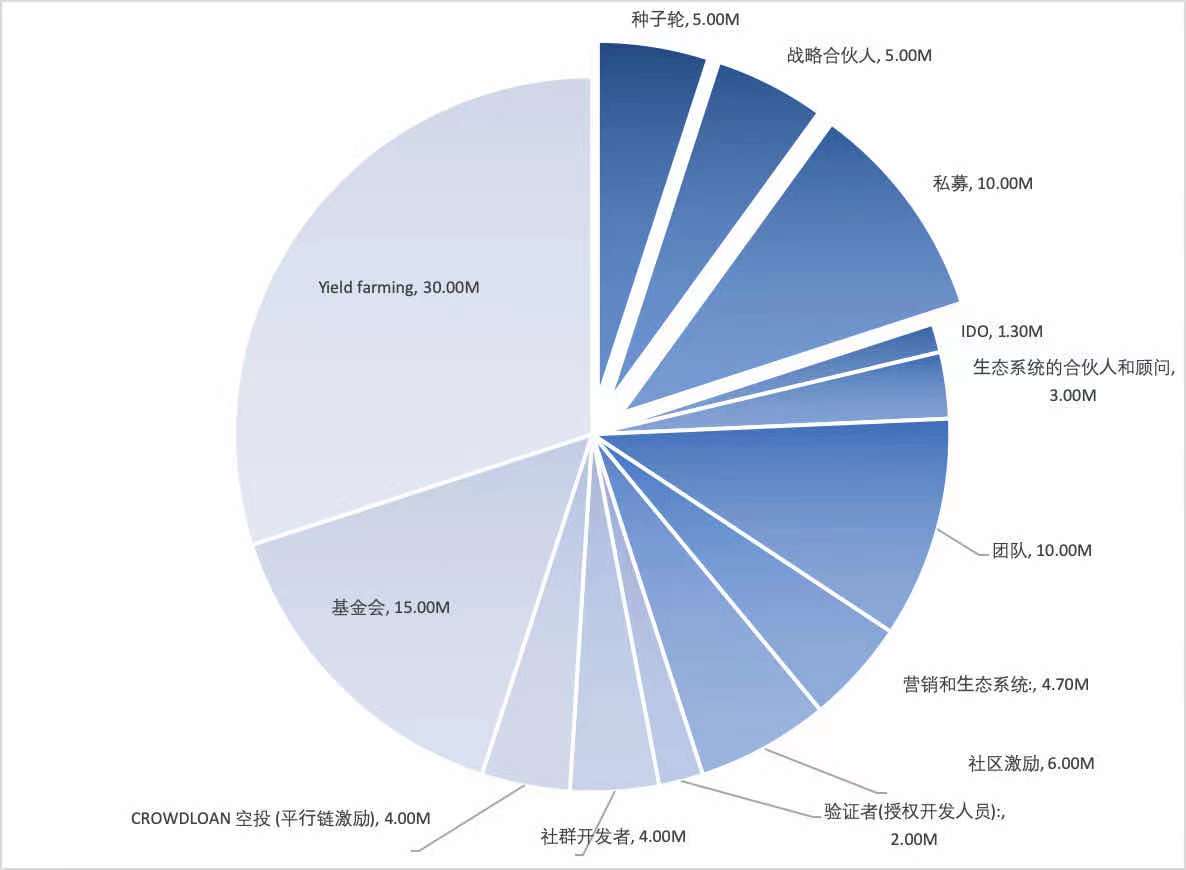

According to the white paper, the total amount of STND is 100 million, and the distribution of tokens is shown in the figure below.

As for the token lock-up status that investors are more concerned about, here we focus on investor allocation (21.3%), consultant allocation (3%) and team allocation (10%).

The 21.3% of the tokens allocated by investors are divided into four parts, of which:

Seed round investors account for 5%, 15% of these tokens will be released on the day of token generation, and the remaining tokens will be released linearly quarterly within one year;

Strategic partners account for 5%, 20% of these tokens will be released on the day of token generation, and the remaining tokens will be released linearly quarterly within one year;

Private placement accounts for 10%, 20% of these tokens will be released on the day the tokens are generated, and the remaining tokens will be released linearly quarterly within one year;

IDO accounts for 1.3%, and all tokens will be fully released on the day of token generation.

Ecosystem partners and advisors will share a total of 3% of the tokens, which will be allocated to Standard Protocol's global advisors. All tokens have a lock-up period of 3 months and will be unlocked linearly every month within a year.

secondary title

On the eve of Polkadot's ecological explosion, what is the prospect of Standard Protocol?

On the whole, the first impression of Standard Protocol is "pragmatic and innovative".

Pragmatically means that Standard Protocol did not act too hastily like many previous algorithmic stablecoins, and chose an overly idealized pure algorithm route, but retained the most ideal mortgage support model in the current market; innovation refers to, for the past For some of the "stubborn illnesses" faced by the stablecoin track, Standard Protocol has given highly targeted and eye-catching solutions.

As the parachain slot auction is approaching, the Polkadot ecology is on the eve of the outbreak. Stablecoins are one of the most important underlying infrastructures of DeFi. It is foreseeable that this track will take the lead after the ecology is officially launched (parachain goes online) Usher in fierce competition. It can be seen from the recent cooperation announcements that Standard Protocol is already planning for a rainy day, and we have enough reasons to look forward to the further development of the project in the future.