This article comes fromMedium, original author: Mason Nystrom

Odaily Translator |

Last week, the US government announced the approval of a $2 trillion economic stimulus bill. Many people think that when facing potential long-term inflation, issuing more dollars will not help, but the reality does not seem to be the case. Perhaps in order to continue to prove that it still has the supremacy of the currency on a global scale, the dollar has been appreciating in the past few weeks. Judging from foreign exchange data, this may be due to the massive sell-off of other foreign currencies after the outbreak of the new coronavirus shocked the global financial system.

secondary title

The US dollar is still at the top of the "food chain" in the financial world, and it is also the "number one predator"

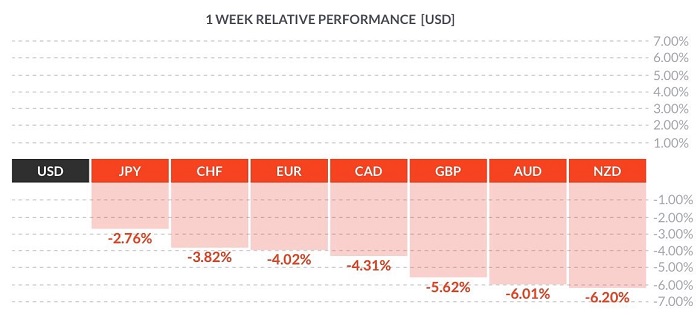

The chart below shows the performance of the U.S. dollar relative to other major fiat currencies around the world for the week ended March 13. (Source: Michael Brown)

So, why is the performance of the US dollar getting better and better when everyone thinks that it is not good?

In fact, most of the global markets are denominated in USD, which makes USD more liquid than other fiat currencies. When a crisis breaks out, liquidity becomes even more important. In addition, many corporations and financial institutions around the world hold mostly dollar-denominated assets (such as U.S. Treasury bonds) on their balance sheets.

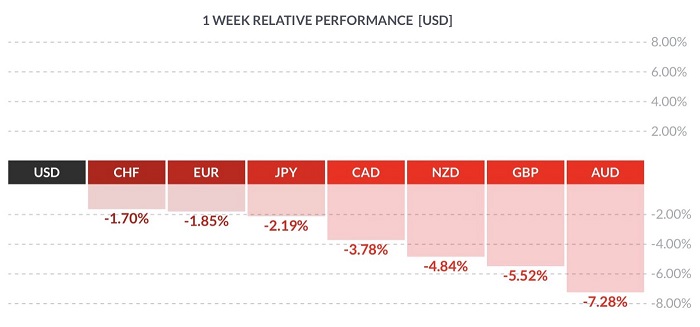

As we can see from the chart below, the USD remained strong against other major fiat currencies during the week of March 15th to March 20th. Take the British pound as an example. Although the Bank of England - the Bank of England announced a new round of quantitative easing and interest rate cuts this week, the pound still hit a new low in nearly 35 years. In contrast, the performance of the US dollar is obviously much better.

The chart below shows the performance of the U.S. dollar relative to other major global fiat currencies for the week of March 20. (Source: Michael Brown)

To a certain extent, the strength of the dollar actually comes from companies that need to sell local currency assets to support more national contracts or US dollar assets. In order to maintain liquidity, many companies around the world may choose to sell their own currencies, or sell assets denominated in relatively weak currencies. Although the currency exchange rate is determined by many factors, it should be noted that one of the important factors is market volatility. As the impact of the global new crown virus epidemic intensifies, especially the number of cases in the United States continues to rise, the performance of the US dollar seems to have begun to be affected. Influence.

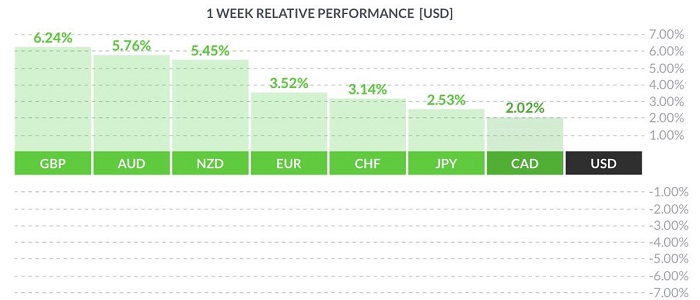

There is concern about the impact of market volatility on the US dollar exchange rate, as evidenced by the market reaction during the week of March 27, as the US dollar underperformed against other countries' fiat currencies, particularly the British pound and Australian dollar.

The chart below shows the performance of the U.S. dollar relative to other major global fiat currencies for the week of March 27. (Source: Michael Brown)

I know what you're trying to say - yes, the dollar doesn't look very good on the chart above. That's right, this chart shows the unprecedented swings in currencies during the market turmoil. In fact, if we pay attention to the weekly exchange rate changes of the Australian dollar against the US dollar this month, we will find that both the increase and the decrease are greater than the fluctuations in the entire 2019.

And currency, shouldn't it fluctuate and remain relatively stable? (Of course, we might allow the currency to inflate a little bit every year.)

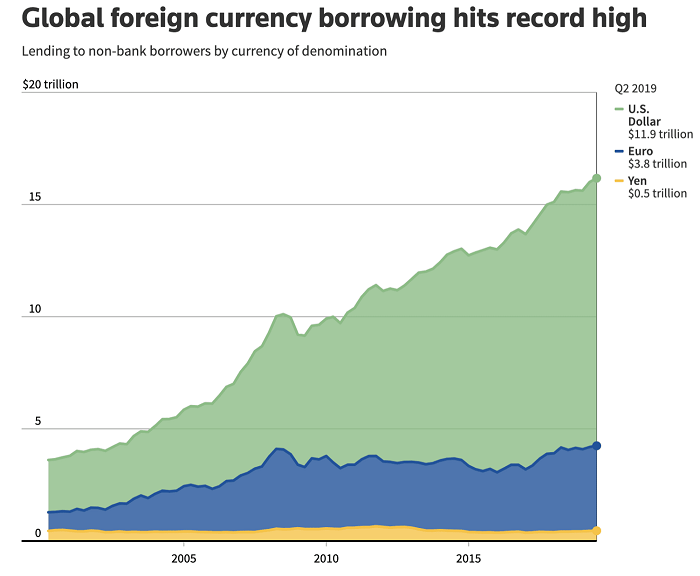

Such is the dominance of the U.S. dollar, and many fear that the U.S. government’s massive multi-trillion-dollar stimulus package and other “helicopter money” measures could have repercussions on the global economy and the strength of the U.S. dollar for years to come. Undoubtedly, there is some basis for such concerns, but it needs to be explained that the U.S. government is not actually issuing a large number of dollars to show its own strong national power. On the contrary, the strength of the dollar depends on other countries, as well as various global companies, Institutions and blocking the desire for dollars. Fortunately for the United States, at least for now, the dollar remains highly valued globally. As a result, the U.S. dollar has continued to remain very strong as most multinationals continue to finance dollar-denominated debt.

As you can see from the chart above, global borrowing levels hit new highs as U.S. bonds and assets denominated in dollars were liquidated — the dollar, so to speak, is actually a bit “cornered.” Although the U.S. dollar is still at the top of the "food chain" in the financial world and is also the "number one predator", as the new crown virus epidemic continues to expand and triggers a sustained economic recession, the U.S. dollar may also gradually become depressed.

secondary title

So, for the cryptocurrency industry, why should we care about the U.S. dollar? What does the dollar have to do with cryptocurrencies?

Yes, after reading this, someone finally wants to ask this question. In fact, global macroeconomics has long-term effects on both the US dollar and cryptocurrencies. Of course, we cannot analyze all cryptocurrencies one by one, so this article will explore some typical cryptocurrencies.

1. The creation of a digital dollar and the revival of central bank digital currencies

In fact, many governments and central banks around the world are now "quietly" researching central bank digital currencies. There is no doubt that it might be easier for the U.S. government to distribute aid relief payments using digital dollars. On March 24, the Democrats in the United States submitted the "PROTECTING CONSUMERS, RENTERS, HOMEOWNERS AND PEOPLE EXPERIENCING HOMELESSNESS" (PROTECTING CONSUMERS, RENTERS, HOMEOWNERS AND PEOPLE EXPERIENCING HOMELESSNESS, SEC. 101. PAYMENTS FOR FAMILIES), which states that it hopes to use digital dollars to stimulate the economy and distribute relief funds to US citizens. But only one day later, on March 25, the latest version of the bill removed all digital dollar content, and we still don’t know why Congress did this.

A digital dollar can send money faster than wire transfers and mailed checks, among other advantages. In fact, the relief bill passed by the United States this time only allows the federal government to provide relief funds to qualified U.S. taxpayers who have direct deposit bank addresses and are recorded in the IRS. Other eligible relief objects may have to wait four years. It will take months or more to get the money, which means that in the next few weeks, only about 70 million people will actually receive relief benefits, while the total population of the United States is 330 million. Not only that, even in a developed country like the United States, there are still many poor people who do not have bank accounts, so they are likely to be unable to obtain government relief funds or other assistance. However, the vast majority of people have mobile phones, which means that people can access digital currency without going to a bank to open an account.

Just after the "digital dollar" was removed from the relief bill, Sherrod Brown, a member of the U.S. Senate Banking, Housing and Urban Affairs Committee, proposed a new draft digital dollar bill aimed at creating a free bank account for every American, This can not only improve the efficiency of currency use, but also save a lot of costs (such as check exchange). Under this latest proposed bill, a digital dollar would be operated and maintained by the Federal Reserve, which would maintain digital wallets on behalf of individuals. Member banks under the Federal Reserve will be allowed to create a "straight-through digital dollar wallet", and the member banks holding the wallet should establish and maintain a separate legal entity dedicated to holding all assets and liabilities related to the digital wallet.

It is worth mentioning that the digital dollar is not an "encrypted dollar" but a "digital version of the U.S. dollar." It will be specially marked with the "FedAccounts" Logo of the Federal Reserve.

Plus, a digital dollar would make money supply control more effective. The U.S. government can easily buy back or issue new currency without expensive labor and printing costs.

Viewed in this light, a digital dollar is effectively a form of central bank digital currency (CBDC) that would represent a claim on the central bank, similar to the function of paper money today. Compared with the controversial cryptocurrency, the central bank digital currency should not have too many regulatory conflicts, and can be integrated into the existing financial system more quickly. In addition to the Federal Reserve, the Bank of England, the Bank of England, has announced cooperation with a number of commercial banks to study the potential benefits of digital currencies. The blockchain analysis company ConsenSys also interpreted the central bank's digital currency and the future of currency in a white paper.

2. Stablecoins based on fiat currencies are bound to rise

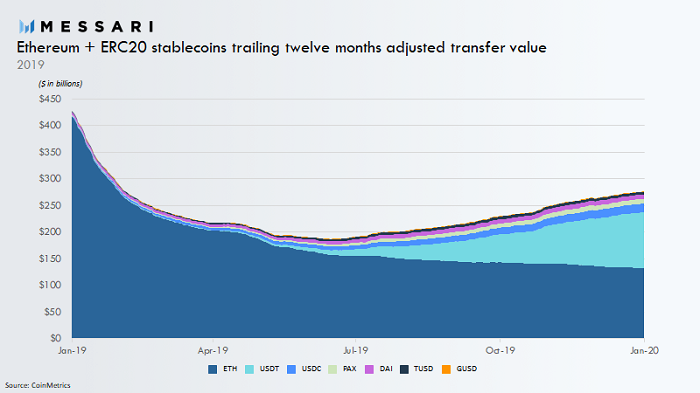

Stablecoins, whether pegged to fiat currencies or other forms of collateral, will be the first "killer" cryptocurrency applications. In this global crisis, more and more people are beginning to understand the importance of currency, because currency is the "last resort" to quell the economic crisis. In January 2020, due to the migration of USDT to Ethereum, stablecoin transaction volume exceeded ETH token transaction volume (as shown in the chart below), this historic event also highlights the value proposition of stablecoins on permissionless blockchains .

Another event worthy of attention is Maker: on March 12th "Black Thursday", the sharp drop in ETH price of 30% within 24 hours and the network congestion caused by the surge in gas fees caused a huge impact on the Maker protocol, the community, the foundation and the entire Ethereum. The Fangfang DeFi system has brought a huge test. As a result, some nursing machines have won multiple batches of 50 ETH collateral (a total of 4.5 million US dollars) at a price of 0 Dai. During the ETH price drop, Ethereum network congestion caused a delay in the price feed of the Maker oracle machine. Although this was an unexpected delay, it objectively gave many users time to replenish under-collateralized assets and repay debts, avoiding liquidation . (Odaily Jun o-daily Note: Keeper is a key part of the Maker system. It is generally an automatic liquidation software or a manual market maker to maintain the health and stability of the Dai system. The Maker Foundation hopes and encourages more Keepers to be used in the Dai system. Participated in collateral auction recently.) Eventually, the Maker Foundation converted the deficit into system debt of the Maker Protocol and launched a debt auction.

This incident highlights the disadvantages of stablecoins based on cryptocurrency collateral, so it will also promote more stablecoins based on fiat currencies to appear on the market. It is worth mentioning that during the market turmoil in the past month, fiat currency-based stablecoins around the world have performed very well. (Of course, another reason for this may be that cryptocurrency investors are worried about large losses during the price fluctuations of bitcoin and ethereum assets, so they are switching to stablecoins.)

Although at this stage, fiat currency-based stablecoins have not received as much attention as other encrypted stablecoins with full autonomy, but such stablecoins are less volatile. In addition, most encrypted stablecoins today are based on the Ethereum blockchain, but the market value of Ethereum is only tens of billions of dollars, so it also limits the development of stablecoins to some extent. In contrast, most fiat currencies are at the "trillion-dollar" level, so the future potential of stablecoins will also be greatly improved.

Taking the stablecoin pegged to the US dollar as an example, in the past three months, the net flow of funds reached an astonishing $2 billion, setting the largest demand growth ever, of which the inflow of Tether stablecoin was as high as $1.55 billion, and the inflow of USDC stablecoin Bitcoin is about 170 million U.S. dollars, while the inflow of BUSD stable currency also has 150 million U.S. dollars.

3. Is the traditional financial system beginning to falter?

The COVID-19 epidemic has had a huge impact on many countries around the world, and it has also had an impact on the traditional financial system. In contrast, the financial systems supported by those superpowers are relatively resilient. The world's demand for more stable currencies such as the US dollar, euro, yen and Swiss franc has increased, but some countries with weaker economies will face currency inflation. Risks such as increasing economic instability.

From the perspective of mitigating financial risks, after the epidemic, some "small countries" may consider storing some other valuable assets, such as gold and bitcoin. Not only that, but due to their offshore nature, some stablecoins have become one of the best ways to dollarize in countries like Indonesia, Russia, and Brazil. As countries implement isolation and travel restrictions due to the new crown virus epidemic, cash transfers have become extremely difficult, and the cash attribute of stablecoins can even partially replace the US dollar and other legal currencies.