With the development of DeFi, aggregation services are also quietly evolving.

Take transaction aggregation as an example. On the one hand, due to the rise of new public chains such as BSC and Solana, liquidity is no longer just scattered in the Ethereum ecosystem. The demand for multi-ecological aggregation has emerged. Many aggregation services including 1inch They have all started to build multi-chain versions; on the other hand, existing projects have jumped out of the DeFi thinking cage, and have begun to try to break down the barriers between DEX and CEX, and aggregate greater liquidity resources.

secondary title

Q0

Odaily:Hello Cindy, please introduce yourself first.

Cindy:Hello, everyone, I am Cindy, from OpenOcean. I graduated from the top ten business schools of the Financial Times. I worked as a Strategy Manager at RBS and as a Senior Investment Director at a Global Private Equity. Since 2017, I have been paying attention to the development trend of the blockchain field and making investments. Because he believes that the aggregation protocol can provide great value to the ecological development of the industry, he created OpenOcean with the team and is currently responsible for the global market and operation of OpenOcean.

secondary title

Q1

Odaily:Please briefly introduce OpenOcean to you first. What is the positioning and vision of the project? What industry problem do you want to solve?

Cindy:OpenOcean is positioned as a fully converged protocol. The team's vision is to build a bridge connecting the isolated islands of DeFi and CeFi transactions through a fully aggregated protocol. Our goal is to create an ecosystem that is beneficial to all kinds of users.

secondary title

Q2

Odaily:Different from other aggregation services, OpenOcean positions itself as a "full aggregation protocol". What are the specific aspects of this "full aggregation"?

Cindy: "Full" can be reflected in many aspects.

1. First of all, aggregate the public chain and aggregate DEX ecology:

OpenOcean has currently aggregated nearly 20 mainstream DEX ecosystems from Ethereum, Binance Smart Chain, TRON Chain, and Ontology to help users find the optimal swap price on the public chain ecosystem and split the path to achieve the best swap price. It will also support public chains such as Polkadot, Solana, and Ethereum Layer 2 in the future. OpenOcean supports almost most mainstream wallets and supports cross-chain. OpenOcean now supports cross-chain between Binance Smart Chain and Ethereum and other public chains through Binance Bridge, and will support direct cross-chain transactions in the future. In addition, we will also realize cross-chain transactions through the DEX that aggregates Polkadot ecology.

2. Aggregate CeFi to connect DeFi and CeFi:

OpenOcean will soon launch aggregation for Binance. After comparing prices and liquidity, users can freely choose to trade at the best price on DEX or CEX. For users with large orders, we will split the paths between centralized exchanges and decentralized exchanges, helping users complete transactions simultaneously on centralized and decentralized exchanges at the best price.

3. Aggregation of all types of transactions:

In addition, OpenOcean will also aggregate lending and insurance products, and provide robo-advisory services to help users participate in more DeFi ecosystems and automate asset management processes.

In addition, OpenOcean will also aggregate lending and insurance products, and provide robo-advisory services to help users participate in more DeFi ecosystems and automate asset management processes.

4. Cover all users:

secondary title

Q3

Odaily:OpenOcean has launched a transaction aggregation service. How is the current data performance?

Cindy:secondary title

Q4

Odaily:For users, what are the advantages of OpenOcean's transaction aggregation service compared to other competing products on the market (such as 1inch)?

Cindy:First of all, from the perspective of aggregation transactions, OpenOcean aggregates DeFi and CeFi ecology, and becomes the first cross-chain aggregation protocol that aggregates multiple chains. In terms of aggregated services, aggregated transactions are only the first step of OpenOcean. Its vision is to aggregate the ecosystem, including lending, insurance, and portfolio margins, improve the utilization rate of funds, and create a robo-advisory platform covering all categories. Provide users with a richer trading ecosystem and create higher value. Compared with aggregators such as 1inch and Matcha that focus on the aggregation of Ethereum ecology and side chains, OpenOcean supports more comprehensive asset types and transaction types.

OpenOcean now supports the decentralized exchange DEX trading ecosystem of multiple mainstream public chain networks and the centralized exchange CEX ecological trading ecosystem. The first and leading aggregation protocol on Binance Smart Chain (BSC). In the near future, OpenOcean plans to aggregate Solona and Ethereum Layer2 DEX, and at the same time reach a strategic cooperation with Polkadot ecological Zenlink to explore more possibilities of cross-chain aggregation.

Next, let's analyze and compare from the cost level. OpenOcean uses a dynamic optimization algorithm, supplemented by massive platform data for machine learning, and dynamically optimizes each node to ensure that users get the real-time optimal price (guaranteed for slippage) and lower gas costs. OpenOcean does not charge users any protocol transaction fees. Compared with 1inch, which will earn part of the slippage difference when the actual transaction price on the chain moves towards the user's side, OpenOcean does not charge any agreement fee for DEX users. In addition, after the OOE token is issued, OpenOcean will use OOE Token users to compensate users for slippage from time to time.

In addition, for institutions, OpenOcean also provides tailor-made trading interface services to help institutions create trading strategies.

secondary title

Q5

Odaily:OpenOcean currently provides two different versions, Pro and Classic, can you briefly introduce the differences between these two versions?

Cindy:secondary title

Q6

Odaily:We found that some small currencies that can be searched through contracts in Uniswap are currently not available in OpenOcean. How does OpenOcean make decisions in terms of which currencies to support? With the launch of the native token OOE in the future, can the community participate in the decision-making of listing the currency?

Cindy:On the one hand, the team regularly observes the top dozens of Tokens on mainstream Dex, such as Uniswap and Pancake. For newly ranked trading pairs, a risk review of the Token will be initiated, including contract validity, liquidity, etc. Tokens with low security will be eliminated, and the reviewed Tokens will be listed for trading in a timely manner. For example, for Dogecoin (DOGE) and SafePal wallet token SFP, which were in the limelight some time ago, OpenOcean was the first to put Token online for users to trade.

secondary title

Q7

Odaily:In the official line, OpenOcean stated that it will issue the governance token OOE and start liquidity mining in the first quarter of 2021. Now that the first quarter has come to an end, OpenOcean has also announced the first round of airdrops last week. The time for receiving airdrops is set to be after the official issuance of coins. Is there a specific time plan for the issuance of coins? How long will it take for OOE to officially come out? Where can I buy OOE?

Cindy:secondary title

Q8

Odaily:Can you briefly describe the use case of OpenOcean’s native token OOE? In what ways is its value reflected? Can you introduce OOE's token economic model (total supply, allocation, lockup)?

Cindy:The value of OOE is reflected in the following aspects.

1. Protocol governance: OOE users have community voting rights;

2. Subsidize gas fees and slippage: OpenOcean DEX users can enjoy gas fees and slippage subsidies in future activities (greatly reducing transaction costs);

3. Liquidity mining: After OOE is released, a liquidity mining plan will be launched, and liquidity mining pools will be opened on different public chains aggregated on OpenOcean, such as ETH, BSC, ONT, TRON, etc., to open OOE-related liquidity mining.

4. CEX VIP members: Users who hold a large number of OOE can enjoy CEX VIP services, such as maker/taker fee discounts, transaction fee subsidies, and cash withdrawal fee subsidies. Once the amount of OOE held reaches a certain level, VIP members can enjoy free use of institutional-level PME product (SAAS) arbitrage tools for a certain period of time.

secondary title

Q9

Odaily:When announcing the first round of airdrops, OpenOcean has made it clear that there will be follow-up airdrops? Do you have a general plan for the follow-up airdrop? If the plan has not been finalized, can you roughly disclose what criteria will be considered for subsequent airdrops?

Cindy:According to the design of the OOE economic model, 2% of the OOE is used for airdrops. The first airdrop of 1% (that is, 10,000,000 OOE) has ended, and the airdrop rewards will be distributed to the user's address when the Token goes online. The second airdrop will also be launched when the OOE goes online The rules will be announced simultaneously and the airdrop will be carried out. In addition, OpenOcean will cooperate with several wallets for airdrop activities in the near future, so stay tuned.

As a full aggregation protocol, OpenOcean provides users with the best price and the lowest slippage by aggregating DEX and CEX in the first step to become a one-stop trading portal, hoping to bring convenience to users when trading. The first airdrop is mainly to give back to the old customers who have been with us for more than half a year and helped us grow. The second round of airdrops has not yet formulated detailed rules, and we will distribute them according to the number of transactions and transaction amounts before going online. The main purpose of setting up the second round of airdrop is to attract more DeFi deep users to use our products, use us as the entrance of DeFi transactions, and experience the best price, lower slippage and gas fee.

secondary title

Q10

Odaily:We understand that what OpenOcean wants to do is not just a transaction aggregation service, can you introduce OpenOcean's future plans based on the roadmap?

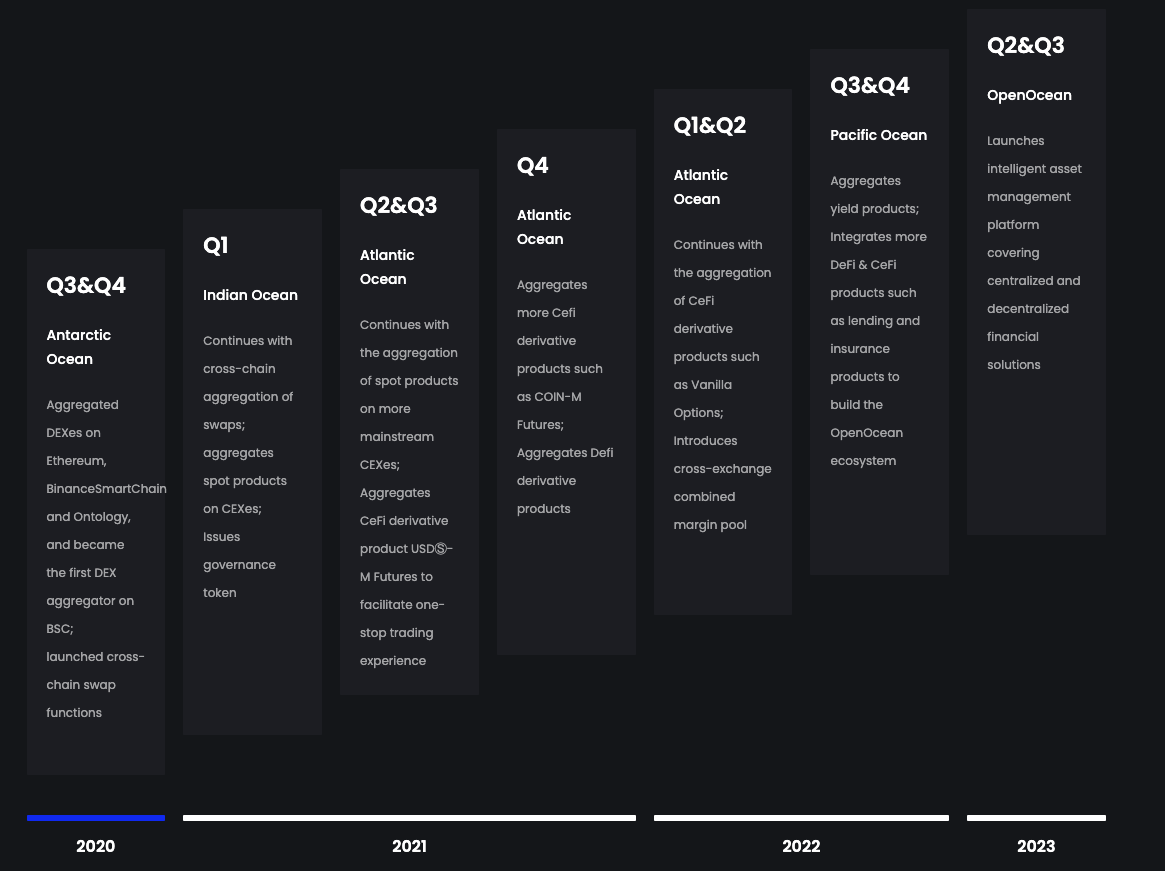

Cindy:OpenOcean will issue the platform token OOE in the near future. In the quarter of 2021, it will continue to aggregate more public chains and centralized exchanges, aggregate the monthly inverse contract (USD-M futures) products of the centralized platform, and the forward contract (Coin- M futures) and aggregated decentralized derivatives products.

In addition, OpenOcean will aggregate centralized derivatives simple options in the first and second quarters of 2022, and introduce combined margin products. In order to meet the diverse needs of users, lending and insurance products will also be aggregated in the second half of next year, and robo-advisors will be implemented in 2023 to further improve the OpenOcean ecosystem.

We will also dynamically adjust the product roadmap according to market development and user needs to help users conduct transactions through OpenOcean more conveniently and improve revenue and capital utilization efficiency.