Every generation of human beings loves the story of a mayfly shaking a tree surprisingly uniformly. They sing enthusiastically about it, whether it is success or failure. Zhuge Liang made six out of Qishan and went north to the Central Plains. Liverpool fell behind by 3 goals and reversed the "Miracle of Istanbul".

Bitcoin launched a charge against fiat currency, IPFS issued a gauntlet to the HTTP protocol, the newborn sprout challenged the big tree, and the brave man was slaying the dragon with a sword.

secondary title

Decentralized blockchain, the most lacking is decentralization

In fact, as early as 2017, the business closed loop in the blockchain world was already very clear.

We compare Internet companies, from project release (writing white paper), to 3C coffee angel financing (1c0), to product launch (community building), to user data endorsement (consensus formation), and finally to IPO completion of capital market exit (online exchange ), it can be said to be a very complete business system.

However, because of the characteristics of the encrypted world, we feel that the business world is still full of reckless heroes, such as countless scams, such as plugging and unplugging network cables of exchanges, such as hacker attacks.

What the blockchain world lacks is not rigorous business logic, but decentralization.

At least until 2020, the blockchain world does not show too many characteristics of decentralization, such as the uproarious OKEx incident, Xu Mingxing’s loss of contact paralyzed a top 10 secondary market platform in the world. All in all, how centralized is this.

At least I have never heard of anyone being investigated that would lead to the suspension of operations of the Shanghai Stock Exchange.

This is why DeFi and Uniswap suddenly became popular, because people in this world have gradually realized that what we lack is not business, capital, models, let alone a few secondary platforms, a few KOLs, or a few ideas. What is missing is the spirit of true decentralization and decentralized gameplay.

You may not believe it, but the decentralized blockchain is, in most cases, the most centralized.

secondary title

Auctions, where it all begins

The popularity of Uniswap has driven a large number of DeFi, released Token, launched on Uniswap, pulled the market, and completed the harvest in the secondary market, which has become the standard process of many "earth dog projects".

But if you really compare DeFi with the entire business logic of the blockchain, have you found anything missing?

The complete blockchain chain is auction-product-listing-market value management-capital exit.

However, in the DeFi chain, the "initial place" is missing. It has a decentralized platform (Uniswap), a decentralized community concept (DAO), and a decentralized product (public chain consensus) , with decentralized exit channels (various types of Dex).

Only the auction is missing.

It's not because the auction is unimportant, and who would not want to be able to raise funds, but the auction process is too complicated and the threshold is too high.

For most blockchain projects, seeking auctions is the most difficult thing in itself.

Because no auction platform accepts them.

The blockchain auction platform is the beginning of all project financing. The largest platform is CoinList. If there are people who are deeply involved in the encryption world, they must have an understanding of it. For this world, CoinList is a hidden mountain. An unseen deep sea.

This is a centralized auction platform. Since its establishment in 2017, it has initiated auctions for less than 20 projects in about three years. There are many projects that have swept the entire encryption world: Filecoin ($257 million), Algorand ( $60 million), Dfinity ($102 million), Nervos ($72 million)

However, here comes the problem.

In the past three years, more than 5,000 projects have appeared on the blockchain. The centralized auction platform represented by CoinList can auction less than 0.5% of the projects, and most of the projects have no chance to participate in the centralized auction. Auction platform, face-to-face communication with traffic.

secondary title

CoinList's Achilles heel

CoinList is an easy-to-use platform, and the auction volume of more than 500 million US dollars has already proved its value. No one dares to underestimate this silent giant, which is entrenched at the top of the blockchain encryption market. Like Binance and Bitfinex, sitting on the top of power overlooks the entire encryption world.

But under the thick scales of the giant dragon, there are already weaknesses.

Even these weaknesses are known to everyone, but no one can change them.

The bar for auctions remains high.

The process of CoinList selecting tokens for auction is itself a screening process. No one is the market, and you can guarantee that your choice must be correct. For example, Uniswap, which was established at the end of 2018, if you try to initiate an auction on CoinList, the result will be certain. It was a light refusal.

Only time and the market can prove what is a high-quality project. Specifying the auction threshold in your hands instead of handing it over to the market has already blocked more than 99% of blockchain projects from the door.

These 99% of the projects cannot give up the market just because they were rejected by CoinList. They have become the largest audience on the decentralized auction platform.

KYC that is difficult to get to the sky.

If you think that the threshold is only for the project party, then you are wrong.

Under the rules of CoinList, blockchain people in dozens of countries and regions such as China and the United States cannot participate in the auction. If you want to participate in CoinList’s auction, such as Filecoin, you must first pass CoinList’s KYC in the black market of Telegram , Overseas KYC has formed an industrial chain, with prices ranging from hundreds to thousands.

In other words, if you are a blockchain enthusiast in China or the United States and want to go to ColinList to participate in the auction, such as Filecoin, such as Algorand, no problem, first spend a few thousand dollars to buy a KYC, and you have to worry about KYC Supplier Fraud.

After intercepting 99% of blockchain projects, centralized exchanges also intercepted 50% of blockchain users.

Delayed issuance of coins.

In 2017, there is a classic routine in the blockchain world:

The project will raise ETH from institutions and investors. After the fundraising, it will not transfer its own Token to investors, but sell ETH at a high price first, and cooperate with empty orders to harvest the market. After the harvest is completed, one month later, the low price Buy ETH, tell institutions and investors that the quota has been raised, and return ETH to investors.

But when investors invest, ETH is as high as $500, and when they receive it, ETH has already shrunk by 40%.

If this is just a way of "crossing the bridge" of funds, then delaying the payment of coins, or even not paying coins directly, is a blatant fraud. Don't take it lightly, delaying the payment of coins is a "glorious tradition of the blockchain". Since entering the industry in 2017, I haven't seen a few investments that take coins on the spot.

It looks like an investment project, 10x, 100x online, but in fact, investors only have very few coins in their hands, or even none. When the coins are unlocked, they can be cashed out, and the roller coaster ride has already been completed, and the market value has dropped by 50%. up.

This is an unavoidable proposition for every centralized auction, whether it is CoinList or the project party’s own auction.

For example, Filecoin, CoinList launched an auction as early as 2017. It was not until 2020 that investors got FIL, and it was released linearly in batches. It seemed that what they bought was 200 dollars of FIL. When they got it, there was only 30 dollars left .

However, decentralized exchanges, such as TokenSwap, have already solved this problem. If the auction is successful, the tokens will be credited immediately, and smart contracts can solve the problem without the need for centralized operations.

Many things were foreshadowed at the very beginning.

secondary title

The boy who slayed the dragon picked up the long sword

As mentioned at the beginning of the article, CoinList is the giant dragon, but it is riddled with holes, and the boy with the long sword has left the village.

It's called TokenSwap.

The subversion of this world is often bottom-up, "Since I can't change you, then I will defeat you".

The founding story of TokenSwap is because there are a group of people who cannot get KYC and participate in the auction on CoinList. They think the auction is very valuable, but the centralized auction keeps them out.

then what should we do?

The answer is to overthrow it.

So there is the TokenSwap platform, which is decentralized, and all on-chain auctions do not require KYC. Anyone can issue an auction pool on the TokenSwap platform. The threshold for survival of the fittest no longer exists.

This is the official website:https://www.tokenswap.finance

Their Telegram has more than 15,000 people

The project party does not need to submit information, and the user does not need to register an account, as long as they connect to the Metemask wallet, they can participate in the auction.

Fund security is also well resolved. All ETH participating in the auction will not go through TokenSwap, and will be directly transferred from the investor's wallet to the project party's wallet, and the tokens participating in the auction will be sent to the investor by the smart contract immediately Or, there is no delay.

OTC has also become a possibility. Traders no longer need a guarantor, just launch a fixed-ratio auction on the decentralized auction platform. It has actually become the "idle fish" in the encrypted world

In fact, the eyes of the market are discerning.

At the end of 2019, CoinList completed the A-round financing of tens of millions of US dollars, with a valuation of more than 100 million US dollars, and the size of the target decentralized trading platform should not be underestimated.

Don't forget that CoinList only got 1% of the projects and 50% of the investors, but the decentralized trading platform has 99% of the projects and 100% of the investors.

So TokenSwap’s first round of financing, 450 ETH, was sold out within 12 hours. What’s even more frightening is that those who didn’t buy it were still making trouble in their TG group.

Therefore, in the second round of fundraising, TokenSwap directly played out the flowers, 550 ETH, divided into 11 days, and only sold 50 quotas per day, and it became more expensive every day.

As a result, on the first day, it was sold out in 14 minutes, and on the second day, it was sold out in 16 minutes.

secondary title

Blockchain Stories of 2020

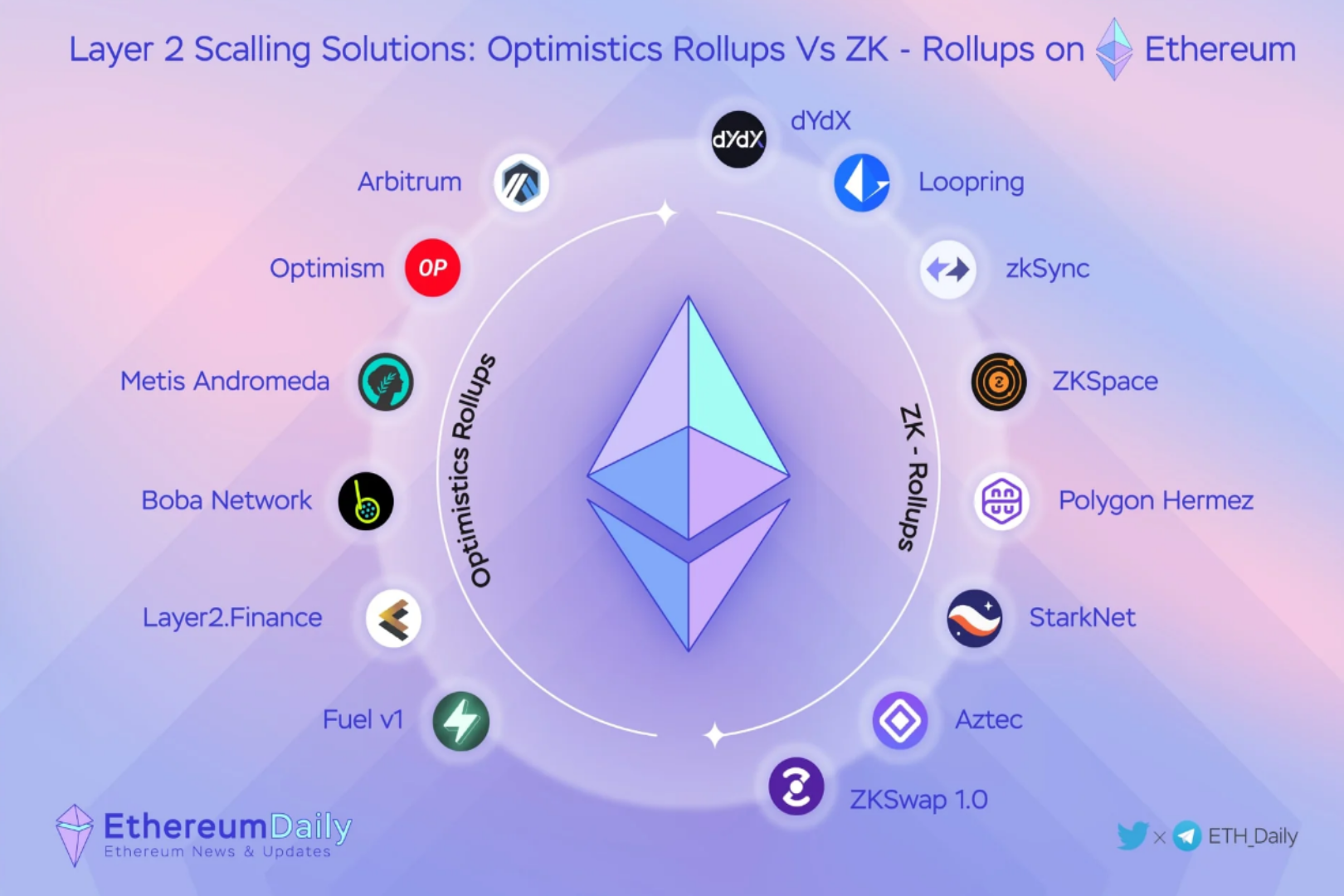

2020 is a year that is really talking about decentralization. The decentralized trading platform Uniswap is challenging the centralized platform, the oracle machine LINK is challenging the old order, and smart contracts are challenging human operations.

Every field is being subverted by DeFi. Auction is the first step of the blockchain, and it is also the last one to be subverted.

It may be late, but it will come—

"My lord, why are you going here?"

"Step into the southern sky, break the sky"

"Will you come back if you go?"

"I'll never come back!"