The world’s first digital currency exchange, Coinbase, was listed on Nasdaq with an issue price of US$250, an opening price of US$381, and an intraday peak of US$421. The market value once reached US$112 billion, and the first day closed up 31.31%. In the US stock market, the turnover is second only to Tesla.

Many cryptocurrency investors around the world see April 14 as a watershed moment in the digital asset space, a milestone event in the history of cryptocurrencies.

(Thanks to the Roast Boy Creators Alliance for supporting this article)

(Thanks to the Roast Boy Creators Alliance for supporting this article)

“Thank you Satoshi,Whoever you are." A few hours before the listing, Fred Ehrsam, the former co-founder of Coinbase, posted this tweet, thanking Satoshi Nakamoto. Founder and CEO Brian Armstrong also paid tribute to Satoshi Nakamoto, who mentioned in the Coinbase listing prospectus Arrived at Satoshi Nakamoto, and attached the address of Satoshi Nakamoto's wallet.

In fact, with the listing of Coinbase (which can bridge the gap between the traditional financial sector and the cryptocurrency sector), more and more mainstream players seem to be optimistic about COIN. One of the important conditions for the support of Coinbase's market value is its status as a "gatekeeper" in the cryptocurrency market.

We have to admit that Coinbase actually determines the success or failure of most cryptocurrencies. In terms of the role it plays in the industry, although digital fields such as Bitcoin and blockchain are frantically playing the banner of "decentralization" and "de-controlling", Coinbase can play a certain role in it. doorman" role. They can decide which digital currency to bring to the market for public trading, and this decision will cause the price of the relevant digital currency to fluctuate greatly.

We can learn that Coinbase's cash flow in 2020 is 3 billion US dollars, of which 2.7 billion comes from the custodial funds provided to customers. From the perspective of business model, the transaction fee rate of Coinbase is 1.4%, and 85% of its revenue comes from transaction fees. In addition, Coinbase provides services such as user deposits and mortgage loans, and pays deposit interest for users. In the future, a savings card will be launched, and users who use the savings card will receive Bitcoin. However, the subscription fee is relatively small at this stage. Coinbase's business model is feasible, and its profit in the first quarter of 2021 will be about 730 million to 800 million US dollars, surpassing the established financial technology giant Square, which is impossible for many growing companies in the market today.

The huge exchange user base has laid the foundation for Coinbase's future trading in the stock market. According to the data in the first quarter, the verified users of the platform are 56 million, an increase of 30% compared with last year, the monthly trading users are 6.1 million, an increase of 117.86%, and the platform assets are 223 million, an increase of 146.94%. 11.1%.

Another important condition for the support of Coinbase's market value is its emphasis on compliance, which is another important reason why it is recognized by the mainstream market. It can be said that it is the one with the best compliance and the most complete license among the existing exchanges.

As the first bitcoin exchange with a formal license in the United States, Coinbase recently hired Ian Rooney, Morgan Stanley's global anti-money laundering consultant, as the head of corporate compliance. As the head of corporate compliance, Rooney will lead Coinbase's corporate compliance team , in order to comply with the set of onerous anti-money laundering (AML) rules that virtual asset companies face, mandated by the Financial Action Task Force (FATF).

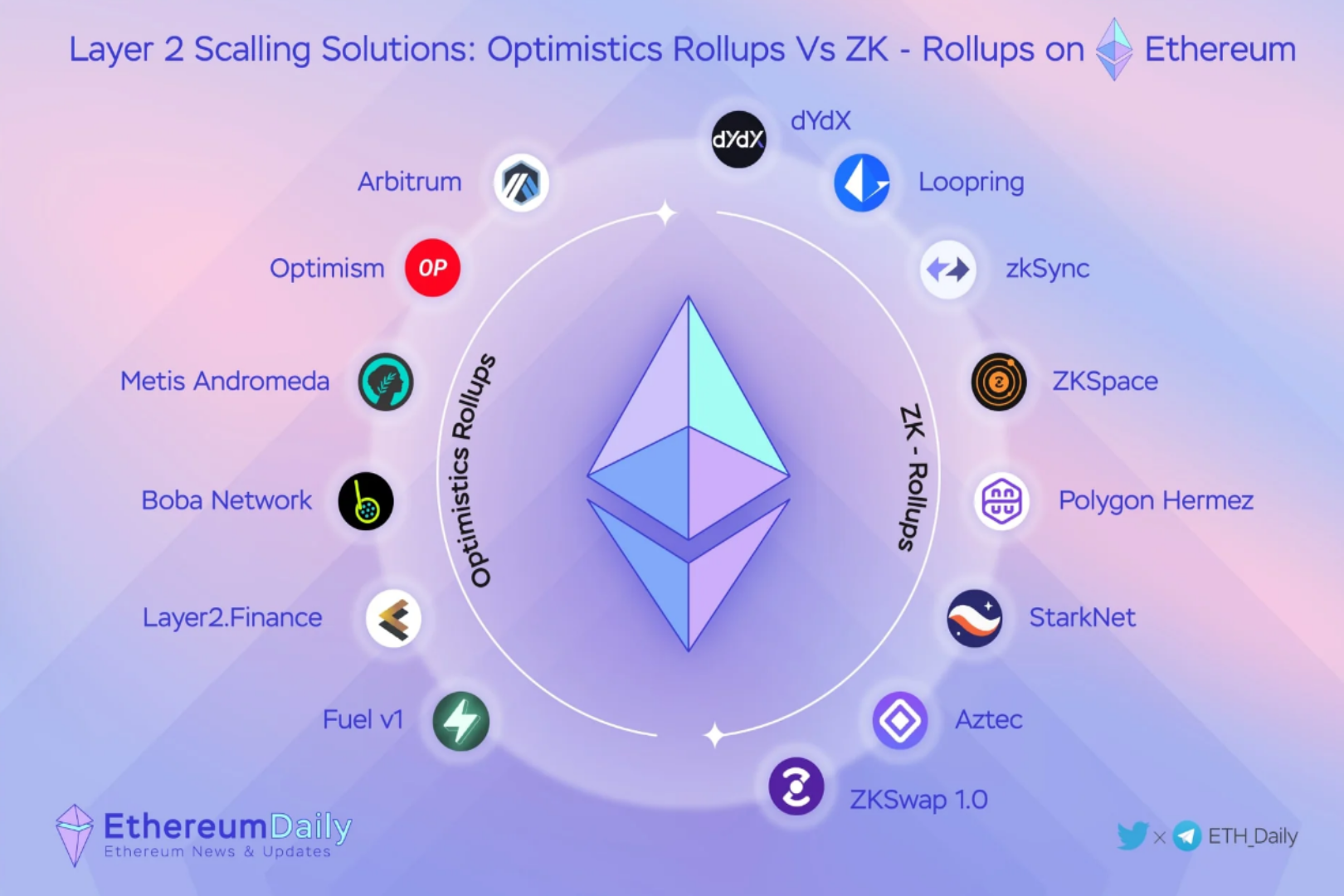

Coinbase founder Brian said that this decade of cryptocurrencies began with complete unregulation, and that Coinbase is the first cryptocurrency company to really take regulation seriously because they believe it will promote long-term adoption. In his view, there is no uniform solution in the world on how to regulate cryptocurrencies. Cryptocurrencies need to face many different types of regulatory agencies. However, the decentralization of cryptocurrencies continues to develop rapidly. Non-custodial wallets, DEX (decentralized Decentralized exchanges), DeFi and dapps have increased in use, and the decentralized nature of cryptocurrencies has led to the need for a new regulatory framework.

Cat Buboo, a Forbes contributor, believes that the listing of Coinbase continues the cyclical law of the bull market, and may even bring about an eternal bull market, because the characteristics of digital currency are destined to make the encrypted world evolve faster than the Internet back then.

Roger Lee, one of Coinbase’s investors in 2017 and a partner of venture capital firm Battery Ventures, believes that the correct posture to evaluate Coinbase is to imagine that Netscape developed a browser in 1994 and opened the Internet world to ordinary people. What the internet world looked like before the gates. Similarly, Coinbase brings a complex technology such as digital currency to the masses, allowing ordinary people to understand this new world and have the opportunity to participate in it and profit from it.

In any case, this day is worth remembering by all of us.