Editor's Note: This article comes fromBlockVC(ID:blockvcfund), author: BlockVC industry research team, reprinted by Odaily with authorization.

secondary title

Highlights of the full text

In the blockchain industry, the Matthew effect still applies, and the smart contract platform will further promote the competitive trend of "the strong will always be strong" due to the homogenization of functionality and application fields. The following factors will promote the continuous evolution of Ethereum (ETH) into a new super species and continue to release market value:

Compared with Bitcoin and similar smart contract platforms, ETH is seriously underestimated by the market. In the competition of similar projects, the victory of Ethereum is almost doomed.

Due to the adoption of the over-collateralization model, the development of DeFi will promote the mortgage of a large number of ETH assets locked in smart contracts, thereby reducing the circulation of ETH;

After ETH2.0 will adopt the POS consensus mechanism, a large amount of ETH will be required to be mortgaged (Staking) to become a node or participate in voting decisions;

In other ETH applications, the locked ETH is naturally stranded due to capital turnover in commercial activities;

In the rapid evolution driven by open source, Ethereum will completely suppress a large number of similar platforms and continue to grow through the "siphon effect".

secondary title

Blockchain: a master of "open source thinking" and "cypherpunk"

Blockchain technology does not emerge from scratch, but is an innovative technology obtained through the organic combination of engineering based on the progress and accumulation of the entire computer technology and cryptography technology. Among them, "open source thinking" and "cypherpunk" are the two spiritual cores and technical support of blockchain technology. The former provides a fertile ground for rapid evolution, while the latter provides a deep technical accumulation.

The rapid evolution driven by open source has once shone brightly in the field of software development. In 1991, under the influence of the spirit of the open source movement, "the father of the Linux kernel" Linus Benedict Torvalds released the LiNUX 001 version. After the "free competition" and "survival of the fittest" in the global open source community, today, Linux kernel technology has spread to include the Internet and enterprise intranet systems, large-scale distributed computing, database fields, teaching and scientific research systems, office applications and mobile hardware and other fields (such as the Android operating system). The figure below shows the rapid evolution of Linux kernel technology over the past 30 years.

Obviously, the open source feature can not only endow software with strong rapid iteration and evolution capabilities, but also enable brainstorming, and the development of blockchain technology is also deeply affected by it. During the same period, the cypherpunk movement also gained further proliferation. This idea advocates the protection of personal privacy through cryptography and eliminates any trust crisis caused by centralized institutions. In the early 21st century, these two ideas gave birth to a new technology that combines the strengths of the two ideas - blockchain, and produced the first successful example of blockchain application: encrypted digital currency represented by Bitcoin and Ethereum .

secondary title

The ultimate evolutionary machine Ethereum: "AlphaGo" on the blockchain

Rapid iterative evolution is the only way for the success of "AlphaGo", and Ethereum is running wildly on this road to success.

Bitcoin is the first successful encrypted digital currency, which has spawned a huge trading market and ecology. As of now, its global market value is close to 158 billion US dollars. However, Bitcoin has a single function, does not have Turing completeness, and does not satisfy the application realization under complex logic. Therefore, blockchain technology has developed to the 2.0 era, that is, represented by Ethereum (ETH), with smart contract technology It is the second-generation decentralized programmable application platform at the core. Among them, Ethereum pioneered and applied smart contract technology. Its only native cryptocurrency is Ether (ETH), which is decentralized and scarce, and undertakes important functions such as global payment and value storage.

In fact, after Ethereum, other decentralized application platforms (including EOS and TRON with greater influence) have appeared in the industry with ETH as a blueprint reference. However, Ethereum is firmly established in technology development and commercial applications. Firmly occupying the dominant influence and position, embarking on an all-round and all-field ultimate evolution path similar to AlphaGo, including but not limited to:

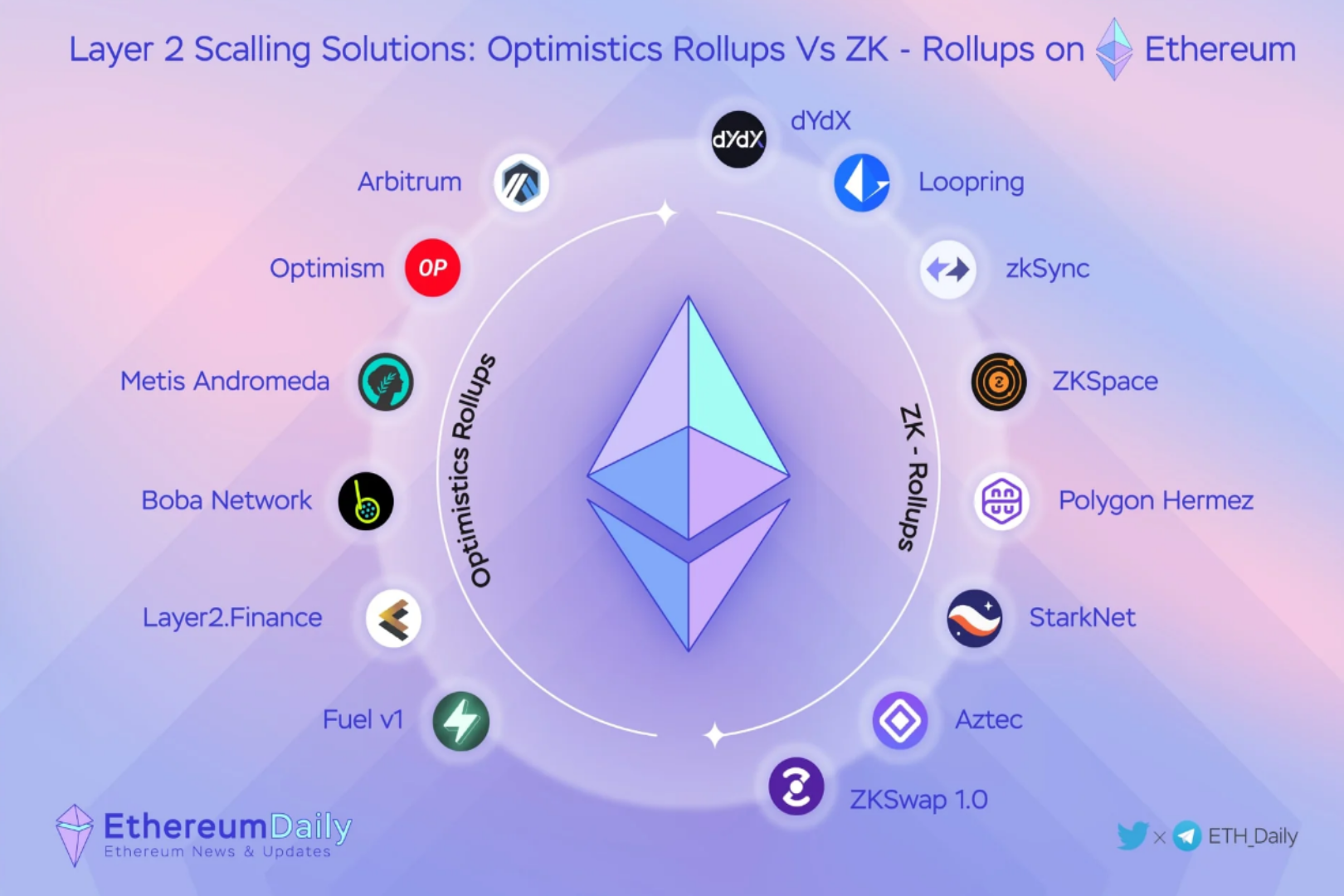

The leader of blockchain technology innovation

Fast and stable iteration is always the ultimate weapon of technological evolution. Ethereum adheres to the engineering idea of "rapid iteration", and from the beginning of the project design, it is determined that the protocol will be continuously upgraded as planned to ensure the optimal configuration of security, usability, functionality and decentralization. The outstanding technical innovations of Ethereum include cutting-edge technologies such as smart contract technology, sharding technology, Plasma and Roll Up expansion technology, and Layer2 solutions. The initial version of the network is Olympic, which is divided into four upgrade stages, Frontier (Frontier) , Homestead, Metropolis and Serenity, the first three stages are ETH1.0, and the last stage: Serenity is ETH2.0. Among them, ETH2.0 refers to the transition of Ethereum from POW consensus mechanism to POS consensus mechanism through a series of technical upgrades. Its core technology is sharding technology, which will greatly improve the processing capacity of the entire distributed system. The main historical upgrade events of Ethereum are as follows:

Main historical upgrade roadmap of Ethereum, BlockVC

The current Ethereum is similar to AlphaGo, which stayed in the laboratory stage before 2015. Although it has not yet entered the world stage, it has already shown unlimited potential for evolution, and it will surely shine in time.

The leader in the implementation of enterprise blockchain

The implementation of Ethereum-related technologies in the enterprise field is mainly carried out through the Enterprise Ethereum Alliance (EEA), which is a global industry standard organization promoted by alliance members and supported by the Ethereum development organization ConsenSys. The empowerment of blockchain technology makes it an open and trusted standard. Up to now, EEA has covered more than 3,000 global developers, covering more than 45 countries around the world (among them, 46% in North America, 31% in Europe, 19% in Asia, and 4% in other regions), more than 300 companies and more than 15 member organizations, including Intel, JP Morgan Chase, Microsoft and IC3 and other well-known corporate institutions. In terms of industrial structure, banks or financial companies account for about 24%, blockchain companies account for 5%, encrypted digital currency projects account for 17%, non-profit institutions account for 15%, academic research institutions account for 11%, and others account for 28%.

Part of the main members of the EEA, EEA

DApp ecological empire pioneer

The Ethereum network is a public blockchain that can be accessed without permission, supporting developers to create trusted and decentralized applications (DApps) through smart contracts, including cryptocurrency wallets, financial applications, decentralized markets, games etc. From the distribution of DApps, it can be seen that the DApps on ETH are mainly distributed in games, lottery, high-risk applications, exchanges, finance, tools, platforms and other fields, among which the number of DApps in the game field accounts for nearly 50%. The number of active accounts on the entire network reached 6494.14K, and the number of potential accounts reached 52959.63K, ranking first among similar platforms.

Distribution of DApps in ETH, DappTotal.com

Notably, DeFi is thriving on the Ethereum network. According to data from the intelligence tracking website Defipulse, the value of locked assets in Ethereum has hit a record high, reaching $779M, of which MakerDAO’s locked assets accounted for more than 56%. MakerDAO is a lending platform that also provides a way to generate the stable currency DAI through multi-asset collateral (such as ETH). In addition, DeFi can not only greatly increase the lock-up rate of ETH, but also provide an alternative channel to open up the traditional financial market, which may greatly accelerate the integration of the entire encrypted asset industry and traditional finance in the future.

Locked Funds for DeFi in Ethereum, Defipulse.com

A practitioner of global economic payment and settlement

Ethereum is becoming the payment and settlement layer of the global economy. Its native token ETH has the ability to perform payment settlement, value storage or collateral on a global scale. With the further improvement of Ethereum's processing capacity, it will even have high-frequency micropayments Settlement ability. In addition, if users choose to pay with stablecoins in order to prevent ETH price fluctuations, then the Ethereum network can also provide a variety of payment options, one is on-chain asset-backed stablecoins including DAI; The fiat currency stable currency project is migrating to Ethereum, among which USDT has migrated more than 4 billion US dollars of stable currency from the Omni protocol to the Ethereum network.

Comparison of various cross-border payment methods, Google

secondary title

Undervalued ETH

However, as a representative star project of the second-generation blockchain, Ethereum created and applied the epoch-making blockchain technology of smart contracts. The real value of its original asset ETH has been underestimated by the market, mainly reflected in :

Undervalued compared to BTC

Observing the price curve of ETH/BTC, we can find that ETH has been in a downward trend for a long time in the past year, but since September 2019, the price of ETH/BTC has stabilized and rebounded recently.

ETH/BTC price curve (2018.12.10-2020.01.15), CoinMarketCap

Compared with BTC, the market value of ETH has reached about 17.8 billion US dollars, accounting for about 11.2% of the market value of Bitcoin, ranking second in the market value of global encrypted digital currencies, and the number of active addresses on the entire network has reached about 311.6K, accounting for about 100% of the active addresses of Bitcoin. 36.6% of the number. Assuming that the unit network value of the two is similar, the market value of ETH is underestimated by the market, which is significantly lower than the size of its network active addresses.

The number of active addresses on the entire network of Bitcoin and Ethereum, Coinmetrics.io

In terms of the historical data of the rising market, according to data from the encrypted digital currency exchange Binance, on December 10, 2018, BTC and ETH reached their lowest point since 2017 at the same time, respectively 3149USD and 81.79USD (standard value), and has risen all the way since then, reaching a high point on June 24, 2019 (14000USD and 362.5USD respectively), and rebounded to 8660USD and 162USD after falling back, the highest growth rate in the past year is 444% and 442%, respectively. The lowest point increases were 275% and 198%. Obviously, BTC and ETH have diverged in the recent rebound, and the increase of ETH is not as high as that of BTC, which is only 72% of the latter. Obviously, compared with the previous round of historical data, the upside of ETH is still huge.

Undervalued compared to similar smart contract platforms

In the market performance of native digital currencies of similar smart contract platforms, the value of ETH is also greatly underestimated. Compared with the basic data of the network ecology, as of now, the number of DApps created on Ethereum far exceeds the number of similar blockchain platforms, reaching nearly 4 times the number of DApps in EOS and TRON platforms.

Comparison of the total number of DApps in ETH, EOS and TRON, DappTotal.com

secondary title

outlook

outlook

From the analysis of simple supply and demand relationship, it can be found that the price change of ETH directly depends on the relationship between supply and demand, that is, the less ETH circulating in the entire ecosystem, the more conducive to the release of ETH value. According to the development trend of Ethereum, it can be judged that the following reasons will reduce the amount of circulating ETH in the trading market, including but not limited to:

Due to the adoption of the over-collateralization model, the development of DeFi will promote the mortgage of a large number of ETH assets locked in smart contracts, thereby reducing the circulation of ETH;

After ETH2.0 will adopt the POS consensus mechanism, it will need to mortgage and lock a large amount of ETH to become a node or participate in voting decisions;

In other ETH applications, the locked ETH is naturally stranded due to capital turnover in commercial activities;

The rapid evolution of Ethereum technology and the proliferation of consensus have prompted investors to actively lock positions, thereby reducing market liquidity.