AMM is the most successful DEX solution in the DeFi world. AMM makes the professional behavior of market making extremely simple. Even ordinary users can conduct market making to earn commission income, so AMM is also called "automatic market maker". .

The AMM represented by Uniswap has achieved great success, but in practice we found that with such a simple market-making mechanism, market-making funds may be lost in actual operation, which is generally called "impermanent loss".

Participating in market making may result in capital loss, which is relative to not participating in market making. That is, if the funds are just placed there, the value after a period of time will be greater than the value after participating in market making.

It is generally believed that there are two reasons for the loss, the arbitrage loss and the loss caused by the price fluctuation of the asset itself.

Impermanent loss may cause very large losses if the price fluctuates greatly. Therefore, if there is no additional incentive, ordinary users are not willing to make the market.

Therefore, there have long been projects that have provided incentives for users who make markets on Uniswap. This behavior was earlier than the liquidity mining started by Compound, and Compound’s mining is generally considered to be the start of DeFi liquidity mining. First of its kind. At present, there are still many projects that provide liquidity incentives for market-making funds, but the incentives are often unsustainable.

For professional market makers and ordinary users, impermanent loss is a big mountain in front of them, which firmly blocks the willingness of professional market makers and ordinary users to make a market.

secondary title

1. DODO

DODO is a newcomer to DEX, and has been recognized by many institutions and professionals in the industry. The list of institutions can be listed on one page. Some people say that half of the currency circle has invested in DODO, which shows the degree of recognition of DODO.

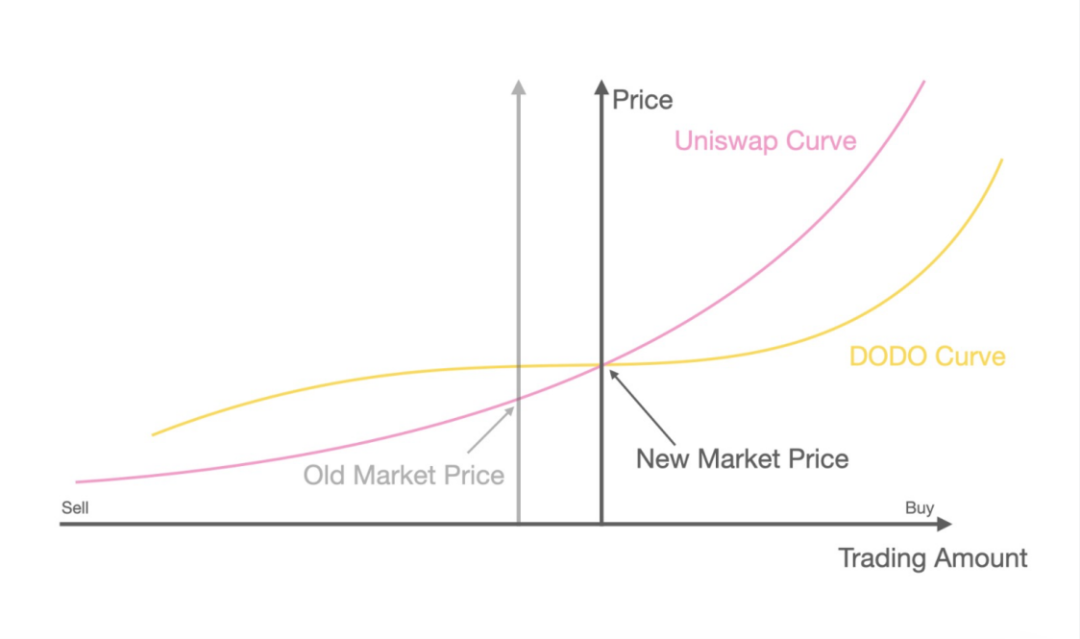

DODO uses the Chainlink oracle to feed the price, and the PMM algorithm can make the transaction curve smoother. From the curve of DODO in the figure below, it can be seen that the transaction curve of DODO is close to a straight line near the price, which will significantly reduce slippage and improve capital efficiency, because funds will gather more around the price as the algorithm is adjusted.

Regarding the risks caused by price fluctuations, for example, if you deposit 1 ETH and 380 USDT on Uniswap, if the price of ETH doubles and rises to 760 U, the amount of ETH you can withdraw must be less than 1. But in DODO, the binding relationship of assets is actually decoupled. Users can choose a single currency to make the market. If you deposit 1 ETH, even if the price of ETH doubles, the amount of ETH you can withdraw will still be 1, that is, Fluctuations in asset prices themselves will have no effect on the number of your assets.

Regarding arbitrage loss, when the accuracy of the oracle quotation is not high enough, DODO will face the risk of arbitrage loss. The loss of LP on DODO some time ago also came from this. However, if the accuracy of the oracle quotation is high enough, the possibility of being arbitraged will be greatly reduced.

In extreme cases, arbitrage losses will be unavoidable. DODO’s solution is to adjust the market-making depth through parameter adjustment. Just like in a centralized exchange, if the market encounters an extreme market, the market maker will withdraw the order and wait and see. The parameter adjustment of DODO can achieve the effect of reducing the depth of the order to reduce the loss of arbitrage.

secondary title

2. CoFiX

CoFiX also introduced the oracle machine as a price feeding solution, and the oracle machine it uses is Nest. For the Nest oracle machine, you can read the previous articles of the Institute"Chainlink, Band, NEST, Tellor which oracle machine is more resistant to attack? "。

The CoFiX model is actually relatively simple. It solves the arbitrage loss by introducing the Nest oracle machine.

As for the risks arising from asset price changes, CoFiX’s solution is hedging. CoFiX provides a dedicated hedging tool that can monitor asset changes in real time and perform corresponding hedging operations on centralized exchanges. In theory, the amount of assets can always be kept in a state of positive growth. Solved the embarrassing situation of ETH price rising, constantly selling ETH, ETH price falling, full of ETH.

At the same time, because of the introduction of oracles, CoFiX has realized a special situation, that is, zero slippage in transactions. This will be a great advantage when there are enough locked-up funds in the pool. But if the pool is not big enough, there is a possibility that the pool will be bought out by a large amount of money.

What effect does this achieve? Basically, the entire pool is providing depth for your single transaction, which may not be possible for any centralized exchange or AMM.

However, the launch of CoFiX trading pairs depends on the development of the Nest oracle machine. At present, the trading pairs with relatively high quotation density of the Nest oracle machine are only ETH/USDT and HBTC/ETH, and currently CoFiX can only trade ETH, HBTC, and USDT three assets .

secondary title

Three, bancor

Bancor is an old-fashioned project and the pioneer of the AMM model in the currency circle, but the pioneer failed to carry it forward. Instead, Uniswap has achieved huge growth using AMM.

Bancor proposed a solution to the impermanence loss of AMM in July, but after 3 months of no movement, it suddenly proposed a new solution (not yet implemented), a new solution that has nothing to do with the previous version .

The proposal proposed by Bancor in July is similar to DODO’s proposal. It solves the problem of impermanent loss by introducing oracles and dynamically adjusting the weight of the pool, but in fact it is more about solving the problem of arbitrage loss.In Bancor's new plan, arbitrage losses and price fluctuation losses are combined to solve the problem.

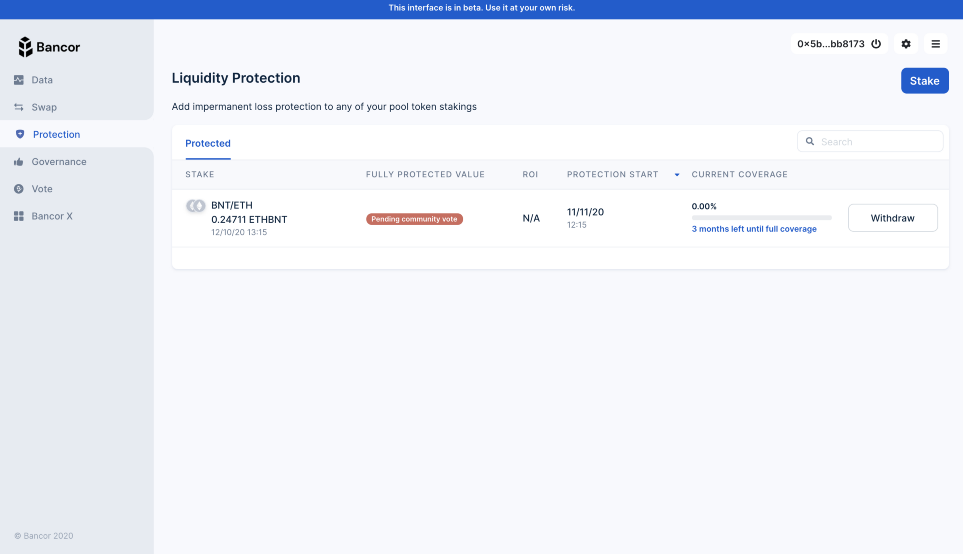

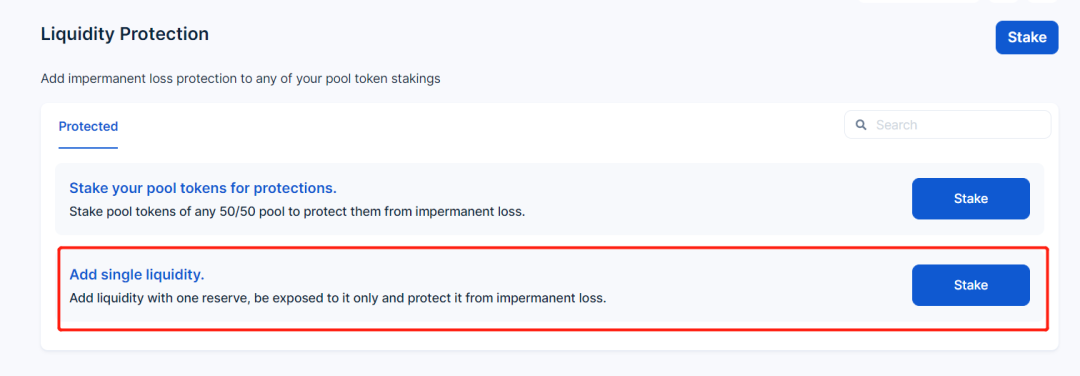

The scheme it uses is called the "elastic supply scheme". In the new version of the Bancor protocol, 100% liquidity protection will be provided for market-making funds over 3 months, assuming you provide TKN with $100 of liquidity (the new version of the Bancor protocol supports single-currency market-making), if 3 After a month, the price of TKN doubles and is worth $200, so you can also raise TKN worth $200.

The source of funds for liquidity protection is the additional BNT issued by the system, and the cost is borne by all token holders. The core here is that the long-term market-making profits are greater than the impermanent losses, then the system will not pay costs, or pay a small amount of costs.

At the same time, BNT also has a destruction mechanism, which is related to the principle of its single currency market making. All trading pairs in the Bancor protocol are trading pairs with BNT tokens. There is no ETH/USDT trading pair in the Bancor protocol, only ETH/BNT , BNT/USDT transaction pair, transactions between other tokens need to be transferred through BNT.

The new version of the Bancor protocol supports single-currency market making (not currently available). If a user deposits TKN into the TKN pool, if no user deposits BNT at this time, the system will mint BNT of the corresponding value and inject it into the pool. These BNT will also receive Fee income.

When a user injects BNT into the pool, the minted part of the system will be destroyed together with the handling fee. If the handling fee of 10 BNT has been obtained at the time of destruction, 110 BNT will be destroyed. Mint 100 and burn 110, which achieves deflation.

Four. Summary

Four. Summary

This article compares the solutions proposed by three DEXs for impermanent loss.

Judging from the information released so far, CoFiX’s design plan proposes solutions to both arbitrage losses and losses caused by asset price changes. In theory, good hedging can achieve positive growth in the number of assets.

DODO can also avoid most of the arbitrage losses through parameter adjustments on oracles and algorithms, and changes in asset prices will not cause losses to users. This is a relatively thorough solution.

Bancor adopts a flexible supply method, and the system issues additional tokens to provide structural protection for the liquidity of market-making funds. The core is that in the long run, the income of market-making funds will be greater than the loss of impermanence. Of course, Bancor does not protect all coins. It has a whitelist mechanism. Otherwise, it will provide liquidity protection for zero coins, and BNT will be compensated to zero. However, Bancor has also designed a deflation mechanism, the core of which is that the market-making income is greater than the impermanent loss.

From the perspective of the complexity of market making, DODO and CoFiX provide more suitable scenarios for professional market makers, but in fact they are no longer the brainless AMMs that everyone understands.

Perhaps we are witnessing the arrival of the era of "professional market maker + AMM".

Acknowledgments: I received help from Mark@DODO and 12@Nest forums for confirming the details. The article only represents the author's personal opinion and does not constitute any investment opinion or suggestion.

References

https://dodoex.github.io/docs/docs

https://mp.weixin.qq.com/s/ajr0vHBS8TXECX4UyzC6VQ

https://mp.weixin.qq.com/s/-Y4qYa8KsR_aErg3cgYRkg

https://mp.weixin.qq.com/s/jhCiPcLKjzK9ca93kku9qQ

https://github.com/Computable-Finance/

-END-

Disclaimer: This article is the author's independent point of view, and does not represent the position of the Blockchain Research Institute (public account).