This article comes fromVoxEU.orgsecondary title

Odaily Translator |

![]()

Summary

Summary

Will the issuance of stablecoins have an inflationary effect on the price of cryptocurrencies like Bitcoin? This paper argues that overall stablecoin issuance does not boost the price of cryptocurrencies, in contrast to other previous studies. Instead, according to the following research, the act of issuance can be interpreted as maintaining a decentralized system of exchange rate pegs and acting as a safe haven in the digital asset economy. The latter can be evidenced by the significant premiums seen in stablecoins during the COVID-19 panic in March 2020. The text is as follows:

To what extent does the total stablecoin issuance drive the price of Bitcoin and other cryptocurrencies? This column discusses the common hypothesis of Griffin and Shams (2018) based on the findings of Lyons and Viswanath Natraj (2019). We ultimately find no systematic evidence that stablecoin issuance drives cryptocurrency prices. However, we do find evidence for alternative hypotheses of the drivers of issuance. Specifically, (i) the issuance of stablecoins is an internal response to the deviation of the secondary market exchange rate from the anchor exchange rate, and (ii) stablecoins play an important role as a safe haven in the digital asset economy. For example, in March 2020, due to the panic caused by the outbreak of the new crown virus around the world, stablecoins saw a significant premium at that time.

If a stablecoin is managed by a centralized issuer, then, in principle, its supply could increase on its own, with potentially inflationary effects on cryptoasset pricing. The question matters because Tether Inc., the largest stablecoin by market value, is facing lawsuits. As of October 2019, there is a class action lawsuit against Tether alleging that: (i) Tether is not backed 1:1 by USD reserves, and (ii) Bitfinex increased Tether issuance in 2017 to manipulate the Bitcoin market. The accusation alleges that Tether Inc. and Bitfinex colluded to fuel the bitcoin price surge that occurred in late 2017 by increasing stablecoin issuance. The idea of the two colluding is supported in a recent paper by Griffin and Shams (2018), which provides evidence that Bitfinex expanded Tether supply in late 2017 to drive Bitcoin growth. In addition, if the stablecoins are purely used to meet the transaction needs of investors, we expect that the issuance of stablecoins will not have a systematic impact on the price of Bitcoin.

secondary title

How Tethers Are Created

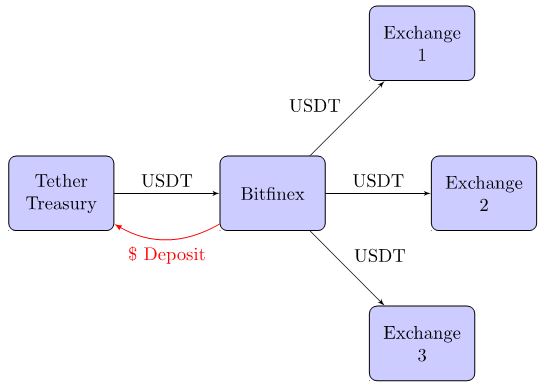

To understand Tether's role in potentially driving crypto asset price inflation, we first document how Tether is created. Figure 1 outlines the Tether creation process by collateralizing USD deposits.

Figure 1: Tether creation process as of 2018:

Similar to the currency board, each Tether issued is in principle guaranteed by 100% of the US dollar deposit, so that in the event of a run on it, all investors can redeem Tether with the equivalent US dollar. Tethers are minted when investors deposit USD into a Tether account, creating an equal supply of Tethers introduced into circulation. Prior to 2018, almost all Tethers created through grants were immediately distributed to Bitfinex and transferred to other exchanges to be traded in secondary markets.

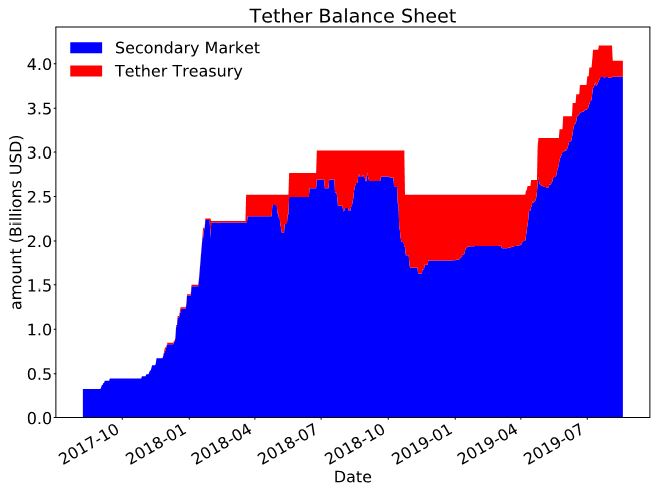

Figure 2: Tether supply in Treasury and secondary markets

image description

The figure shows the total amount of Tether in circulation and divides the total amount in circulation on the secondary market (held by investors and exchanges) and the total amount in reserve held by the Tether Treasury. Data comes from Omniexplorer and Etherscan API.

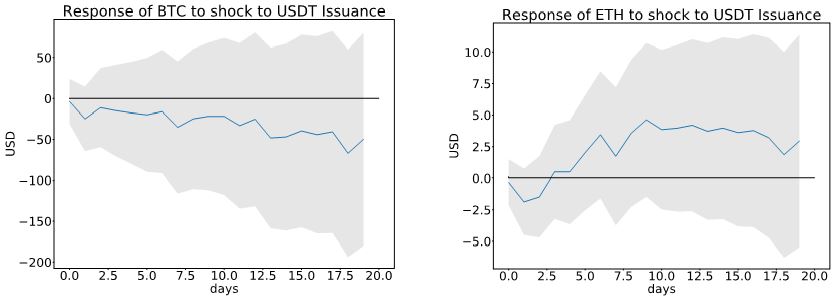

Our first test measures the impact of a shock to Tether's supply on Bitcoin's price after controlling for past supply and Bitcoin price movements. For example, this controls bidirectional feedback and hysteresis effects. Through a more precise calculation of Tether flows in the secondary market, we find that this has no significant impact on the prices of mainstream non-stablecoins (Figure 3). This is a strong conclusion for the choice of sample period (including late 2017 when Bitcoin's price surged), as well as for other major stablecoins.

Figure 3 Bitcoin and Ethereum Price Response to Tether Issuance

This data records local forecasts of changes in the secondary market issuance prices of Bitcoin and Ethereum using the method of Jordà (2005). The data stream for the secondary market comes from Omniexplorer and Etherscan. Price data comes from cryptocompare. According to Bhambhwani et al. (2019), controls include lagged price changes, changes in cryptocurrency fundamental hashrate, and the number of unique addresses on the network. The sample period is from August 2017 to November 2019. Gray areas indicate two standard error intervals of statistical significance at the 5% level, indicating no significant price effects over the subsequent 20 days.

secondary title

Basic Principles of Stablecoin Issuance

secondary title

in conclusion

This article answers a series of questions about whether stablecoins have an inflationary effect on cryptoasset prices. The conclusion: We found no systematic evidence that stablecoin issuance affects the price of cryptocurrencies. On the contrary, our evidence supports the alternative view that the issuance of stablecoins is an endogenous response to the deviation of the secondary market exchange rate from the anchor exchange rate, and stablecoins always play a safe-haven role in the digital economy.

references:

Baur, D G and L T Hoang (2019), “A Crypto Safe Haven Against Bitcoin”, Available at SSRN.

Bhambhwani, S, S Delikouras and G M Korniotis (2019), “Do Fundamentals Drive Cryptocurrency Prices?”, Available at SSRN.

Griffin, J and A Shams (2018), “Is Bitcoin Really Untethered?”, Available at SSRN.

Jordà, Ò (2005), “Estimation and inference of impulse responses by local projections”, American Economic Review 95(1): 161–182.

Lyons, R K and G Viswanath-Natraj (2019), “What Keeps Stable Coins Stable?”, Available at SSRN.

Yermack, D (2015), “Is Bitcoin a real currency? An economic appraisal”, In D L K Chuen (ed.), Handbook of digital currency (pp. 31-43), Elsevier.

references: