When it comes to DEX, we have to mention the legendary Uniswap. Uniswap is a decentralized exchange built on Ethereum. It uses the AMM model, replaces the order book with a liquidity pool, and provides LP tokens for liquidity providers. The AMM model eliminates the need for partner cooperation when trading. Hence, less transaction time is consumed on DEXs using this model.

Uniswap is one of the earliest and most successful DEXs, surpassing the trading volume of the largest centralized cryptocurrency exchange, Coinbase. At present, many DEXs have more or less borrowed the relevant functions of Uniswap. The development of DEX and the strong pursuit of users have made it gradually threaten the status of CEX. Many CEXs have gradually launched DEX products based on their own public chains to seize the share of DEX.

Binance Smart Chain is one of them. Due to the high gas fees and transaction congestion of Ethereum, many developers and users are looking for new alternatives. BSC has gradually become a new way of choice for users and developers. Token prices and market caps in the Binance Smart Chain (BSC) ecosystem are currently booming. In addition to BNB leading the list, PancakeSwap’s token CAKE has achieved remarkable results, gaining more than 6,000% in less than six months, which also attracted a lot of attention.

What is PancakeSwap?

PancakeSwap is a decentralized exchange (DEX) powered by Binance Smart Chain (BSC), and the tokens follow the platform's BEP-20 token standard. It looks a bit like Ethereum's SushiSwap, which uses an AMM (Automated Market Maker) model to fulfill orders. Liquidity providers can interact with the pool to receive LP tokens representing their shares in the pool, and then lock LP tokens in exchange for other tokens and rewards.

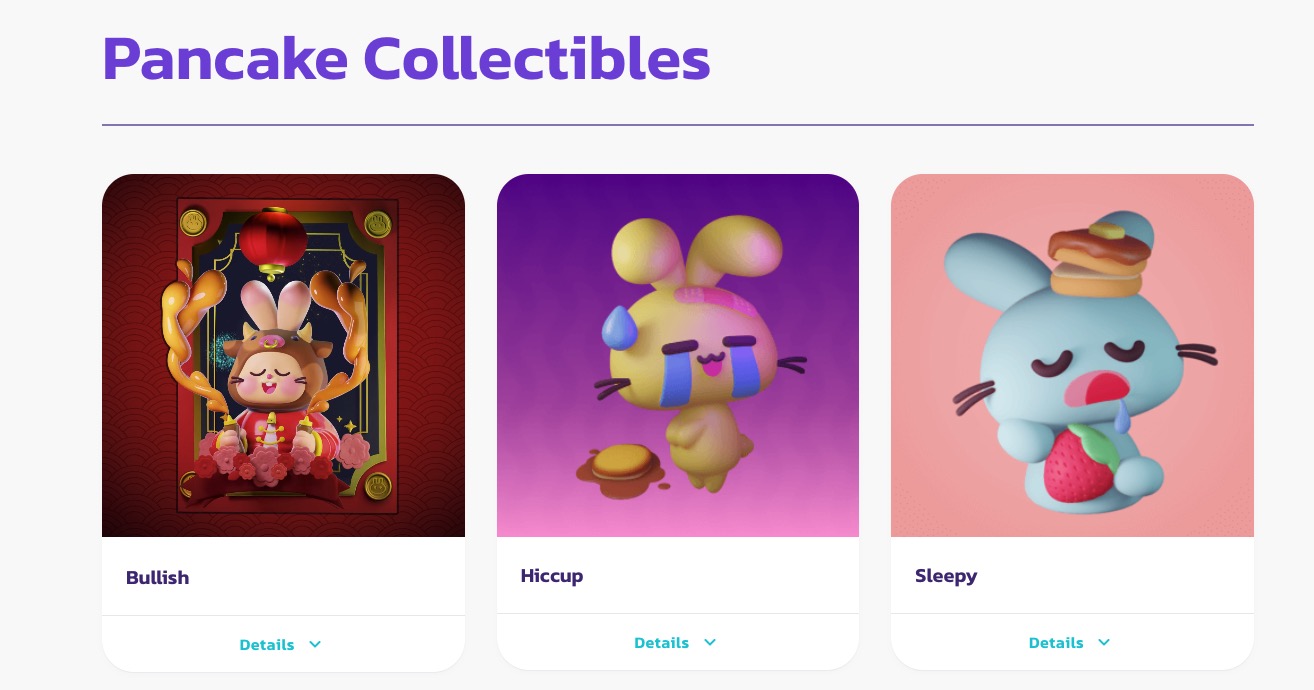

On PancakeSwap, you can provide liquidity, mine, pledge, draw, earn NFT, participate in IFO, etc. At present, PancakeSwap has successfully held many IFOs, such as Helmet, BLK, WATCH and BELT.

Uniswap and PancakeSwap

When many DEXs are competing for development, a competition cannot be avoided.

1) PancakeSwap is the unofficial winner of this war, its liquidity has increased by more than 1000% in about two months. Additionally, PancakeSwap’s volume has skyrocketed from $370,000 to $1 billion in the first 49 days of 2021.

A large part of the price change of digital assets depends on demand. Due to the rising adoption rate of BSC and CAKE generation, PancakeSwap is gradually approaching Uniswap. In February 2021, PancakeSwap once surpassed Uniswap to become the largest DEX. The BSC-based DEX has $400 million more daily trading volume than the ETH-based DEX. And Ethereum users need to consume a lot of gas fees in transactions, while BSC users only need to pay a small part of it, and BSC uses the PoS consensus, which can greatly improve the transaction speed. As of now, there seems to be more demand for CAKE than UNI.

2) Although the adoption rate of BSC and CAKE generation is rising, and the liquidity of PancakeSwap is also increasing, Uniswap is still in the lead. Most tokens on Uniswap have a lot of liquidity compared to tokens on PancakeSwap. More liquidity providers prefer Uniswap, because PancakeSwap's liquidity provision incentives are biased toward depositing the most volatile foreign tokens.

3) There are more than 1,500 tokens on Uniswap, and there are about 200 tokens on PancakeSwap. From this perspective, Uniswap is more able to meet the needs of Ethereum users.

4) As a DeFi project, security is also one of the considerations. Even top-tier projects are not immune to hacking and theft of funds. For example, the Vether (VETH) pool on Uniswap was attacked, draining 919,299 VETH, worth about $900,000, and the entire attack cost was only 0.9 ETH, or about $200. In addition, Uniswap's non-permission system for listing coins has also caused many counterfeit projects to issue coins to defraud users of funds.

PancakeSwap is no exception. Recently, PancakeSwap has been attacked by DNS. The attacker requests users to submit personal private keys or mnemonic words through the website, and resolves the domain name of the target website to Wrong IP address so as to realize the purpose that the user cannot access the target website or deliberately or maliciously require the user to visit the specified IP address (website).

It can also be seen from this that security is one of the problems that DeFi projects urgently need to solve. It cannot guarantee the security of funds, transactions, and information. Even if there is a high liquidity, it cannot gain the long-term trust of users.

The comparison between PancakeSwap and Uniswap shows not only the fierce competition of DEX, but also the ambition of public chains such as BSC and Heco to compete with Ethereum. The development of ETH2.0 will take about 2 years, but the update and iteration speed in the encryption field can regain a new look overnight. While waiting for the success of ETH2.0, there will be countless infrastructures like BSC, and they will also have a large volume of transactions and liquidity. For example, taking BSC as an example, between January and February 2, 2021, the number of unique users recorded by BSC increased from 12,700 to more than 50,000.

references:

references:

Werner Vermaak:Uniswap vs PancakeSwap