At 1 a.m. on December 18, the decentralized data index project The Graph announced its mainnet launch. 10 minutes later, Coinbase Pro announced that it would launch The Graph token GRT immediately after sufficient liquidity. Soon Binance, Huobi, Kraken, Mainstream exchanges such as OKEx have also announced the listing of GRT. Following the DeFi boom in the past few months, exchanges have reappeared to grab tokens, especially Coinbase, which is prudent to list tokens, is so eager, which is even more rare.

We once published an article "Deciphering the darling behind the DeFi craze—the blockchain data query project The Graph》secondary title

Introduction to The Graph

To put it simply, Graph is to the blockchain similar to search to the Internet.

secondary title

The Graph's Economic Incentive Model

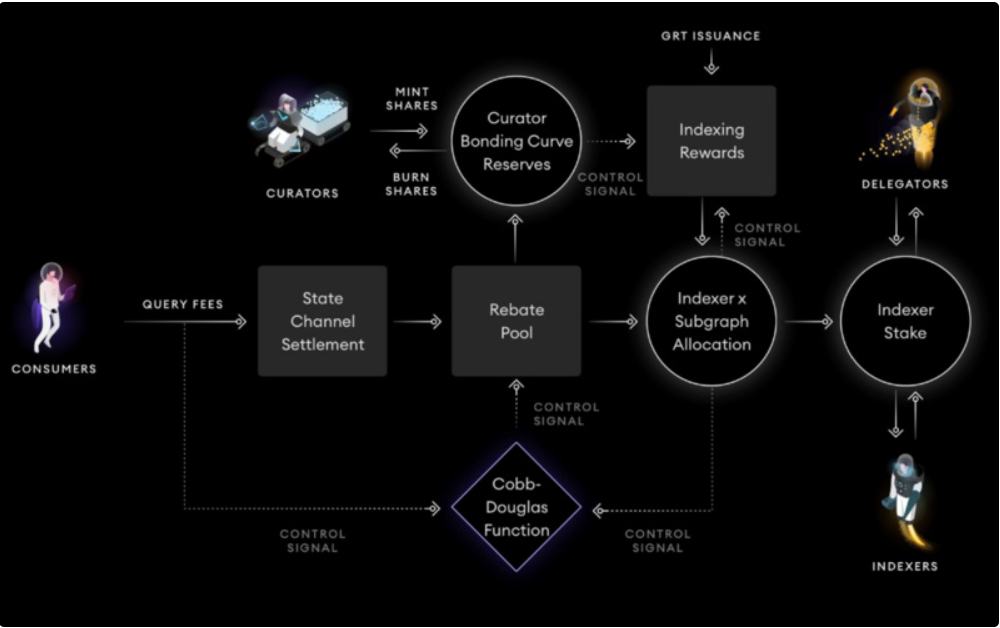

In The Graph network, the entire ecology mainly includes consumers, indexers, guides and clients. In these four types of roles, consumers (users) pay fees (can pay ETH or DAI, but ultimately settle in GRT) to query; indexers run nodes to earn query fees and node rewards; guides (Curator, can Subgraph developers, data consumers or community members) deposit GRT to indicate which subgraphs are worth indexing; delegators pledge coins to nodes to earn income.

GRT has three main roles in The Graph:

Indexers pledge GRT to provide security support for The Graph network;

GRT's staking bonding curve will help guiders and delegators point to the most popular subgraphs(Odaily Note: Subgraph is an open API that applications can query using GraphQL), when the leader successfully pledges the best subgraph, he will get query rewards. Since the leader pledges GRT on the bonding curve, the sooner he points to a subgraph with excellent performance, the more query fees can be allocated;

secondary title

The development prospect and valuation of GRT

The Graph, like Chainlink, is an important key middleware in current decentralized applications. According to The Graph's official website, DeFi leaders Uniswap, Synthetix, Decentraland, and Aragon have all adopted The Graph. The figure below shows the consumer's index data growth graph in The Graph.

Oracles like Chainlink introduce Web2 data into Web3, the most important application of which is to feed the reference data of digital currency prices to DApps such as decentralized exchanges and lending platforms. Through cooperation with The Graph, Chainlink can provide key on-chain indicators directly to projects in almost real time, reducing latency and improving user experience better, which will help developers build powerful and real DApps.

Since The Graph is so important, how should GRT be valued?

A slightly rough benchmarking method is to use the market value of Link, which is also an important component of DApp, as a reference for GRT valuation.

The total supply of GRT Genesis is 10 billion, and then it will be issued at a rate of 3% per year. On October 24, The Graph completed a 400 million token sale in 10 minutes at a price of $0.03. Another 800 million tokens will be awarded to early participants in the network through airdrops. The total amount of LINK tokens is 1 billion. Currently, the total amount of tokens in circulation is 396 million. The crowdfunding price is US$0.11. The market value of circulation is US$5.19 billion, and the total market value is US$13.1 billion. At present, GRT private placement has not been unlocked, and the long-term reasonable price of GRT is expected to be stable at $1.

However, short-term speculation may cause a substantial premium to its price, and traders should pay attention to risks.