Open the search box on the media homepage and enter the six words "centralized exchange". On my 27-inch computer screen, more than a dozen webpages popped up, all of which seemed to be mocking me: because the six words I searched before Added a "go", and all the content is "decentralized exchange".

A tweet on August 30, 2020 (mostly yesterday when I saw it in China) continued to ignite the entire market: the trading volume of Uniswap surpassed that of Coinbase. Coinbase has a license in the United States and is a leading institution in the field of encrypted asset trading. This tweet has a feeling of "the emperor takes turns, come to my house today". Do centralized exchanges still have a future?

Today, let’s briefly talk about how centralized exchanges may not give readers information such as popularity, clicks, registered users, active users, etc., because first, a lot of data can be faked; second, a lot of data does not have you It's as meaningful as I imagined; besides, I don't have good anti-reconnaissance means and data filtering means for the time being. If you have any, you can leave a message and tell me, and I will reply with the word "teachable" with my hands clasped.

The content structure of this article:

Introduction to Trading Volume Data

Trusted and Untrusted Data

The story of the poor hourglass: jokes after drinking

New Energy Vehicles: A Data Nightmare

Growth curve of DEX

Summarize

Summarize

Introduction to Trading Volume Data

image descriptionThe picture above is from Debank (15:55, September 1, 2020)

This is the transaction data of the decentralized exchange (DEX), and the 24-hour transaction volume has reached 1 billion US dollars. Let's go back and look at the situation of centralized exchanges.

This is the data of coingecko. I have talked with the public chain project parties and investment institutions in the industry, and everyone said that the data is not bad. Let's say it's okay. Select the data of the top 12 exchanges.

This is the data of coingecko. I have talked with the public chain project parties and investment institutions in the industry, and everyone said that the data is not bad. Let's say it's okay. Select the data of the top 12 exchanges.This is the data from Coinmaketcap. After CMC was acquired by Binance, there may (just be a guess) some changes in the ranking rules and data. It is just released here for comparison. You can do your mental calculations and compare, and you can see such a result on the CMC list (24h transaction amount ranking):

Coinbase did not make it to the top 12;

The transaction amount statistics of OKex and Huobi (familiar in China) are similar to those of coingecko, about 3 billion US dollars;

Binance’s transaction volume CMC and gecko platform statistics have doubled.

secondary title

Trusted and Untrusted Data

Theoretically speaking, the data of the centralized exchange (CEX) has untrustworthy factors, because the platform's own server system and its own transaction fees can ask market makers to refresh liquidity, which is possible in terms of system rules.

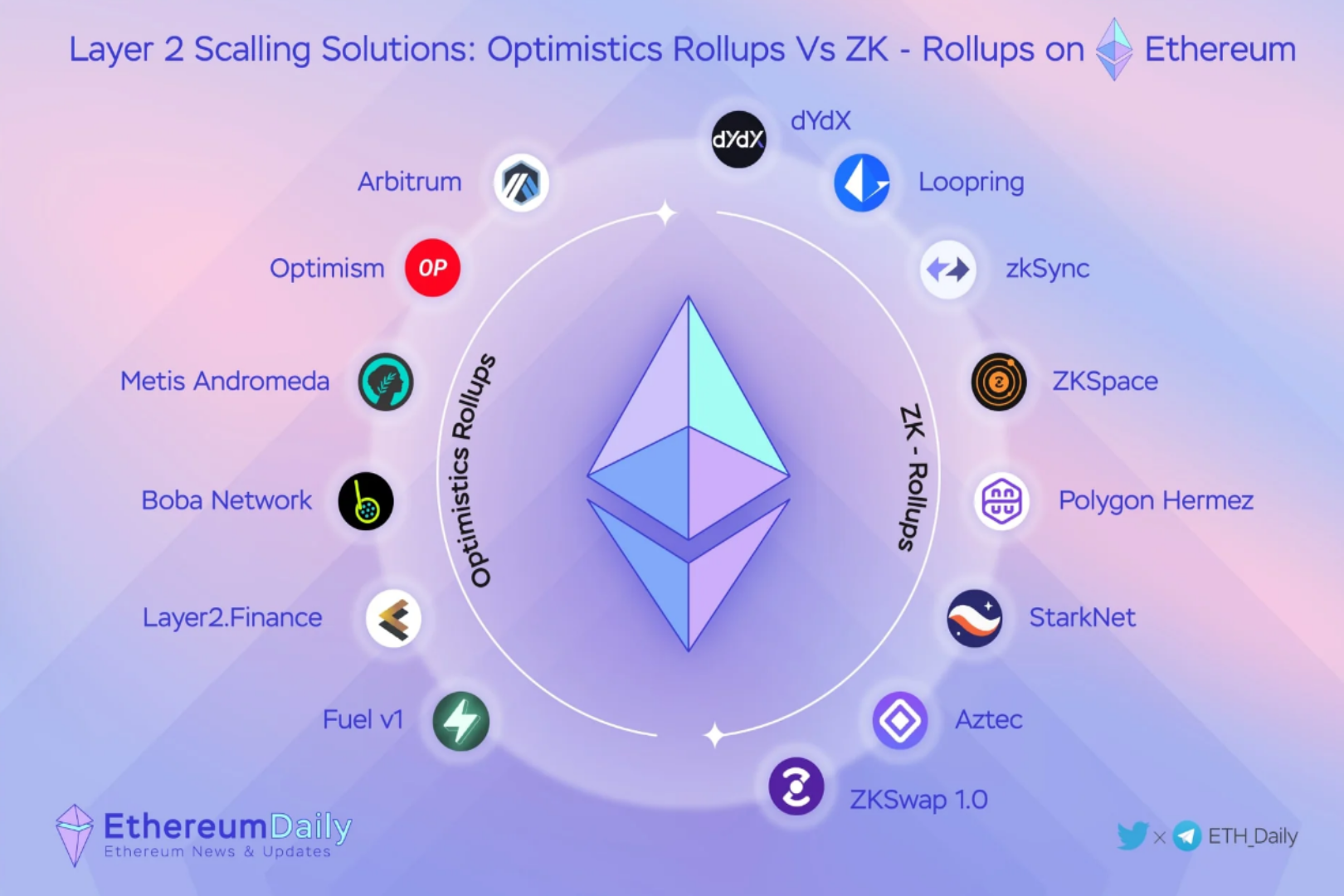

Due to the relatively high transaction fees of DEX during transactions, AMM (automated market maker) or order book (this is no different from centralized exchanges) data will eventually be uploaded to the chain swap (replacement) assets, which include gas fees , and in theory, data can be captured on the ETH network, which means that the transaction volume of DEX is less likely to be falsified. It will also not happen that, like the Binance Exchange, changing to a data statistics website will double the difference. Why choose the top 12?

secondary title

The story of the poor hourglass: jokes after drinking

Looking at the transaction volume data, the total DEX is only 1 billion US dollars, while the three major exchanges add up to more than 10 billion US dollars. Looking back at the data recently stated by major blockchain media platforms: "DEX transaction volume accounts for 100% of all cryptocurrency transaction volume. 4%".

secondary title

New Energy Vehicles: A Data Nightmare

Here I will put a little bit of data, and you will understand the whole picture.

The data of the consulting agency in the above figure is close to the data of other platforms, and there is no huge deviation. Well, this is the production data of the world's major auto groups. The traditional auto industry has been in a downturn for the past two years. After reaching its peak in 2017, the industry thought that after breaking through 100 million vehicles per year, the growth curve would turn downward. Today is September 1, 2020. You can check the data for 2020. It is normal to see the horrific situation—it will come down whether there is an epidemic or not. Let's look back at new energy vehicles:

The author of the picture above is Mr. Ren Zeping from Evergrande Group. The link to the article is as follows: https://www.thepaper.cn/newsDetail_forward_8913701 Compared with the competition in the encrypted world exchanges, DEX is like a new energy vehicle around 2014. Although the volume is extremely small, But the growth rate is very fast. In 2014, there were 89.75 million traditional cars, and an estimated 250,000 new energy vehicles. A fraction can do three times your amount. However, if you look at the plans of various countries, you will know that new energy vehicles have a bright future. Look at the completion of Tesla’s Shanghai factory last year. The first phase of the target is an annual output of 250,000 vehicles. Recently, Weilai Automobile was launched, and the target is also an annual output of 200,000 vehicles. . Is it a small amount? Please look at the picture of the data below, whether you smile or not, I smile.

secondary title

Growth curve of DEX

What laughing? Go back to the blockchain industry and look at the growth curve.

If you don’t understand what exponential growth is, just look at the growth of DEX’s trading volume over the past year. If the data looks from November 2017:

secondary title

Changes in the status quo and pattern (six-point outline)

Summarize

Summarize

This article starts with the trading volume of decentralized exchanges and centralized exchanges, discusses the general theory of venture capital, goes to the oil industry and new energy automobile industry to find the answer to volume and growth, and finally draws an exponential curve. The changes in the status quo and pattern are given, that is, six-point induction.

Postscript: "If you want to learn poetry, your kung fu is beyond poetry." This is a special analysis report on the exchange industry. Because only by going deep into the industry can we understand the industry, and only by jumping out of the industry can we see the industry clearly. The power of the trend is unstoppable, the future of DEX can be expected, and the future of CEX can also be expected. When one day DEX can really be the opponent of CEX, and then look back at this document, you will find more fun.