First of all, I would like to state that Mr. Li Xiaolai's microblog content today has very unique insights and cognitive biases. No matter from which aspect, if we can understand the entire content of this Weibo and put forward different views, it will greatly enhance our insight into DeFid.

Analyze the content of Mr. Li (hereinafter Mr. Li Xiaolai referred to as Mr. Li) is divided into two parts and levels.

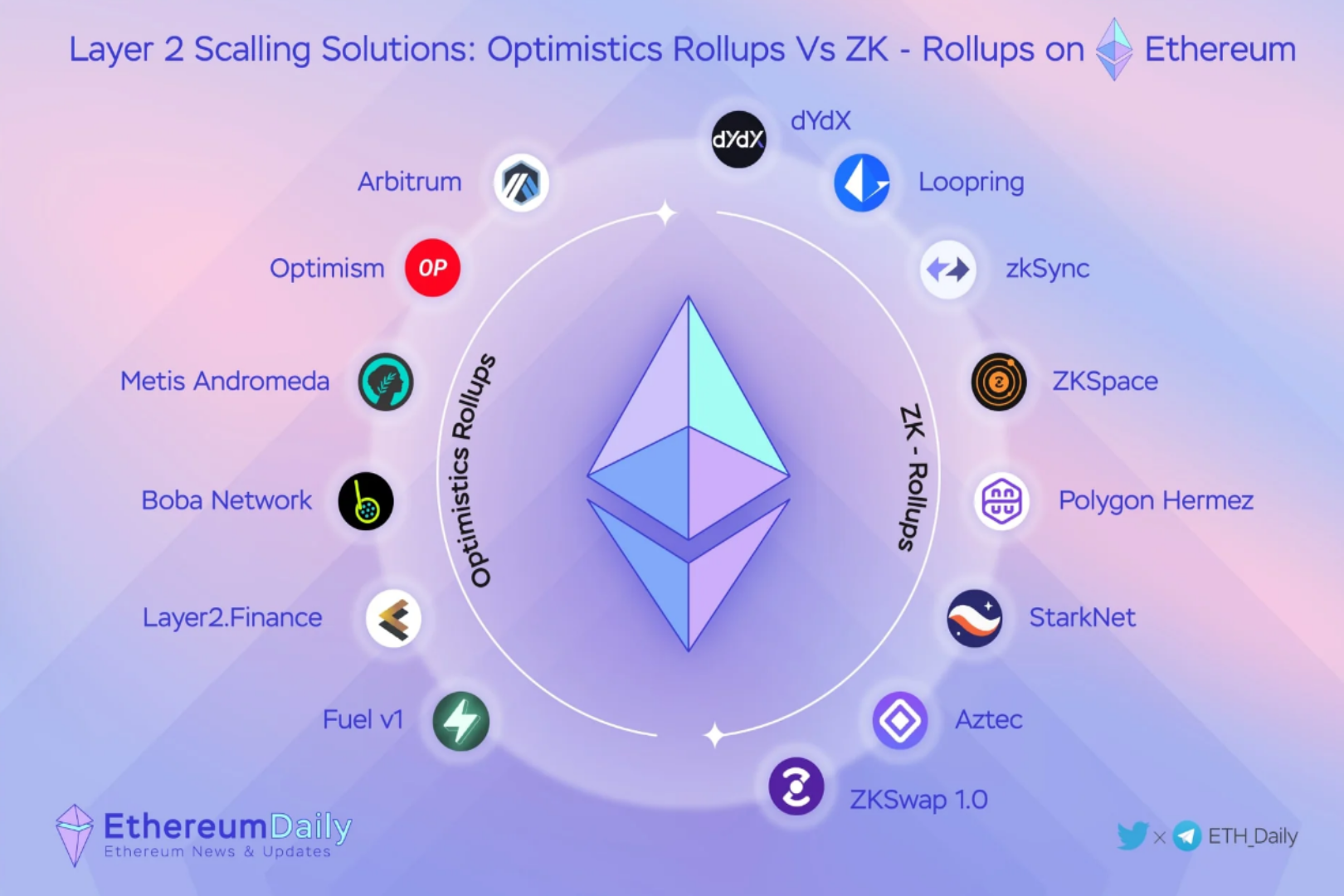

Using DeFi as an analogy to The DAO event

image description

first level title

Using DeFi as an analogy to The DAO event

DAO is the abbreviation of Decentralized Autonomous Organization. The DAO is the world's largest crowdfunding project based on the Ethereum blockchain platform so far. Its purpose is to allow participants holding The DAO tokens to jointly decide the invested project through voting, and the entire community is fully autonomous, and it is realized through smart contracts written in code. The crowdfunding was completed on May 28, 2016, and a total of 11.5 million ethers were raised, with a value of 149 million US dollars at the time.

The above is a simplified introduction to The DAO (search "The DAO event" on the Internet for a lot of information, you can learn about it). What happened in 2016 led to a direct split in the ETH community, with a hard fork of ETH and ETC.

Simplified understanding of The DAO is crowdfunding (eth) and then everyone votes for community governance and decides what projects to invest in. A more popular understanding is an open and transparent private equity fund, but this private equity fund faces the public and has the form of a public equity fund. It is a great innovation.

In the above paragraph, the reason why private equity and public equity are mentioned is that the two require different qualifications and licenses in traditional finance and the real world. There are many institutions that can do private equity, but few can do public equity. The DAO bypassed regulation, but not the hacker's shotgun. Strictly speaking, the hackers did not break the rules, and exploited code loopholes to frantically plunder the wool. This is also caused by the immutable characteristics of the blockchain. The fork goes against the spirit of the blockchain. However, most people in the community support the Vitalik fork, so fork.

first level title

DeFi is still issuing coins in essence, no progress compared to ICO

secondary title

One of the main functions of these popular DEXs is to issue coins-is this understanding correct?

no problem. Mr. Li Xiaolai's opinion, this point can be regarded as hitting the nail on the head, yes, it is to issue coins.

1. No listing fee is required (it can be done in less than a few thousand yuan, and you can issue your own ERC20 token on Uniswap with no more than 100 mouse clicks).

2. There is no need for centralized exchange audits. In fact, centralized exchange audits sometimes have many unnecessary restrictions. These restrictions are not entirely based on their own short-term interest demands (that is, they can make money immediately), and some restrictions are for cooperation. Regulators, these regulations have caused many Tokens to be released on exchanges, and they want to package themselves as functional tokens rather than security tokens. The design of the token model is relatively complicated, and it is unnecessarily complicated for the economic model itself. Just for compliance. If issuing a token directly is no different from securities, the CSRC will intervene strongly, and a project will be wiped out in an instant. However, many people are unaware of these subtleties in the design of these token models.

3. There is no need for a white paper to issue coins on DeFi DEX, just issue them directly. Fast, efficient, and decentralized, this is what Mr. Li Xiaolai said, "I am not responsible for the coins sent out this time." Mr. Li's view is basically correct on this point. However, no matter who issued the currency and when it was issued, they must be responsible for the currency-it is only a matter of the size of this responsibility.

secondary title

No progress compared to ICO

This is not quite accurate. There is progress.

Let’s talk about the Lending business first—although Mr. Li is not referring to Lending, let’s briefly review it.

1. Lending’s liquidity mining, ordinary people can participate in and obtain benefits. This is the victory of the token economic model, which greatly improves the liquidity and improves people’s enthusiasm for participation. The risk of this kind of thing is relatively small (the risk of the wool party is originally just small).

2. Lending is an extension of the "asset" attribute of digital currency. The so-called encrypted assets in the past are not qualified to be called assets. Assets in the real world can be mortgaged. Encrypted assets did not work before, but now they can, which is not a bad thing.

Going back to what Mr. Li said was no progress compared to ICO, he was referring to the way the DEX system issues coins. Great progress has been made.

image description

dogecoin logo

Now the two links of white paper and listing (centralized exchange) are omitted. There is no regression, but the redundant part is deleted. Teams that want to reflect their vision will still talk about what they are going to do and give some proof. Of course, many of the previous digital currency teams were anonymous and decentralized. Anonymity does not mean fakes. Who is Satoshi Nakamoto? no one knows.

2. There is progress. It is easier for current projects to issue coins, but it is still very difficult to pull the market for simple and crude projects. It requires a fund pool. Curve, Uniswap, Bancor, etc. are exchange pool type DEXs, and the price cannot be raised without capital injection. , if I have to invest, the price that does not go up or down will not quickly cause me to lose money.

There is no essential difference between the liquidity in the early stage and the ICO model. It is necessary for the project party to inject liquidity and replenish the water in the exchange pool. Pay attention at this time!

All exchange records of DeFi projects, time, quantity, scale, frequency and other information are all uploaded to the chain, which can be grabbed from the chain. There are related websites for statistics. If you are really worried, you can use crawler software to crawl the data. This requires the investment of real capital , and the previous ICO project, can you go to the backstage of the exchange to see how the project is marketed? Only exchanges and project parties themselves know.

Summarize

Summarize

This article is based on the words of Mr. Li Xiaolai, leading to the classification of DeFi, decentralized lending and related content in the field of decentralized exchanges. Pointing out that DeFi is not The DAO, decentralized exchanges can issue coins, but it is a great improvement over traditional ICOs. Of course, we also highly affirm Mr. Li Xiaolai's risk warning.