Before the story begins, let’s understand a small fact: We know that centralized exchanges are trading protocols based on order books, while decentralized trading AMMs are exchange pool transactions based on smart contracts deployed on the blockchain. That is to say, users deposit their own Token into the fund pool of an exchange, and then they can exchange for another Token according to the algorithm, which greatly enhances the immutability and autonomy of the transaction.

In the second half of 2020, the strong wind of DeFi decentralized finance will blow, and the fastest out of the circle is none other than Uniswap. Rising stars are also quietly upgrading, and various "Swap" such as Sushiswap, Mooniswap, and Airswap have emerged as the times require. They rob better data, including more users, trading volume, and liquidity, in order to obtain a higher market value ranking. There was smoke everywhere.

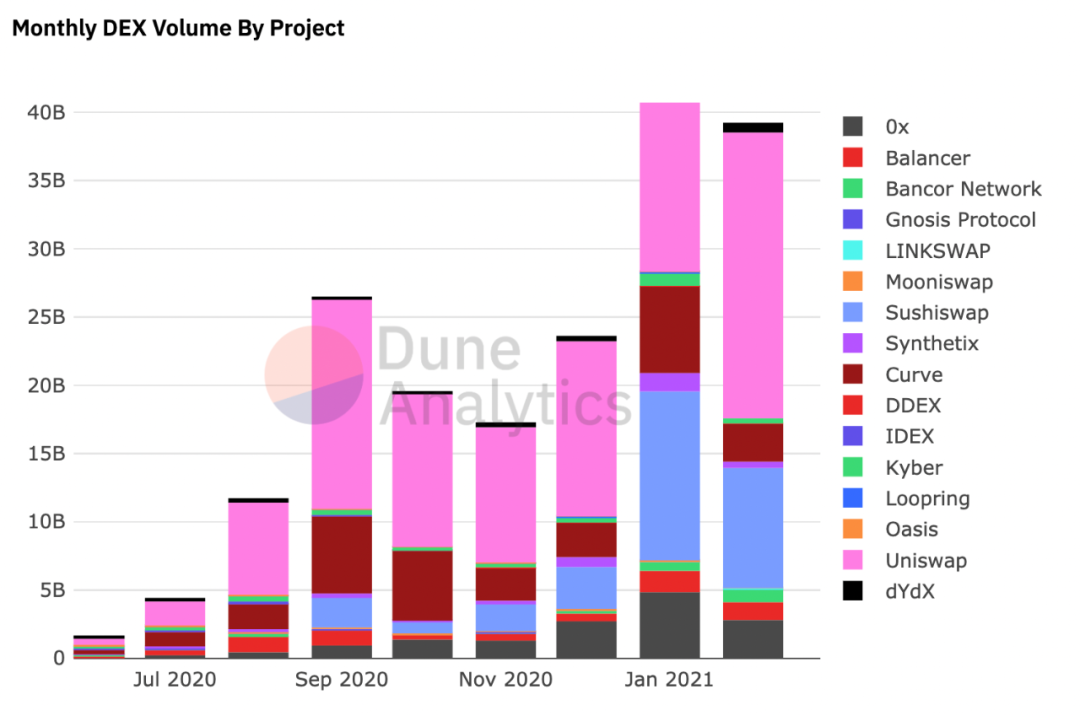

Since July 2020, various DEX projects have emerged to divide the market share. The picture shows the transaction volume indicator. Source: Dune AnalyticsThe relationship between Uniswap and Sushiswap is like a pair of twin brothers. Because of the open-source nature of the blockchain project code, its appearance comes from directly copying Uni’s code, or it is a fork of Uni, which is why Sushi has always been controversial. The place.However, the controversy cannot stop Sushiswap from keeping up with the rapid growth of Uniswap. It not only provides users with benefits similar to Uniswap, but also issues its own platform currency SUSHI and introduces token incentives, that is, allocating part of its transaction fees to tokens. Holders of SUSHI tokens. This model prolongs the timeliness of benefits. Even the early liquidity providers of the platform can benefit from the protocol and continuously obtain tokens from the SUSHI they mine. On the other hand, Uniswap was not “forced” to launch its own governance token UNI until a few weeks after it was attacked on September 18, and then backtracked 15% of Token quotation compensation to early liquidity providers through airdrops.Token incentives are like throwing out a lot of bait, and how to solve the large amount of liquidity on the platform? Sushiswap had an idea and proposed a method to attract liquidity providers (LP): if you have deposited money with Uniswap, then you can use the "passbook" to pledge the LP Token with me, and give you interest on schedule (earn SUSHI tokens), your "passbook" can also be taken away at any time.After hearing this good news, everyone went to Uniswap to create an asset pool, replace LP Token, and then pledge LP Token in Sushiswap to win "interest". Afterwards, the total TVL locked in Uniswap skyrocketed at a speed visible to the naked eye. In September last year It exceeded 1.6 billion US dollars on the 1st.

Comparison of DODO's PMM function curve and Uniswap's AMM function curve