In the week of 10.19-10.25, the events worthy of attention in the progress of star projects include: Filecoin has activated the FIP-004 proposal at block height 170,000; Uniswap’s first governance proposal was rejected; Chainlink’s verifiable random function has been introduced into the Ethereum mainnet; Announced the termination of the lawsuit against Kik.

Star Project Progress

The following are specific project progress and financing events:

Star Project Progress

Filecoin has activated the FIP-004 proposal at block height 170000

Filecoin has activated the FIP-004 proposal at block height 170,000, and miners who have implemented the latest network upgrade will immediately receive 25% of the block reward. (The Block)

Uniswap's first governance proposal was rejected

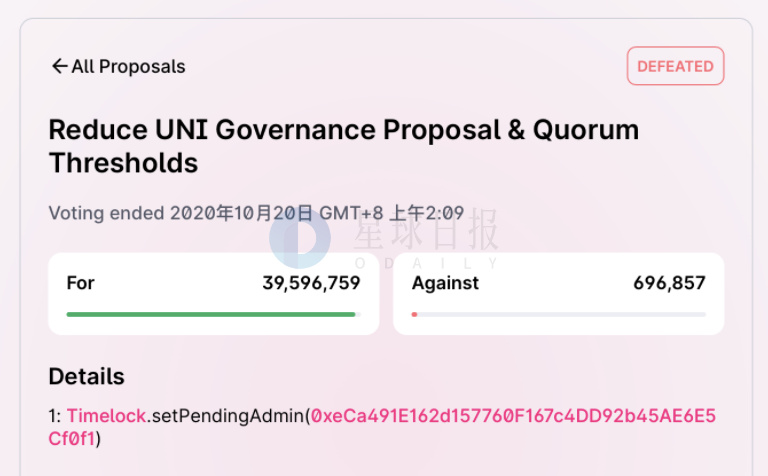

On the morning of October 20th, Beijing time, the first Uniswap governance proposal failed because the required quorum (votes) was not reached. The final vote was 39,596,759 in favor and 696,857 against. It is only about 400,000 short of the quorum of votes (40 million) required for the proposal to pass.

Compound community members proposed a loan safety factor to avoid liquidation risks

On October 20, Getty Hill, a member of the Compound community, published an article titled "Compound Finance: Asset Risk", introducing the new concept of loan safety factor. The introduction of this concept is to help lending users to better avoid property losses caused by liquidation. It is reported that the loan safety factor will be determined by community voting. The safety factor is similar to the mortgage factor, but both the mortgage and the assets of the borrowed party are taken into account during liquidation.

Chainlink Verifiable Random Functions Introduced to Ethereum Mainnet

Chainlink’s Verifiable Random Function VRF has made its way to the Ethereum mainnet. VRF will provide a decentralized source of randomness for the project's decentralized ecosystem. (Cointelegraph)

Deribit will require all users to authenticate by the end of the year

John Jansen, CEO of crypto derivatives exchange Deribit, said that Deribit will require all users to verify by the end of the year. This enhanced KYC program means that all Deribit traders must provide government identification (such as a passport) as well as proof of residency. It is reported that Deribit is the world's largest cryptocurrency options exchange in terms of trading volume. (The Block)

US SEC announces termination of lawsuit against Kik

Last Wednesday, the US Securities and Exchange Commission announced the termination of its lawsuit against Kik Interactive. According to the judgment, Kik will need to pay a $5 million fine to the SEC and file a notice with the SEC about any fundraising over the next three years.

Earlier news, Kik and the SEC have proposed to settle their dispute over the 2017 ICO with a $5 million fine. The proposed joint settlement also requires Kik to prevent future violations of U.S. securities laws, but that still needs to be approved by the trial judge, according to public court documents. If approved, the settlement would end a year-long legal battle between the two. (Cointelegraph)

Curve has resolved the issue of unsafe parameter changes

DeFi stablecoin exchange platform Curve officially tweeted that the problem of unsafe parameter changes has been resolved. The amplification factor for the old pool can now be safely reduced. In the previous news on the 17th, Curve 3pool announced the implementation of a new amplification factor Ramp, which aims to make the market use liquidity more effectively.

ETC Labs members: 99% of ETC computing power is now protected by MESS

McDappas, a member of the ETC Labs developer relations team, tweeted that 99% of ETC's computing power is now protected by MESS. The ETC official responded that it seems that most ETC mining pools have adopted MESS (modified index subjective score). Therefore, the number of confirmations will likely decrease over time.

On October 2, ETC Labs officially issued a document stating that it is implementing a 51% attack solution MESS (modified index subjective score). Core developers and community members have accepted the MESS scheme, and the scheme was successfully activated on the Mordor testnet on September 28, and passed strict stress tests and simulated attacks.

YFII DAO's proposal to establish a Grant system vote has passed

The YFII community voted to establish the YFII DAO Grant system and the Grant application template. The proposal proposes to implement the Grant system in YFII DAO to provide economic incentives for the contributions of community members and promote the sustainable development of the community. The proposal also provides a template for Grant applications.

Privacy computing public chain PlatON meta-network Alaya officially launched

The privacy computing public chain PlatON meta-network Alaya was officially launched at 10:24 today. According to reports, the original Token in the Alaya network is called ATP. ATP has no hard cap and is divided into initial issuance and additional issuance. All ATP will be used to motivate ecological participants to promote the vigorous development of the Alaya network ecology and community. ATP does not have an initial price, and is only used as a measure of distributed infrastructure and service calls in the Alaya network. The initial issuance of Alaya does not include the part allocated to the founding team and private equity issuers, but will be allocated to the ecological development fund, node incentive fund, community operation fund and technology fund in a certain proportion, and the corresponding locking mechanism will be introduced. At the same time, in order to protect the rights and interests of the locked account, the locked ATP can be used to verify the pledge and delegation of nodes.

ForTube is about to conduct the first FOR repurchase destruction

Investment and financing overview

Investment and financing overview

Cryptocurrency brokerage BTC Direct completes about $13 million in Series A funding

Dutch cryptocurrency brokerage BTC Direct has raised €11 million (~$13 million) in Series A funding from undisclosed investors. (The Block)

The public chain project CasperLabs (CLX) announced the completion of a $14 million token private placement, and plans to launch the mainnet in the first quarter of 2021. The investment was led by Digital Strategies, ZB.com/ZB Global, Gate.io, Consensus Capital, Cluster Capital, HashKey Capital, AU21 Capital, Blockchange Ventures, GSR, QCP/QSN, RockTree Capital and dozens of institutions and individuals Participate in voting.

The decentralized index protocol The Graph has completed two rounds of public offering of token GRT, with a total financing of about 13 million US dollars. According to the official statement, only 10 minutes after the launch of the second round of GRT public offering, all 400 million tokens have been sold, with a unit price of 0.00008 ETH, and a total of more than 4,500 addresses have successfully snapped up. Tokens will be unlocked after the mainnet launch.

O(1) Labs, a Mina protocol development company, received another US$10.9 million in strategic investment to accelerate the development of the lightweight blockchain protocol Mina (formerly Coda protocol) in Asia. The financing was led by Bixin Investment and Three Arrows Capital. Participating investors also included SNZ, HashKey Capital, Signum Capital, NGC Ventures, Fenbushi Capital and IOSG Ventures. Previously, O(1) Labs had received US$3.5 million in seed round financing in 2018, and received US$15 million in investment from major investors including Polychain, Paradigm, and CoinbaseVentures in 2019.

MathWallet A+ round received Fundamental's million-dollar follow-up investment

On October 21, Math Wallet received an additional investment of US$1 million from strategic shareholder Fundamental Labs following the A+ round of US$7.8 million investment from Alamenda Research and Multicoin Capital. Math Wallet was established in 2017, and its investors include blockchain investment institutions such as Fenbushi Capital, Alameda Research, Fundamental Labs, and Multicoin Capital.

Prediction market Polymarket raises $4 million, led by Polychain Capital

Polymarket, an AMM-based prediction market, has completed a new round of financing of US$4 million, led by Polychain Capital, Naval Ravikant, Balaji Srinivasan, Meltem Demirors, 1confirmation, ParaFi, Jack Herrick, Kal Vepuri, Stani Kulechov, Kain Warwick, Samir Vasavada , Marc Bhargava and Calvin Liu participated in the vote.

According to a report on October 19, Polymarket announced the launch of the beta version, which allows instant execution of unlimited free transactions. In addition to encrypted users, it also provides an easy-to-use experience for non-encrypted users. It supports credit cards, debit cards, USDC deposits and email logins. While maintaining non-custodial and on-chain transactions. (Brave Newcoin)

Crypto Custody Firm Curv Receives Investment from Franklin Templeton and Illuminate

Cryptocurrency custody firm Curv has secured additional funding from fintech venture capital firm Illuminate Financial Management and Franklin Templeton, one of the world's largest asset management groups. The new investment brings Curv’s Series A round to $30 million, following a $23 million Series A in July from investors including CommerzVentures, Coinbase Ventures, Digital Currency Group, Team8 and Digital Garage Lab Fund. (Finance Magnates)

The distributed storage project CMD has received a total investment of 3 million US dollars from LP Capital. So far, CMD has received investment from nearly ten investment institutions including LP Capital, BK Capital, AMF Financial, Xiangfang Capital, Geek Capital, and Xingsheng Capital.

CMD is an independent, built-in smart contract, distributed computing, point-to-point decentralized big data storage, which solves the problem of global huge data storage, a public blockchain network based on cross-chain technology, and combines zero-knowledge proof, CryptoNote and other anonymous protocols, which improve the security and privacy of the entire network transactions, and its DPOS+POC+POJ application prize pool allows more miners to participate.

Binance Labs Strategically Invests in Decentralized Streaming Protocol Audius

According to the official blog, Binance Labs strategically invested in Audius, a decentralized streaming protocol.

To complete its third version, Ethereum-based lossless lottery platform PoolTogether has raised more than $1 million in a seed expansion round led by ParaFi Capital, with participation from Robot Ventures, OpenLaw’s The LAO and MetaCartel DAO, and angel investor Synthetix Founder Kain Warwick and Aave CEO Stani Kulechov.

At the same time, PoolTogether launched a new version v3, which will support more types of ERC-20 tokens, more revenue sources and more bonus distribution schemes. (CoinDesk)

German start-up peaq received 750,000 euros in angel investment. Investors include Werner Geissler, former vice chairman of Procter & Gamble, Michael Ganser, former CEO of Cisco Germany, Xavier Sarras, partner at 4P Capital, Friedrich Neuman, senior consultant at Deloitte, and Steffen Seifarth, former CEO of Mäurer & Wirtz.

Peaq, led by CEO Till Wendler, provides blockchain platform infrastructure for the Internet-of-The company, developing neutral innovation and transaction infrastructure for decentralized IoT applications. (Finsmes)