In fact, after entering 2020, DeFi began to spread and expand with a sudden emergence. In fact, in 2019, many people still think that DeFi is a thing that can only be developed after a few years. They did not expect that after the 3.12 crash, DeFi became a fat man in one bite.

secondary title

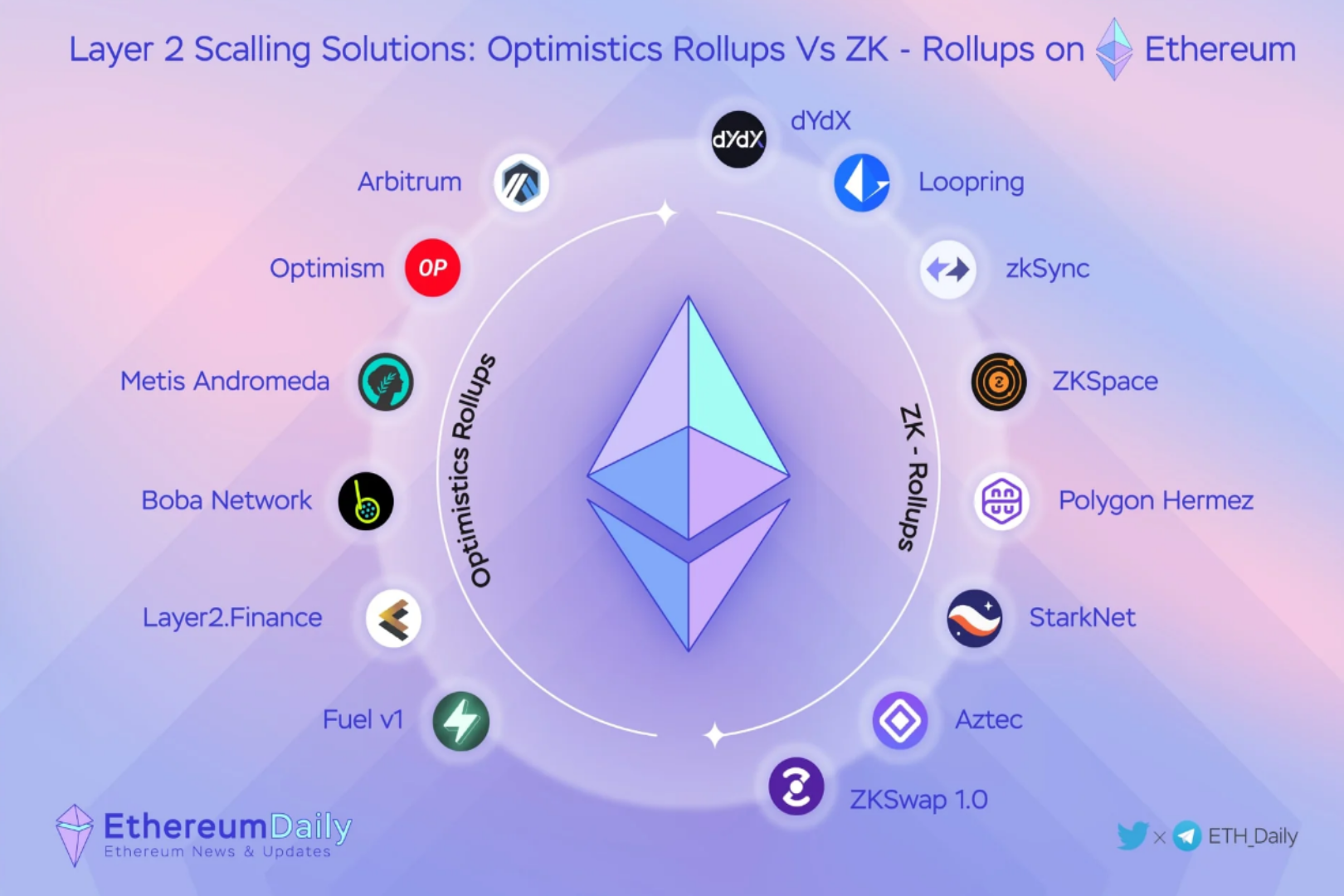

Although Ethereum DeFi is hot, its bottleneck is fatal

DeFi, in fact, has been around for nearly 6 years. MakerDAO was established in 2014. We can think that this is the earliest prototype of DeFi. With the follow-up, the Ethereum-based DeFi protocol continued to be built, which gradually exposed the problems of Ethereum's carrying capacity and efficiency.

In fact, many users are thinking about such a question, Ethereum itself has such a poor carrying capacity, and the transaction cost is so high, why do many developers still enjoy building protocols based on Ethereum? Part of it is due to "historical reasons", and part of it is due to Ethereum's own reasons.

Speaking of historical reasons, Ethereum already supported the issuance of various tokens in 2017 when other public chain technologies had not yet taken shape, so currently Ethereum has the most types of tokens among all public chains, and carries As the public chain with the highest value, we can think that Ethereum has seized the opportunity. So it boils down to the type, quantity, and deposit of assets on Ethereum that are unmatched by other chains, so the liquidity on the chain of Ethereum assets is relatively sufficient.

As far as Ethereum itself is concerned, both in terms of architecture and security, it is worthy of the title of "Heavenly King Public Chain". Developers are already familiar with or trust Ethereum more.

So in summary, even if the system on Ethereum is inefficient and the transaction fees are so high that they vomit blood, developers are still happy to deploy DeFi on Ethereum. Therefore, Ethereum DeFi, which sacrificed user experience, has been criticized by users. So the current situation faced by many users is that I don't want to use it, but I have to.

secondary title

Infrastructure in the DeFi field, Serum ecology

For DeFi at the moment, what is needed is a system that can provide sufficient liquid and consensus asset types, and can complete various transactions efficiently and at low cost. Few of the current solutions can take care of everything. The emergence of Serum has completely broken this deadlock. On the one hand, it relies on the underlying advantages of Solana, and on the other hand, it has mature and feasible cross-chain technology.

On August 30 this year, the launch of Serum DEX, a decentralized exchange of the Solana public chain, has attracted much attention. In just a month or so today, Serum has formed a very large ecology, and Serum It has always been the focus of the industry. The Serum project has been supported by organizations and individuals such as Solana, Kyber, CMS, 3Commas, and Compound founder Robert Leshner. In the list of Serum’s partners, we can also see Multicoin Capital, Robot Ventures, Genesis Block, Sino Global Capital, AKG Venture, CoinGecko, TomoChain, Gauntlet Network, Bcoin, Proof of Capital and other institutions.

Serum was founded by the Project Serum team. It is worth mentioning that its close partners also include legendary trader Sam Bankman-Fried, founder of FTX and Alameda Research. Therefore, the uniqueness of Serum's design and the resources in the circle are first-class. Serum is an ecosystem that includes a decentralized exchange (DEX) based on the public chain Solana, as well as a complete set of supporting DeFi infrastructure such as cross-chain assets, interoperability solutions, stable coins, etc.

So we can understand that Serum is an infrastructure in the current DeFi field. In this ecology, the richness of assets can be guaranteed based on cross-chain technology. Serum first provides a set of interoperability solutions with ERC-20 tokens, so that Serum can interoperate with Ethereum and ERC-20 assets, which means that Serum tokens will also be circulated between Ethereum middle. At the same time, Serum also provides a cross-chain solution for Bitcoin and USD stablecoins, which provides a very necessary guarantee for the richness of Serum's assets.

For the Serum ecology, Serum DEX is used as the ecological hub, and it is built on the Solana public chain, which provides the possibility for its efficient and low-cost transactions. Solana is a blockchain bottom layer that focuses on scalability and adopts PoS consensus. Solana expands Layer 1 without fragmentation, and expands by optimizing GPUs. Based on the POH consensus mechanism, a trustless distributed encryption protocol is created to solve the scalability problems faced by many other blockchain protocols. Solana finally presents a platform that does not rely on sharding, partitioning, side chains, and multi-chains, and can still achieve high throughput and high load capacity (up to 710,000 transactions per second).

At present, most of the DEXs on Ethereum are in the form of AMM, so the lack of order book makes the user’s transaction price uncontrollable, and at the same time, it is impossible to deploy derivatives. This also leads many junior traders to think that the form of DEX is the form of AMM. It can only perform liquidity mining.

secondary title

Wheat Money provides an entrance for the Serum ecology

After the earliest EOS launched its mainnet in the second half of 2018, it has the support of a number of ecological portals including TOKENPOCKET and MEET.ONE. But times have changed, and now that DeFi is booming, MathWallet began to provide an entrance for the Serum ecology. At present, the support for the current popular blockchain ecosystem is also the largest, so the daily user activity of Maizi in the past year has also continued to surge.

In the new version of Math Wallet updated in the past two days, it supports account import at the bottom of Solana. Users who want to experience the services in the Serum ecosystem need to import or create a Solana account in the Math Wallet, and then enter the Serum ecosystem, such as SerumDEX and Serum Staking etc. (Android users of the new version of Math Wallet can go to the official website of Math Wallet to download, and IOS users need to use TestFlight to obtain it)

At present, it is possible to enter SerumDEX through Math Wallet. SerumDEX includes order book and SWAP trading methods. Users need to switch to the Solana underlying account imported or created in Math Wallet and enter SerumDEX through the application interface of Math Wallet. Trading experience, and the underlying efficiency of Solana is lower than other systems in terms of transaction fluency and transaction costs.

The trading experience of SerumDEX is not inferior to the current CEX. In terms of SWAP, due to its low cost and compatibility with other on-chain assets such as Bitcoin and Ethereum, SerumDEX has also become a strong rival of DEXs such as Uniswap.

For Serum, which was born with a golden key, it is a very comprehensive infrastructure in the current DeFi field. Through mature cross-chain technology, it breaks the bottleneck of DeFi asset types and insufficient asset liquidity, and more importantly, Serum's innovative model provides a technical basis for the layout of derivatives games on DEX. The integration of Math Wallet and Serum ecology will also make Serum ecology more radiant.