A long time ago, observers were very interested in NFT, and once wrote about NFT observations.

Primer

Primer

Since the first foot of human beings stepped into the Internet age, a word has been invented.

flow.

It represents the game of social focus and eyeballs. If you get what the society cares about, you will have greater value. It has become an inviolable rule of the Internet. No one will fight against traffic. This is an artifact. , the owner will embark on the road of grabbing wealth, while the disobedient will enter the dark corner of the times, not worth mentioning.

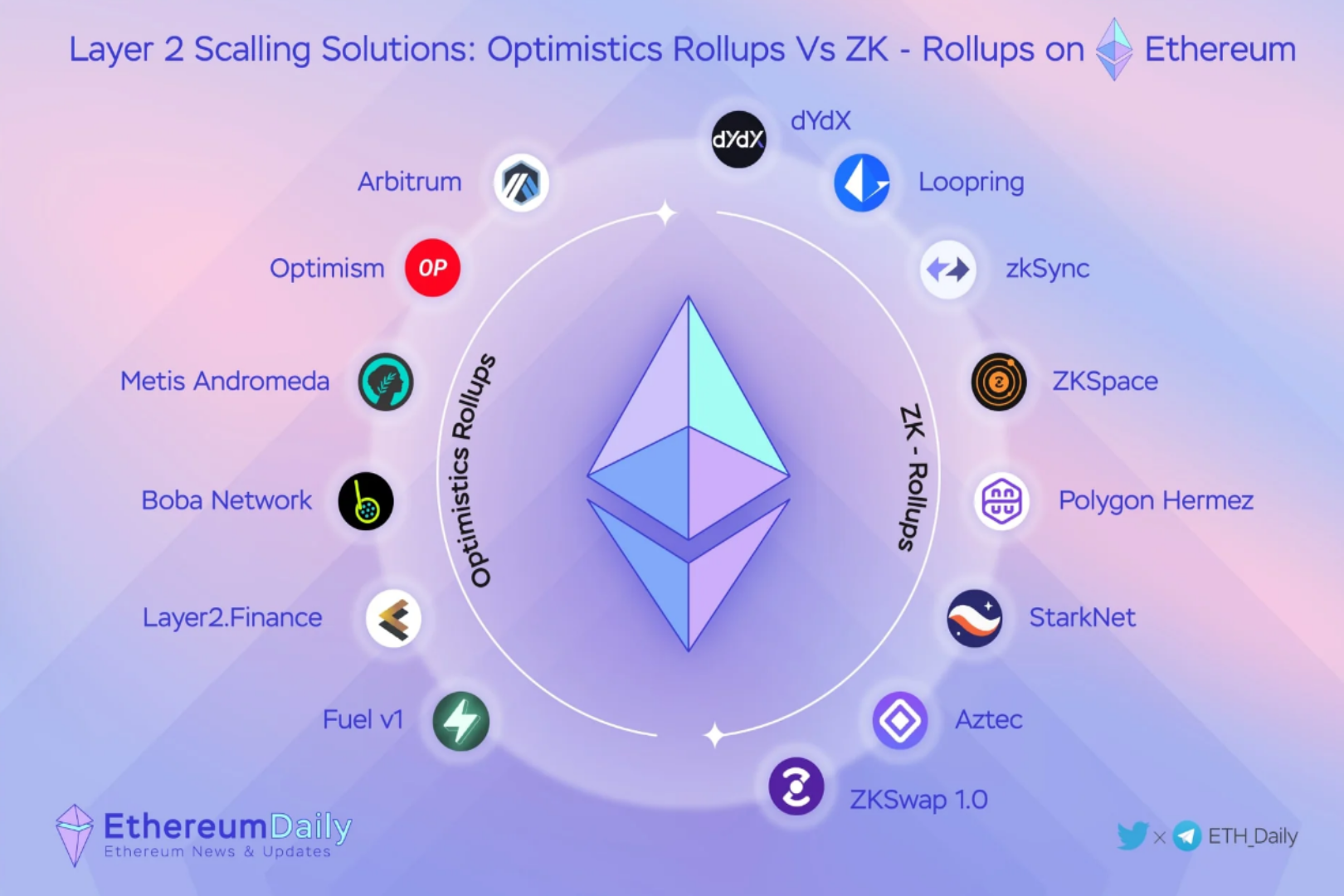

On the road of the blockchain, the power of traffic is stronger than that of the Internet. From Bitcoin, to Ethereum, to DeFi, it paves the road from traffic to wealth more broadly and smoothly.

To manipulate traffic, what is needed is a topic that is worthy of the audience's attention and enough to focus on.

NFT exploded and became that topic, and OpenSea and TokenSwap, two of the best NFT auction platforms in charge of traffic, embarked on the road of close combat.

Why is traffic so important?

Let's take NFT as an example. NFT itself has no value. All its value comes from auctions and transactions. Without auction transactions, NFT is just a painting, a wallpaper, and a piece of equipment, but with transactions, it is wealth. .

secondary title

The lucky ones of traffic, NFT and MEME

In 2020, the topic of traffic focus has changed a lot, from "halving" to "DeFi" and then "NFT".

On August 15, MEME appeared.

A few hours later, MEME had its own official website with a basic user interface and a Telegram link. There were too many curious people. In less than an hour, 500 people poured into the group, and the MEME community took shape.

30 minutes later, the MEME token was born.

The total amount of MEME is 28,000, and the airdrops in the Telegram group are evenly distributed, and each person gets 355.55 MEME. On the same day, the price of MEME tokens rose from $11.29 to $40.02.

At the highest point, those who obtained MEME airdrops got MEME worth more than 600,000 US dollars, which also led to the saying in the blockchain community that "UNISWAP sent a red envelope, and MEME sent a house".

Behind the explosion of MEME is the rise of the concept of NFT.

MEME has two mining pools, which can be mined by mortgaging UNIV2-LP on Uniswap, you can mine Legendary-level NFT tokens, and you can also mortgage MEMECoin to mine Pineapple-PNPL, the non-circulating token of MEME. The latter can be exchanged for different cards.

This is a relatively new model, because what is mined by pledge is no longer the token in the DeFi doll, but an independent and non-replaceable NFT.

MEME has seen the magic of traffic and the eyeball effect brought by NFT. While bringing traffic to it, it also brought myths of wealth explosion, and such myths have once again attracted the second wave of traffic.

It has become the second beneficiary of NFT traffic dividends.

The first beneficiary dates back to 2017, and it was that incident that promoted the focus of NFT. This is the CryptoKitties that caused a sensation in the encryption world. How popular CryptoKitties used to be, it single-handedly brought the congestion period of Ethereum up to a month, and countless Ethereum miners made a lot of money , a virtual "crypto cat" is as high as tens, even hundreds, thousands of ETH.

The blindness of capital and the wealth myth brought about by the flow have unfolded since then.

NFT, Non-Fungible Token (Non-Fungible Token), means a unique and indivisible Token. For a long time, NFT has been one of the important application forms of blockchain technology, and its landing scenarios include game props, tickets, vouchers, collectibles, artworks, etc.

In recent years, the ecology around NFT has gradually developed. CryptoKitties is the beginning, but MEME will not be the end.

secondary title

OpenSea, the first traffic authority

The artifact of flow may occasionally favor strange travelers, but it will eventually return to its owner.

Just like DeFi in full swing, Compound, YFI, and SUN were all smash hits, but Uniswap is the biggest winner, and only those who control the traffic authority can feel the final harvest.

The same is true for the NFT arena. The platform that controls the flow will have the right to speak with the largest flow. This right to speak is not explicit, but recessive.

On the surface, every NFT creator can freely auction his works in the encrypted world, but in fact, he can show them to the audience, win the favor of the audience, enter the auction link and finally bid a sky-high price, relying on the platform, Not just recommendations, but more basic drainage.

The core is because the works behind NFT, whether it is game equipment, paintings, or non-homogeneous cards, have never had an anchor as a price reference, and all value is given by people. For example, for two paintings by the same encrypted artist, perhaps one can fetch a sky-high price, while the other can only sink on the platform.

This has a lot to do with the recommendation and support of traffic masters.

The platform itself does not mind the unsold auction of a certain work, or the high price of the auction, which may bring benefits to the platform in the short term, but in the long run, the platform only needs to have enough painters, paintings, cards, and game equipment. Has been endless.

Good works are never scarce, what is scarce is the platform, and those who have the right to speak in terms of traffic can decide the life or death of an NFT.

OpenSea is a traffic authority.

OpenSea was established in January 2018. Subsequently, in May last year, OpenSea received 2 million seed round financing.

For NFT transactions on OpenSea, the main payment includes selling products, such as game equipment, painting authorization and signing fees, and OpenSea will hand in 2.5% of the transaction amount. In addition, some game parties will also charge a certain fee. For example, in My Crypto Hero, the game party charges 7.5% of the transaction amount as a handling fee.

Although the expenditure cost is not low, the functions are not weak either. Fixed auctions, Dutch auctions, English auctions, etc. can all be seen on OpenSea.

secondary title

TokenSwap, the chase for a decentralized token auction platform

According to NonFungible statistics, the total transaction volume of the NFT market today exceeds 110 million US dollars, and more than 4.8 million NFTs are sold, with an average price of 23.36 US dollars.

Such a big cake, OpenSea can't finish it, which also led to the emergence of TokenSwap.

Different from OpenSea's small and beautiful route, TokenSwap is a very large traffic pool, which covers ERC20 and NFT auctions, including Dutch auctions, fixed auctions and English auctions.

The emergence of TokenSwap is inevitable.

In the traditional currency circle, the route of a project party is to find a team, build a project, start fundraising, and complete distribution or harvest through a centralized exchange. The emergence of Uniswap has actually revolutionized the entire currency circle process from the beginning to the end. Many projects no longer need a star team, nor do they need to be listed on a centralized exchange. No KYC is required, and a pool is directly built, which greatly increases the threshold of the currency circle. reduce.

But it is worth noting that in the three steps of team building-fundraising-transaction, the problem of fundraising has not been solved.

Liquidity mining has solved the problem of depth on Uniswap to some extent, but the problem of raising funds urgently needed by the project side to obtain more promotion opportunities has not been solved.

The market needs a Pre-Uniswap product. It cannot be a product like CoinList. Although CoinList has managed Algorand, Nervos, and Filecoin, it is excessively centralized, only supports star projects, and has a very high threshold for listing coins. It cannot be the choice of the new currency circle.

An auction platform that does not require KYC, has no threshold for token auctions, decentralized governance, smart contract transfers, and a platform that solves the "fundraising" problem in the new currency circle has become an inevitable thing.

TokenSwap is the chosen one.

NFT is actually a part of the TokenSwap auction. Unlike OpenSea, which focuses on making NFT "small and beautiful", TokenSwap is a large traffic pool. Countless DeFi and NFT will be auctioned here. No one knows the identity of the auctioneer. It may be the project party, it may be a hacker, it may be a wool party, or it may be a profiteer grabbing benefits.

In terms of business logic, the traffic power war between "small and beautiful" and "big and comprehensive" has never ended. This scene appeared in clothes, shoes, food, and then in the encrypted world.

Jumeiyoupin once obtained traffic with the concept of "focus" and "small and beautiful". But in the end, only Taobao, JD.com and Pinduoduo were left. Coincidentally, they all chose the "big and comprehensive" route.

NFT is a niche auction item. Even though its carrying capacity has reached a transaction market value of hundreds of millions of dollars, the small plate and unsustainable liquidity make the auction focusing on NFT a business with little revenue. It can be seen that the handling fee of OpenSea is 2.5%, while that of TokenSwap is 0.2%.

But the encryption world is not completely equal to the Internet world. The traffic battle between OpenSea and TokenSwap has just begun, and the NFT battle has just begun. Comparing the two platforms, OpenSea has already gained a firm foothold, and TokenSwap is the next strong attack opponent.

Hands-on-hand combat between traffic authorities.

Wait and see.