Author: BlockTempo

Preamble:

Since the launch of the Serum protocol at the end of last year, the development of the Serum ecosystem has gradually improved. The ecosystem includes the Serum front-end Bonfida, Raydium that integrates AMM liquidity, Maps.me of the offline map app, and Oxygen, the prime broker agreement.

This article will briefly introduce the functions of each DeFi protocol in the Serum ecosystem one by one, and finally integrate the roles played by each protocol in the Serum ecosystem to spell out a complete "Serum Universe" created by FTX founder SBF (Sam Bankman -Fried). "situation.

The following are the members of the Serum ecosystem that will appear in this article:

● Serum – decentralized exchange

● Raydium – AMM protocol

● Bonfida – front-end platform

● Maps.me 2.0 – application scenarios

secondary title

Decentralized Exchange Serum

The first gem of the Serum universe is the Decentralized Exchange (DEX) is the Serum protocol, and this is the DeFi protocol launched by Sam Bankman-Fried, founder of FTX exchange and market maker Alameda Research.

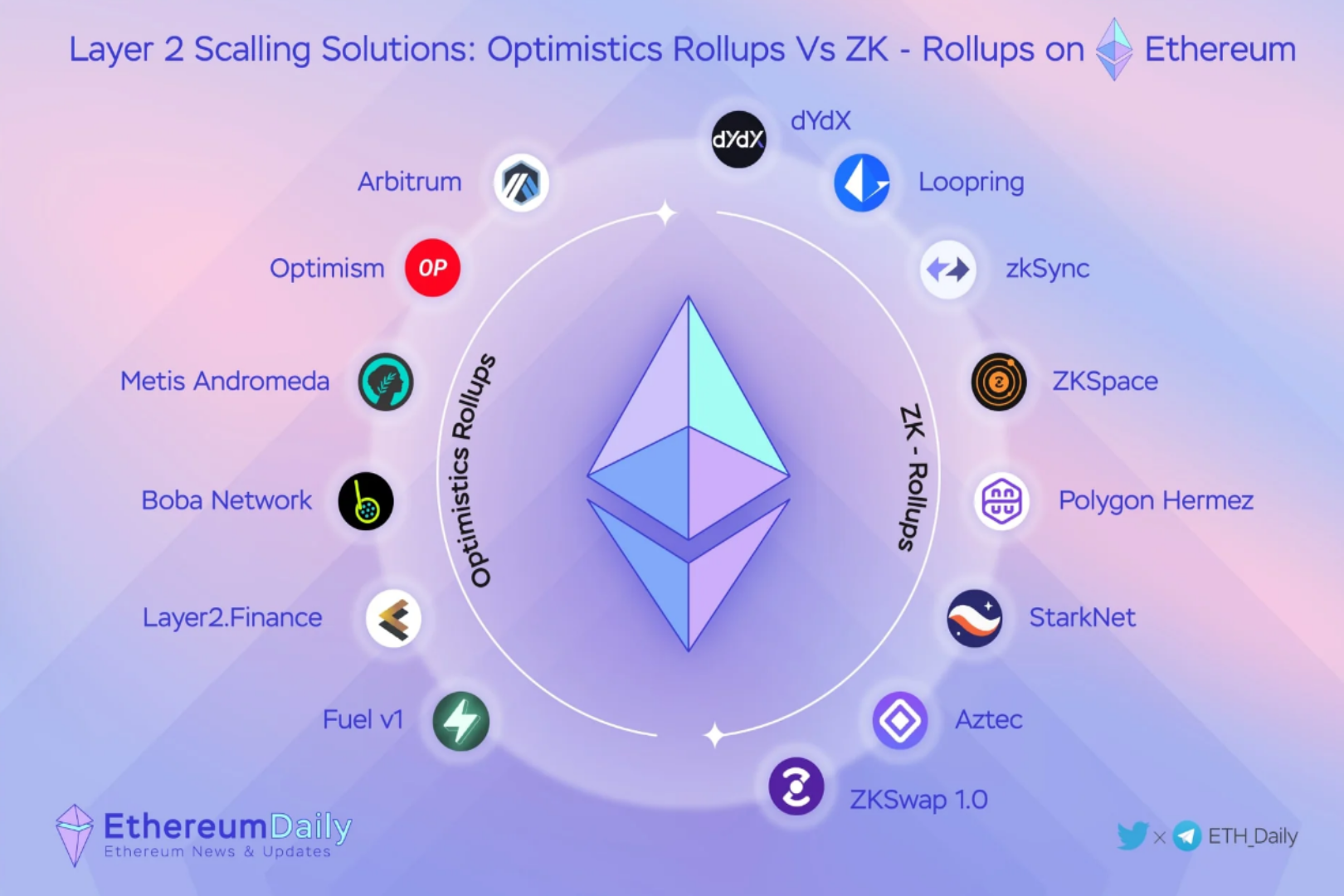

Generally speaking, most DEXs use the "automatic market maker (AMM)" mechanism, which relies on mathematical models to operate, such as "x * y = k". The advantage is that there is no need to rely on traditional market makers to provide liquidity. Of course, the disadvantage is also obvious, that is, when the liquidity is insufficient, there will be a large "slip price", and users cannot , Pre-orders to buy and sell, to protect assets, and even impermanent losses may occur.

The reason for the emergence of AMM is that in addition to decentralization, it is more due to the lack of scalability of the underlying architecture (such as Ethereum). If the traditional "order book mechanism" is used, the handling fee will be too high and the transaction speed will be delayed.

Serum solves this problem through the scalability of the Solana blockchain, which allows users to trade based on the "Orderbook" mechanism. In addition to realizing pre-orders, high transaction speed and low handling fees also make high-frequency transactions possible.

From the description in the white paper, Serum not only has a cross-chain transaction protocol, but also issues Serum USD backed by a basket of stablecoins to avoid single points of failure. Therefore, in the long run, Serum’s future benchmarking model should be a “decentralized version "'s FTX exchange has become a spot and derivatives trading platform on Solana.

secondary title

Raydium AMM protocol

Although the Raydim protocol is also a trading protocol, it is different from Serum's direction of becoming a derivatives trading platform. Raydium uses the "AMM" mechanism to create liquidity for the entire ecosystem.

The mathematical model currently used by Raydium is "K = Y/X", and orders will be placed in the Serum order book according to this mathematical model, so as to achieve the purpose of liquidity sharing. For any two tokens specified, it provides traders with "unlimited" liquidity without providing any information about their relative prices or values.

The key liquidity pool will use RAY tokens as liquidity incentives. Projects that want to reward users for providing liquidity can also add other reward tokens. When a new project starts an initial transaction, it can also use Raydium to create a new trading market and provide instant liquidity for the trading market.

The most valuable thing about DeFi is "combinability", which allows different protocols to connect with each other, integrating and increasing the liquidity of assets on the chain.

secondary title

Bonfida front-end platform

According to Bonfida’s official website, Bonfida is also a DEX, but from the introduction of the white paper, Bonfida is not a DEX, it is more similar to Serum’s front-end platform. The white paper reads:

The functional integrity of the Bonfida platform strengthens and optimizes the connection between Serum, Solana, and users. Bonfida is Serum's most complete "flagship front-end", and it is also the first front-end that provides users with analysis of Serum DEX transaction data on the Solana chain.

Currently Bonfida has five functions:

Bonfida Serum web front-end (GUI): Bonfida DEX is mainly the front-end of Serum, providing users with a good trading experience and equipped with a built-in wallet.

Serum API: Provides data storage for all Serum transaction data. Currently, Serum API has been used by data platforms such as CoinGecko and CoinMarketCap, as well as market makers of many decentralized top exchanges.

Serum integration (Dashboard): Bonfida integrates all components of the Serum ecosystem, including the Serum front-end, transaction protocol (Swap), lending, and pledge, to provide users with one-stop transactions.

Bonfida program trading: Users can use technical indicators to construct trading strategies and realize program trading. These trading strategies can also be opened to other users for subscription.

secondary title

Maps.me 2.0

Maps.me is an offline map application. Since its launch, it has accumulated 140 million users. Users can download maps in advance before traveling, so that even when the local network traffic is exhausted, they can also query maps, local hotels, restaurants, and plan their itineraries in the app, which is very important for mountaineering and travel enthusiasts application.

In addition to planning trips on Maps.me, users can also make reservations for accommodation and restaurants in the app. However, due to the cooperation with a third-party payment platform, high handling fees are required. Statistics show that for every US$100 spent on international travel, passengers must bear an exchange loss of US$17, including remittance fees and third-party platform handling fees.

Valuing the potential of DeFi ecological development, Maps.me will build a wallet in the app, allowing users to book accommodation, book restaurants, and pay for meals directly in the wallet without going through any intermediary platform, and the process is almost zero. exchange loss” (blockchain fees are required).

Due to the large number of users and users all over the world, Maps.me chose to join the Serum ecosystem. Solana's high efficiency and low handling fees can meet the needs of frequent transactions; on the other hand, the conversion between stablecoins in various countries requires a lot of Liquidity and trading pairs, fiat currencies and stablecoins also need exchange channels.

secondary title

Oxygen protocol

The Oxygen protocol is a decentralized prime brokerage protocol (Prime Brokerage), which emulates the prime brokerage service designed for "institutional investors" in traditional finance. This service mainly connects various market participants, including hedge funds, pension funds, insurance companies, asset managers, and liquidity providers. Users can directly trade in it to match the user's asset mortgage and loan (such as securities) needs, so as to maximize the efficiency of the user's capital use.

The Oxygen protocol is a lending protocol based on the "capital pool structure". The capital pool is the assets of everyone. Through the license-free, low-cost, and scalable prime brokerage service agreement, Oxygen democratizes lending. For DeFi users, Oxygen makes the use of funds more efficient.

The application scenarios of Oxygen include:

Generate income: users deposit funds and earn income from them.

Borrowing: Users can borrow assets from the fund pool and pay interest to the fund pool.

Trading: Users can trade with the decentralized exchange Serum in the fund pool.

Synthetic products: Assets mortgaged in the fund pool to trade more complex structured synthetic products.

From the above application scenarios, Oxygen is more like a one-stop DeFi, which is equivalent to Compound + Synthetix + Uniswap. User funds only need to be placed on the Oxygen platform to meet the needs of loans, mortgage assets, synthetic assets, and transactions.

It is worth noting that the Oxygen protocol also solves the problem of inefficient use of funds in the current DeFi protocol. This is because, although the DeFi protocol is configurable, the funds mortgaged on a single platform cannot be circulated to another platform; on the other hand, users need to bear the exchange rate to purchase or synthesize other assets with the stablecoins lent In addition to the risk of attrition, managing assets in multiple agreements also consumes a lot of management costs.

secondary title

Avengers, Assemble!

After listing the DeFi protocols in the Serum ecosystem one by one, it is not difficult to find that Serum has almost completed the important puzzle of building a complete DeFi ecosystem.

Meet scalability

First of all, because Serum is built on the Solana blockchain, this satisfies the "order book" mechanism of Serum DEX, which allows traders to use the pending order mechanism such as CEX, and avoid price slippage during transactions; and the characteristics of the order book, It also allows Serum DEX to trade derivative products in the future.

On the other hand, the issuance of Serum USD backed by a basket of stablecoins can also satisfy the native stablecoins of the Serum ecosystem. In addition to helping asset pricing, it also avoids single points of failure.

Optimize trading experience

As the front end of Serum DEX, Bonfida optimizes the interface, API connects data, and integrates all components of the Serum ecosystem to achieve a one-stop service, and the program trading can also accommodate more traders and optimize the trading experience, making Serum DEX as a Derivatives trading has great advantages.

Integrate on-chain liquidity

While optimizing the trading experience, the Raydium AMM protocol integrates the liquidity of various DeFi protocols through the "improved version of the AMM protocol", and provides on-chain liquidity to the central limit order book, and provides liquidity to the entire Serum ecosystem.

Not only to integrate liquidity on the Solana blockchain, Sam Bankman-Fried has previously proposed to the SushiSwap community to copy SushiSwap to Solana. If the proposal is passed, through Solana's cross-chain mechanism, it can cooperate with SushiSwap And the rewards of liquidity mining, attracting the external liquidity of other blockchains, thus strengthening the Serum ecology.

Import real users

Maps.me joins the Serum ecosystem. On the one hand, it introduces the advantages of DeFi to Map.me users. From another perspective, it introduces a large number of users to the Serum ecosystem. At present, there are about 1.2 million active wallet addresses in DeFi. After deducting duplicate addresses, the real active users may be less than 1 million, or even less.

Maps.me has as many as 140 million users. It attracts real users to use Maps.me’s DeFi wallet through the “zero exchange loss” method, and then integrates Maps.me’s wallet into the Oxygen protocol, allowing users to mortgage assets and obtain "Passive income", or lending other assets, maximizes capital efficiency.

As long as more than 1% of users (equivalent to 1.4 million users) are imported, the Serum ecosystem can obtain a large user base. This means better liquidity and a wider ecology, and Solana's scalability is fully capable of accommodating so many users.

Maximize capital efficiency

On the other hand, the "Compound + Synthetix + Uniswap" one-stop DeFi of the Oxygen protocol allows users to meet the needs of lending, mortgage assets, synthetic assets, and transactions on a single platform. At this point, Oxygen complements the "composability" of the Serum ecosystem. Borrowing and mortgage assets have greatly increased the efficiency of users' funds, coupled with the advantage of "same account cross-asset mortgage", which reduces the risk of being liquidated and allows users to better manage assets.

The "synthetic assets" function launched later allows developers to tailor structured products for themselves or customers, while the Oxygen protocol uses an on-chain risk management engine to evaluate users' capital pools.

In the long run, Serum DEX is more like a derivatives exchange, and the synthetic assets created by Oxygen can be listed on Serum DEX to create a secondary market and liquidity.

The scalability of the underlying architecture Solana, the optimized trading experience of the Bonfida front-end, the integrated liquidity of the Raydium AMM protocol, the imported user base of Maps.me, the lending protocol of the Oxygen protocol, and synthetic assets, the current prototype of the Serum ecosystem has been formed. Under the leadership of Sam Bankman-Fried, it is bound to create various topics.

But at this stage, the Serum ecosystem is still in its infancy. Solana’s language for developing smart contracts, Rust, is not the programming language used by Ethereum dApp developers in the past, and the front-end wallet is still improving. The above two points have indeed increased the value of Serum or Solana. The use and development threshold, and whether the Serum ecosystem can break through the limit and become a self-rotating universe depends on time to prove.