OpenOcean.Finance - the first fully aggregated protocol that connects the DeFi and CeFi ecosystems

This article is from:This article is from:OpenOcean Official Medium

, forwarded with authorization.

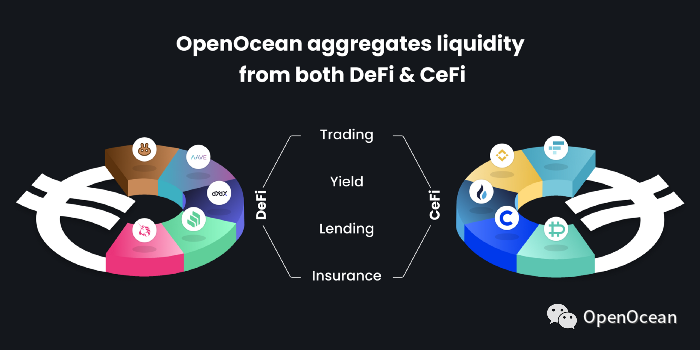

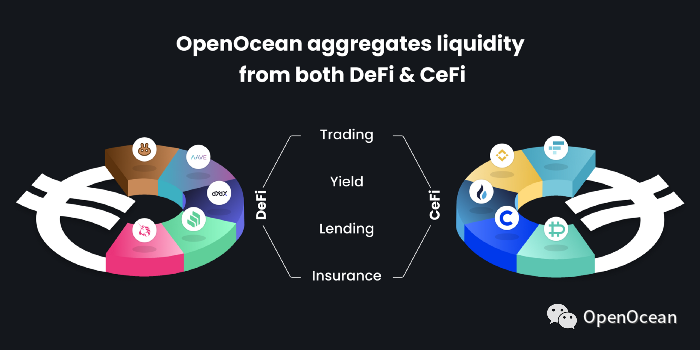

As the first fully aggregated protocol that aggregates DeFi and CeFi liquidity, OpenOcean provides an entrance to the encrypted world.Build a bridge connecting the isolated islands of DeFi and CeFi transactions through the aggregation protocol, and create an ecosystem that is beneficial to all types of users. The vision of the team is to provide users with a one-stop trading portal with symmetrical price information and all mainstream asset types can be traded through aggregation in the current fragmented trading market, empowering individuals and investment institutions so that they can use their own investment Strategies trade with the highest efficiency at the best price.In the future, OpenOcean will further aggregate derivatives, portfolio margin, income, lending, insurance products, and robo-advisory wealth management products on DeFi and CeFi.secondary title

How does OpenOcean achieve full aggregation?

1. First aggregate DEX transactionsOpenOcean plans to aggregate most of the public chains and most of the DEX ecosystem. OpenOcean has currently aggregated nearly 20 mainstream DEX ecosystems from Ethereum, Binance Smart Chain, TRON Chain, and Ontology, and helps users find the optimal swap price on the public chain ecology through path splitting to achieve The transaction with the best price and lower slippage will also support public chains such as Polkadot and Solana, as well as Ethereum Layer 2 and almost most mainstream wallets.OpenOcean now supports cross-chain interaction between Binance Smart Chain and Ethereum and other public chains through Binance Bridge, and will also support direct cross-chain transactions in the future. In addition, we will also realize cross-chain transactions by aggregating Polkadot ecological DEX, and realize cross-chain transfers to any chain.3. Connect DeFi and CeFi through CeFi transaction aggregationOpenOcean will launch aggregation for Binance at 8:00AM (UTC) on March 29, 2021. Users can freely choose to trade at the best price on DEX or CEX after comparing prices and liquidity. For users with large orders, we will realize the path splitting through CeFi and DeFi in the future, helping users complete transactions simultaneously in CeFi and DeFi at the best price.4. Aggregation of derivatives, lending and insurance productsCurrently OpenOcean supports asset exchange services, and soon we will aggregate centralized derivatives and decentralized derivatives. For the aggregation of derivatives, we will achieve in-depth aggregation through combined margin. Users can realize long-short transactions in multiple CEXs at the same time with the most reasonable margin through the combined margin pool on OpenOcean.In addition, OpenOcean will also aggregate lending and insurance products, and provide robo-advisory services to help users participate in more DeFi ecosystems and automate asset management processes.OpenOcean not only supports DeFi users, but also CeFi users; not only newbies, but also professional traders. The existing interface is user-friendly and completely free to users. For funds and professional traders, OpenOcean will provide API interfaces and tailor-made trading interface services to assist investment institutions in formulating trading strategies such as quantitative arbitrage.secondary title

How far has OpenOcean made so far?

Since its establishment until March 26, 2021, OpenOcean has had more than 150,000 transaction addresses from more than 210 countries, more than 440,000 transactions, and a transaction volume of more than 800 million US dollars. According to DappRadar data, OpenOcean ranked between 3/4 among all DEXs in the number of active users in the past month. Additionally, OpenOcean was named the No. 1 DEX aggregation protocol on Binance Smart Chain.Does OpenOcean charge users?The optimal path function provided by OpenOcean is free for DEX users. OpenOcean's main profit method comes from providing professional traders and investment institutions with tailor-made trading interfaces and strategy execution, portfolio margin products, smart investment advisory service products, and APIs.Who are OpenOcean's existing competitors?At present, there is no all-aggregation protocol like OpenOcean in the market. Both 1inch and Matcha are DEX aggregation protocols, which support relatively few chains and do not support CEX. 1Inch focuses on the DEX that aggregates the Ethereum chain and Binance Smart Chain, while OpenOcean supports all mainstream public chains. In addition, OpenOcean will provide full aggregation of derivatives, lending, and insurance products, which will be wider than Yearn Finance's product aggregation.Who are the well-known institutional investments in OpenOcean?In the strategic round of financing, OpenOcean received $2 million in financing led by Binance, with participation from industry-leading investment institutions such as Multicoin Capital, CMS Holdings, Kenetic, LD Capital, and Altonomy.Recently, OpenOcean completed a new round of financing, followed by Altonomy and LD Capital following the strategic round. AU21, FBG, TRON Foundation, DAO Maker, Asymmetries Technologies, LIAN Group and other investment institutions and partners of Republic.co participated in the investment.What benefits will OOE Token holders get?1. Protocol governance: OOE users have community voting rights2. Subsidize Gas Fee and Slippage: OpenOcean DEX users can enjoy Gas Fee and Slippage Subsidy in future activities (greatly reduce transaction costs)3. Liquidity mining: The liquidity mining plan will be launched after OOE is issued. Liquidity mining pools will be opened on different public chains aggregated on OpenOcean, such as ETH, BSC, ONT, TRON, etc., and OOE-related liquidity mining will be activated.4. CEX VIP members: A large number of OOE users can enjoy CEX VIP services, such as: maker/taker fee discounts, transaction fee subsidies, and cash withdrawal fee subsidies. Once the amount of OOE held reaches a certain level, VIP members can enjoy free use of institutional-level PME product (SAAS) arbitrage tools for a certain period of time.5. Combine margin and collateral as margin for lending.

Some community platforms:

Official website: openocean.finance

Twitter: @OpenOceanGlobal

Email: contact@openocean.finance

WeChat public account: OpenOceanGlobal

Telegram group (English): t.me/OOFinance

Telegram group (Chinese): t.me/OOFinanceCN

Medium:https://openoceanglobal.medium.com