releasereleasesecondary title

Accelerate the development of a "digital dollar"

According to Giancarlo, former chairman of the Commodity Futures Trading Commission (CFTC), the U.S. government should try toaccelerateDevelop a "digital dollar" or risk losing control of the global financial system's standard of value.

secondary title

Digital Dollar Project White Paper Released

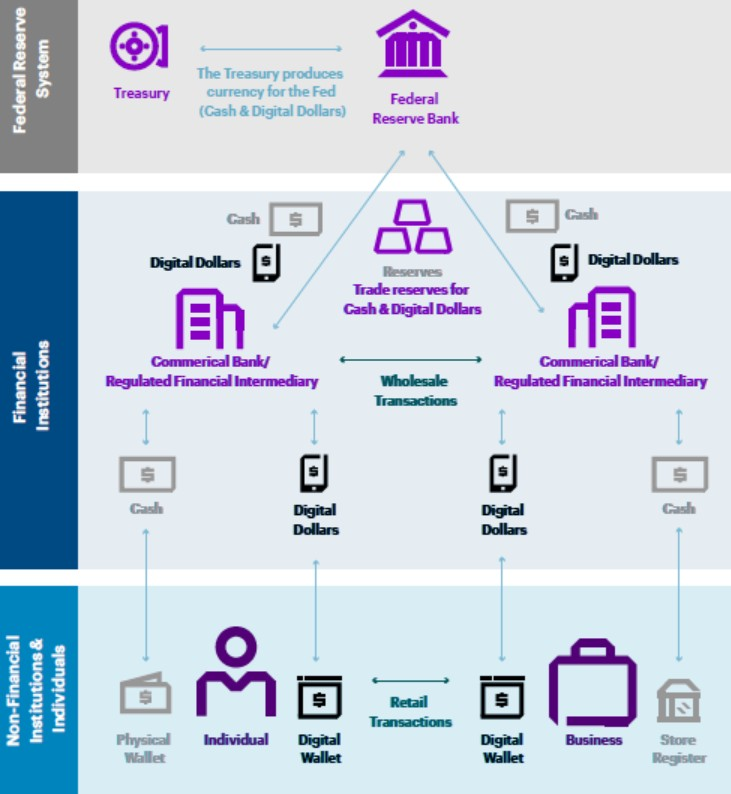

this projectthis projectA digital dollar would be created with the same legal status as physical banknotes. The currency is then distributed to commercial banks, who then distribute it to the populace, similar to how cash is distributed through loans and at ATMs.

Similar to the traditional financial system, the base layer will be the Federal Reserve, which will distribute digital dollars to users through regulated intermediaries.

secondary title

The digital dollar should be tokenized

In the interview, Giancarlo said that as more and more governments began to explore their own CBDC solutions, the current global view on currencies has shifted. The current COVID-19 pandemic has also sounded the alarm about the future of physical currencies and the problem of currency oversupply.

In early March, the U.S. House of Representativescame up withA feasible plan: distribute digital dollar tokens toto effectivelyAllocation of funds from the COVID-19 Treatment Package Actto millions of americans. The bill states that users should be allowed to open retail accounts with the Fed to receive funds.

The white paper recommends adopting a tokenization method instead of an account method, so that the US dollar can be used not only in the United States, but also globally.

Giancarlo said: "We think that a real US CBDC will solve this problem, but there is more to it, including building a new architecture for future generations that not only serves the US during the crisis, but also expands Go abroad to serve global inclusive finance.”

After the platform is built (unknown date), the Digital Dollar Foundation will start a pilot test. These pilots will test “the impact of tokens on money supply, technology choice, user privacy, government control and commercial exploitation and sanctions, and whether transactions comply with AML/KYC laws, etc.”

secondary title

Competition from EU, Russia and China

As its biggest competitor, China, continues to make efforts in CBDC, the United States is gradually gaining ground in the competition for digital asset dominance.behind. The DCEP of the People's Bank of China is advancing in an orderly manner, and pilot tests are also in full swing.

AnnounceAnnounceSouth KoreaSouth KoreaSome developed countries, such as China, Russia and Switzerland, are also planning to launch their own CBDC projects in the near future.

If you want to get more interesting and cutting-edge "dry goods", remember to search for "rich women, intellectual women and big beauties"!