In 2020, the two major currencies of the "Ether system", ETH and ETC, are in their respective transformation periods. ETC, the original chain of Ethereum, is about to experience its second production reduction, ETH plans to transfer from PoW to PoS in the second half of the year, and the layout of graphics card computing power is about to undergo a round of major adjustments.

Where does the computing power of mainstream graphics cards go from Ethereum to PoS? Can the "same root and same origin" ETC take over the baton of computing power and lead the PoW camp? Under the change of computing power and price, how should miners mine ETC and ETH?

A few days ago, the Yuchi live broadcast room invited Xu Kang, head of ETC Asia Pacific, Zhang Songqing, co-founder of minerOS, and Kevin Zhou, head of Aladdin Mining Coin Research Institute, to analyze network value, ecology, computing power, etc. Enthusiasts discuss the changes in computing power and understand the ETC ecology.

secondary title

Reduce production by 20% and enter "Era 3"

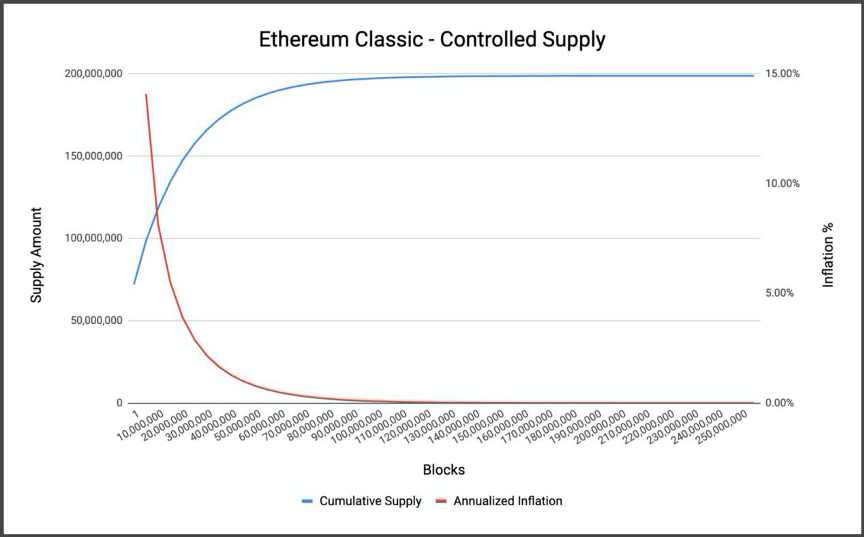

As the original chain of Ethereum, the economic model of ETC refers to the design of Bitcoin, and its production reduction logic is similar to that of Bitcoin. Considering the design requirements such as network function and security, the production reduction of ETC is not halved, but reduced every 5 million blocks. 20%.

ETC's monetary policy is the result of protocol programming and does not rely on human subjectivity. This set of monetary policy is mechanized and algorithmic, with an upper limit and a saturating supply curve, which will keep inflation on a downward trend.

What are the characteristics of ETC's block rewards?

Xu Kang, head of ETC Asia Pacific, compared BTC and pointed out the characteristics of ETC. The average ETC block generation time is 15 seconds, and the genesis block has more than 72 million pre-mined, including 1 EVM, 1 programming language and 1 gas system.

In block rewards, an obvious feature is the existence of "uncle block" rewards. When dealing with the situation where more than one block is discovered at the same time and broadcast throughout the network, Bitcoin's rule is to discard blocks from shorter chains and name them "orphan blocks", without giving any reward. In ETC, due to the higher frequency of block generation, the possibility of generating multiple valid blocks at the same time is higher. The rule of ETC is to reward stable blocks at the same time. These blocks are called "uncle blocks".

How does ETC's rewards change with "ages"?ETC enters a new "era" every time it experiences a production cut, and each era lasts about 2.38 years

. ETC has entered "Era 2" at the end of 2017 and is about to enter "Era 3".

In "Era 1", a single block will receive 5 ETC rewards, a single uncle block can receive 4.30375 ETC rewards and 0.15625 ETC encouragement, and a maximum of 2 uncle blocks can be packaged, so a maximum of 14.0625 ETC can be obtained each time;

In "Era 2", a single block will be rewarded with 4 ETC, a single uncle block can be rewarded with 0.125 ETC and the same ETC, and a maximum of 2 uncle blocks can be packaged, so a maximum of 4.50 ETC can be obtained each time;Starting with "age 3", all block rewards will be reduced by 20%

. Incentives including uncle block rewards will receive the same discount.

Where is the current position in the halving market during the "era" change?

Kevin Zhou, head of the Aladdin Mining Coin Research Institute, believes that the market has completed the first wave of production reduction according to the "production reduction script" and has entered the pre-production callback stage.Mainstream graphics mining coins such as ETC will continue to develop in accordance with the production reduction script. Although the incentives for the outbreak and the final development of each project may be very different from before, the trend of mainstream projects will still continue.。

At present, we are at the tail end of the ETC production reduction market, and at the head of the development of the entire production reduction cycle.

secondary title

ETH/ETH, the ratio depends on the changesZhang Songqing, co-founder of MinerOS, pointed out the three elements of miner decision-making:Computing Power, Currency Price, Earnings, and pointed out that ETH and ETC, both of which are Ethash algorithms, can benefit from their price, computing power, and incomeratio

, to understand how mining resources flowed at the critical moment of the development of the two networks.

ETC and ETH with the same algorithm, how do the computing power, price and income change?

Through data analysis, we can find some characteristics:

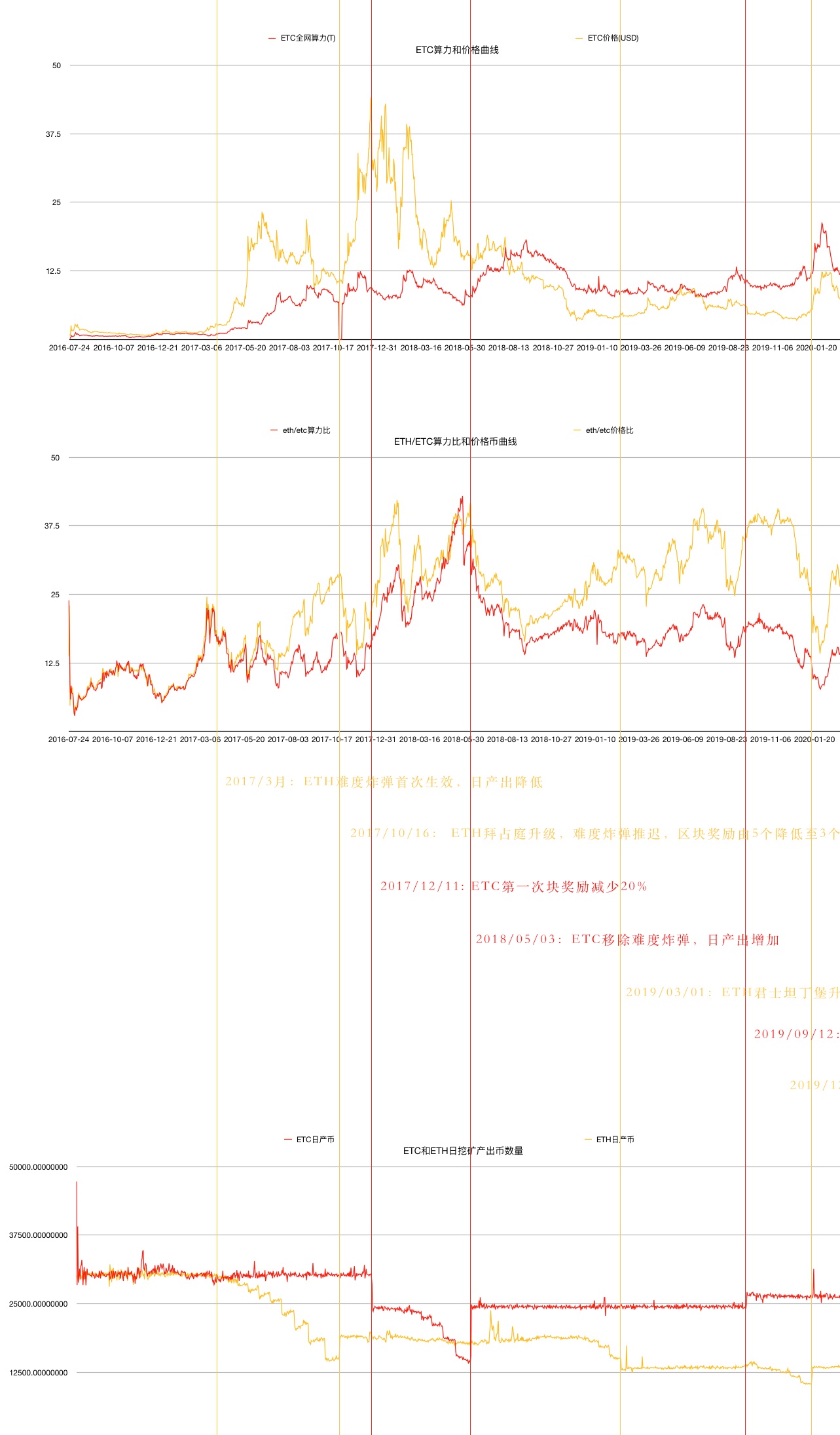

The computing power of the ETC network is strongly related to the currency price, and the computing power and the price rise and fall simultaneously. In terms of range, from the end of 2019 (the expected start of production reduction) to the near future, the currency price has increased by up to 4 times, and the computing power has increased by up to 2 times.

Changes in the daily output of ETC and ETH will also affect the currency price. From historical data, each change in daily output will have some impact on the currency price. After the daily output of ETH is reduced, the price of ETH will first fall and then rise, and the opposite will be true for ETC; and after the daily output of ETC is reduced, the price of ETC will first fall and then rise. ETH is the opposite.

Production cuts are expected to affect computing power comparisons. From the end of 2019 to mid-January, the computing power gap narrowed as the ETH/ETC price ratio decreased; after that, the ETH price rose, and the computing power gap increased. Compared with other currencies with the same algorithm, the market has a reluctance to sell the currency with reduced production. It rises first and then falls. After halving, due to the reduction in supply, the currency price gradually recovers.

How can the ETC and ETH computing power markets achieve self-regulation?Similar to the "moving bricks" of the exchange, miners can realize self-regulation in the process of changing the price of mining coins with the same algorithm

. Due to the emergence of miner management systems such as minerOS, NiceHash computing power trading system and some smart pools, the current short-term income of miners mining ETH and ETC is the same.

Compared with reducing production by 20% and 50%, for miners, the risk of short-term income changes is a little bit smaller. According to Tokenview data, on March 8, 2020, the total market value of ETC was 869 million US dollars, which is still very small compared to ETH 24.89 billion US dollars. The daily output value of ETH is 2.3 million US dollars, and the daily output value of ETC is 142,000 US dollars. Under the condition that other market conditions remain unchanged, the estimated impact of a 20% reduction in ETC production on the overall income of relevant miners is (-14.2*20%)/(230+14.2 )=-1.1%.

secondary title

ETH to PoS, computing power redistribution

How will ETH's transfer to PoS affect the graphics card mining pattern, and ETH miners are concerned about the "where to go" of computing power. At present, half of the entire network’s computing power in the graphics card market is in ETH. ETH2.0 is transferred to the PoS consensus. Miners will inevitably choose ETC or other projects. How will this part of the computing power change? How will the ETC computing power increase? The distribution of computing power with ETH has become the focus of miners' attention.

ETC, to undertake ETH computing power?At present, there is still a big gap between the market value of ETC and ETH. Whether it can "catch" enough computing power from ETH depends on the market performance

. Although the price is difficult to predict, we can try to focus on future trends from the current situation, value, and development potential.

The person in charge of ETC Asia Pacific analyzed the reasons for the rise in ETC production cuts and said that supply and demand are only one aspect. In addition to making ETC tokens a "hard asset" because of the fixed monetary policy and issuance cap, the recognition of institutions and mainstream ecology, as well as the progress of technical interoperability with Ethereum have all promoted the value increase.

Zhang Song, co-founder of MinerOS, pointed out that according to CoinMarketCap, ETC currently ranks 18th in the market value of cryptocurrencies, and it is the graphics card mining currency second only to ETH in market value. After ETH is converted to PoS, graphics card miners are likely to come to ETC. Judging from the current market value of ETC, it is far from enough to undertake ETH computing power, but compared with other currencies, ETC is more likely to undertake computing power.

Kevin Zhou, head of the Aladdin Mining Coin Research Institute, believes that in the long run, stable and continuous project operation and development will have a great impact on the market value of graphics card mining coins, because there is currently a lot of competition in the public chain ecology, and only technology can be used to complete public chain applications Only by landing can we seize the future. The value of ETC also depends on the growth of computing power to promote the improvement of network security. Once separated computing power gathers together again, which will inevitably promote the new development of the community and development.The mining revenue of ETC has long occupied the first place in A card mining coins.

Computing power can guarantee the network security of mining coins, and can also explain the value of mining coins, thereby promoting the rise of prices; and under the promotion of prices, computing power will automatically flow to mining coins with higher prices. The growth of computing power and price go hand in hand.

What strategies can ETH miners choose?"Tuning coins" is considered one of the coping strategies.

The two factors of "ETC production reduction + ETH2.0" are superimposed. Kevin Zhou, a member of the Aladdin Mining Coin Research Institute, believes that this is "bad" for graphics card miners. After the output of the project decreases, the income of the same computing power will decrease under the condition of constant price. Although the conversion of ETH to PoS has to go through a process, graphics card miners will eventually be unable to mine ETH with mining machines, and must consider switching computing power to other projects."ETH is going to be converted to PoS, can the mining machine still mine, and how long can it mine?"

In this regard, graphics card miners need to make good use of the current computing power resources to dig out and hoard more ETH and other production-reduced tokens. Because 1) after ETH is converted to PoS, only by holding more ETH to participate in the network consensus can more token income be obtained; 2) if other tokens with reduced production are calculated according to the model that the daily output is fully accepted by the market, then in After the production reduction, the market will demand the inflow of tokens with the same output value, raising the price of tokens.

secondary title

Long-term value and new narrative topics

Although in the short term, the entire cryptocurrency market has been impacted, in the long run, the growth of network value and the iteration of mining hardware are still important factors driving the increase in currency prices. We can look forward to DeFi ecology, interoperability, and more new narrative topics.

How can ETC achieve a stronger community?There will be more discussions and progress on the compatibility of ETC and ETH, which is also a breakthrough point for the ecological development of ETC.

Xu Kang said that through Atlantis, Agharta and the upcoming Phoenix hard fork upgrade, ETC and ETH will be fully compatible. DApps on ETH are copied or transferred to ETC to build almost zero cost, and even DApps on ETH and applications on ETC can be seamlessly connected and communicate with each other, truly interoperable.

Soon there will be a large number of various types of DApps on ETC, including DeFi ecosystems such as lending, exchanges, and stable coins. After ETH is converted to PoS, ETC can be used as the data availability layer of ETH2.0, responsible for the confirmation of security. This combination will be more conducive to the mutual integration of the two communities and achieve the result of common prosperity.

What kind of test is the graphics card mining machine facing?The ASIC mining machine of the Ethash algorithm will become a big topic.

Zhang Songqing pointed out that this year, the DAG files of ETH and ETC will successively exceed 4G, which will cause 4G graphics cards to be unable to mine. Compared with the topic of production reduction, the iteration of graphics card mining machines may have a greater impact.

Xu Kang analyzed that Ant E3 stopped mining ETH and ETC not long ago. The most important reason is the DAG limit of 4G. In addition, the mining algorithms of Ethash and Bitcoin are very different, and the major Bitcoin mining machine manufacturers will inevitably be unacceptable. In addition to E3, Innosilicon’s A10 has been announced for Ethash mining machines, and other manufacturers such as Rinzhi are also eager to try it. I believe that many Ethash ASIC mining machines will surface this year.

This year, new narrative topics will emerge with the development of network protocols and changes in the market. Financial derivatives, DeFi network security, and the topic of production reduction will also bring more discussions in the industry.