Editor's Note: This article comes fromBabbitt Information (ID: bitcoin8btc)Editor's Note: This article comes from

Babbitt Information (ID: bitcoin8btc)

Babbitt Information (ID: bitcoin8btc)

This paper presents the design of a "yield dollar" token based on the UMA infrastructure.

The model was inspired by Dan Robinson and Allan Niemerg in their paper "

Yield Protocol: On-Chain Lending with Rate Discovery

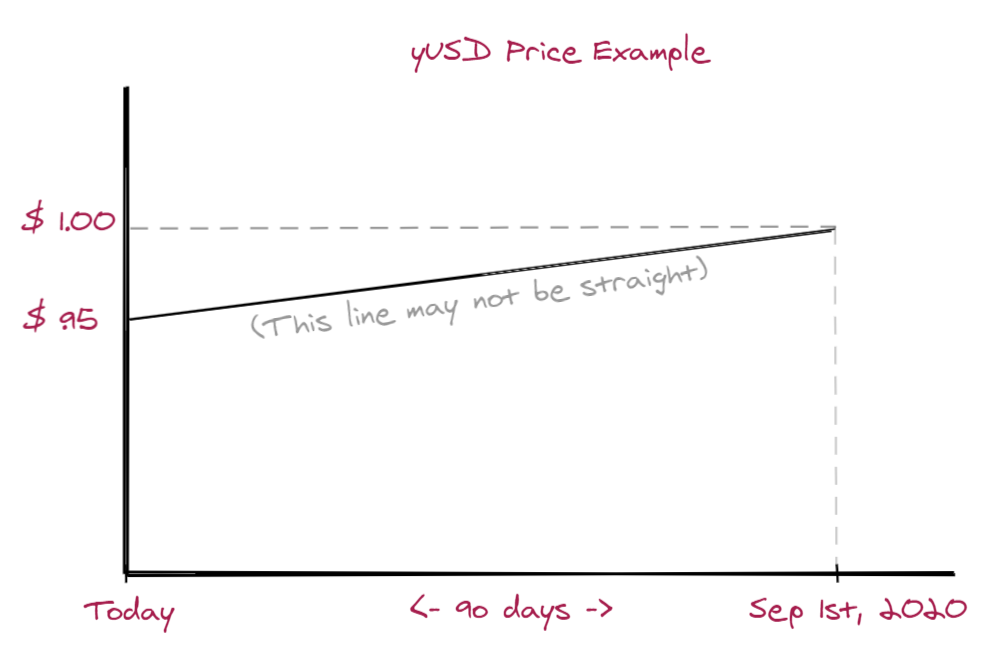

As the expiry date approaches, its price will approach $1

Taken together, this yield dollar represents a fixed-rate, term loan

At maturity, $1 of collateralized assets can be redeemed on the exact maturity date

Taken together, this yield dollar represents a fixed-rate, term loan

secondary title

Example: Borrow ETH

Alicia wants to maintain her exposure to ETH, but also wants to borrow money to use elsewhere (such as increasing her exposure to ETH or buying a car).

She locks her ETH as collateral for the UMA contract and mints yUSD-SEP20 (expiring on September 1, 2020). In this example China, let's imagine that there are 90 days left from now. Then go to an AMM like Uniswap or Balancer and find this yUSD-SEP20 token trading at 95 cents.

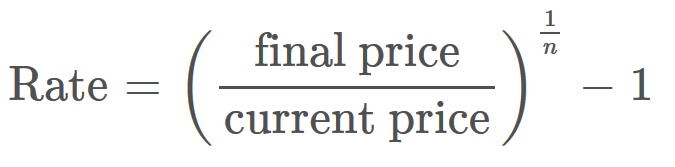

This means that she would pay a fee of $0.05 to borrow $0.95. The interest rate is calculated as:

Where n is the time until expiration in years, which is 90/365 in this example, we get (1/0.95)^(1/0.2465)-1 = 23%.

Note: Although the example shows yUSD trading at a discount to its maturity price of $1, it is also possible for yUSD to trade at a premium if there is a lot of demand from users to buy yUSD, thereby providing the equivalent of a negative rate loan to the minter.

secondary title

Example: Hold yUSD for yield

Robert can be the other side of the above equation. He found on the AMM that yUSD-SEP20 expires in 90 days and is trading at 95 cents. He figured that was equivalent to 23% APY and decided he wanted a return on his capital.

His process is simple: he buys yUSD-SEP20 and keeps it. As the 90 days pass and yUSD-SEP20 expires, he can redeem the $1 collateral and receive its proceeds.

Types of Earning Dollars

Yield Dollars (yUSD tokens) come in different varieties or characteristics and differ in the following ways:

expiry date

Tokens will "expire" after reaching a specified date, which will be reflected in the name of the token, such as yUSD-SEP20, that is, the yUSD will expire on September 1, 2020.

Underlying Mortgage Type

All supported collateral types in the UMA contract may become the underlying assets of the yUSD token. For yield dollar minters, this means that once a particular portfolio is launched, they can use the system to generate leverage on all approved collateral types.

Tokens with different maturities or underlying collateral are not fungible.

secondary title

Rates: Maker vs. Compound vs. yUSD

The mechanism for determining the yUSD rate is structurally different from that of MakerDAO and Compound.

MakerDAO adjusts the interest rate to maintain a fixed exchange rate of 1 Dai = $1. These rates are the borrowing cost (stability fee) and holding yield (Dai Savings Rate). They are adjusted through governance votes. External forces can drive up the price of Dai, and governance is tasked with adjusting the rate accordingly.

Both MakerDao and Compound have variable exchange rates.

For yUSD, the interest rate associated with yUSD moves freely in the market, and the interest rate is fixed at the time of transaction.

secondary title