The "Roasting Friends" series will select innovative, interesting and potential ecological projects in the Conflux network, record their whole process from "birth to growth", and show you the colorful Conflux ecology.

Traveling against the mountains and seas, fortunately, you are accompanied by you.

The "Roasting Friends" series will select innovative, interesting and potential ecological projects in the Conflux network, record their whole process from "birth to growth", and show you the colorful Conflux ecology.

Traveling against the mountains and seas, fortunately, you are accompanied by you.

ns3.finance will have two insurance models, one is more like the current commercial insurance company and has some characteristics of CDS. In terms of capital structure, insurance shareholders contribute funds to bear the risk of repayment to obtain premium income. In addition, the policy can be transferred, with CDS The feature that can be traded; the other is a form of mutual insurance, more like a lottery pool model, using retained premiums to pay for risk events.

Ins3 will operate two business lines at the same time. Since the mutual insurance prize pool was small at the beginning, it first operated the commercial insurance business line, and waited for the asset custody of mutual insurance to gradually increase, and then entered the model of paying equal attention to both lines.

The two business lines of Ins3.finance share the two infrastructures of investment strategies and oracles.

Overall Line of Business: Shared Infrastructure

Commercial insurance and CDS mixed business line: oracle machine, decentralized arbitrage trading

Mutual Insurance Business Line

1. Commercial insurance and CDS hybrid model

(1) The insurer is also the insurance seller and the staker

The insurer chooses a safe project for staking, and as the seller of the insurance, receives 70% of the premium income.

The insurer has funds n, and the insured amount of each project is m, and can put up to 10 times leverage to undertake the staking of k projects, where 10n = k*m,

Any loss of staking funds will be used to compensate policyholders. The actuarial capital model can guarantee 99.5% of the cases are safe compensation. If the situation is higher than 99.5%, the team will reinsure the compensation through token auctions The bottom warehouse is paid.

Compared with NXM's staking, which must be locked for three months, INS3.finance's staking has three modes: free exit, policy cancellation, and NFT exit, which has a higher degree of freedom than NXM.

(2) Insurance Buyer

Policyholders can purchase insurance on ins3 without KYC. Once the oracle judges that the payment conditions are met, they will receive compensation for the purchased insurance amount from the staking funds.

If customers want to withdraw from the insurance, they can choose to withdraw the policy or sell the policy on uniswap, moonswap.

2. Mutual insurance

Mutual insurance is more like a lottery pool model. Everyone bets that a certain project will have a risk event, and the person who bets successfully (the oracle machine judges that the payment condition is established) wins the retained premium in the pool; the bet fails (the oracle machine Judging that the repayment conditions are not established), the premium will be retained in the pool.

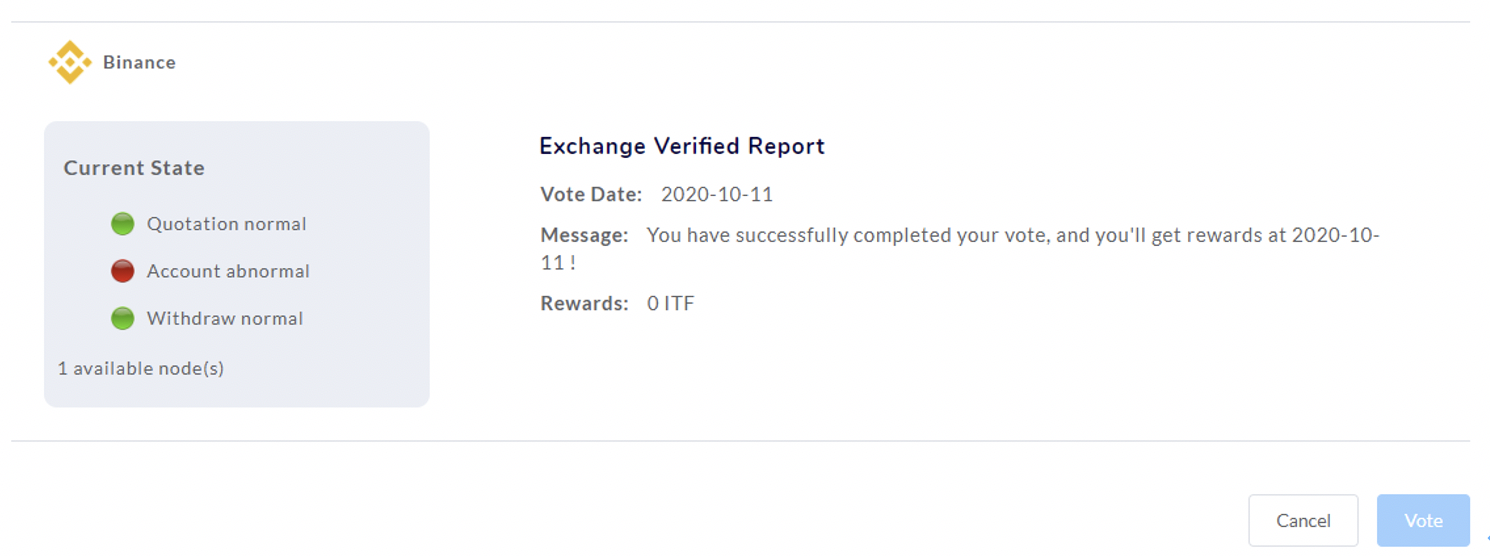

In order to ensure whether the payment is credible enough, we have built a decentralized oracle machine and judged whether the payment conditions are established through the model that anyone can verify the results.

Prophecy certification mining needs to mortgage ITF tokens. If the result of the prophecy certification is inconsistent with the final collective prediction result, the ITF tokens will be confiscated, and ITF tokens will be rewarded anyway.

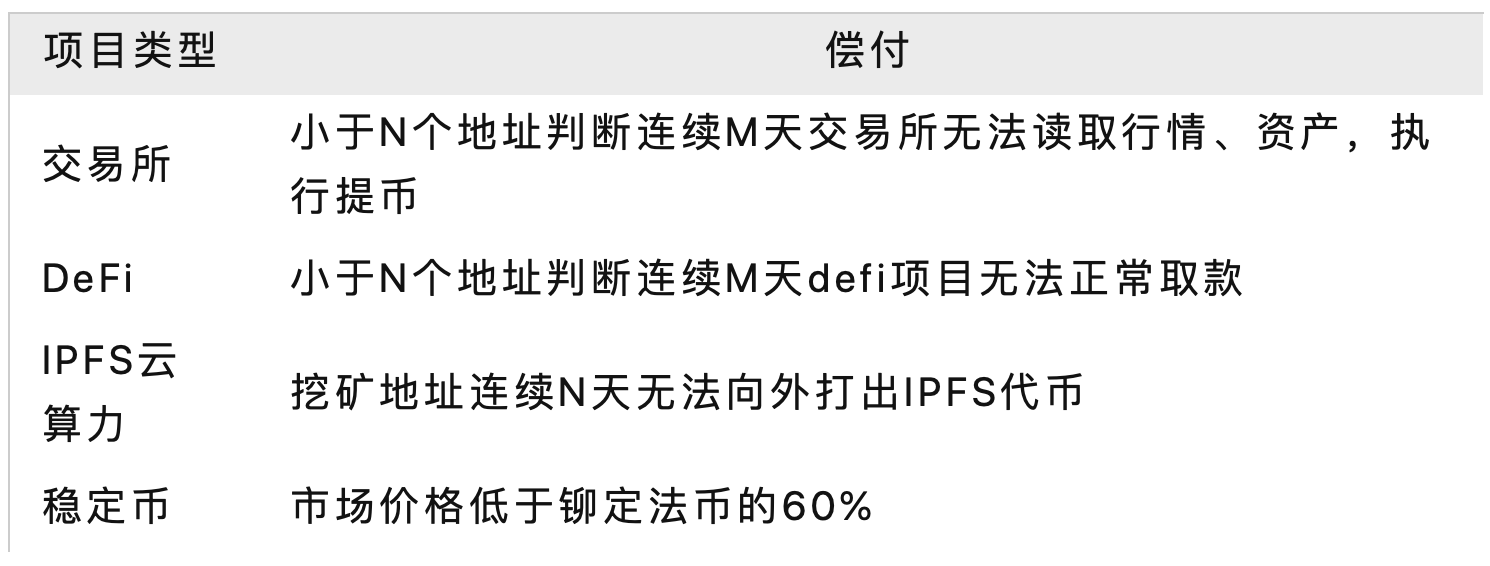

image description

4. The business token attributes of INS3.finance

(1) CDS Token

The insurance policy of INS3 is the ERC777 token (ERC20 upgrade version) of the CDS concept standard, which can be traded anywhere, and customers can also withdraw the policy at any time.

In addition, the customer deposits the policy and USDT of INS3 in Moonswap and Uniswap to provide liquidity for the policy CDStoken, obtain LP, and deposit the LP token into INS3 to obtain the token reward of INS3.

image description

(2) Captital Token

text

After the customer performs staking, an NFT token will be generated. Since N projects are selected from 100 projects, and the insurance amount of each project is different, the staking token is an NFT token. Therefore, when the customer needs to withdraw from staking, he can pass The mode of transferring NFT tokens to exit staking is more flexible than NXM’s staking, which must be locked for three months.