We always vowed to change our minds, we always believed we could win.

This is today's liquidation order.

It's just a normal day, because I fell asleep while staring at the disk. Somewhat annoyed.

Sometimes I think, what kind of gambler psychology leads to the generation of contract players?

There is a theory called the gambler's fallacy, also known as the Monte Carlo fallacy, that is, the probability of an event in a random sequence is related to the previous event, and the probability of occurrence will increase with the number of times the event has not occurred before.

This is a series of liquidation emails.

At this time, I have just been employed for 4 months.

With a better understanding of the blockchain industry, the frequency of making contracts has unknowingly increased by a full 20 times compared to 4 months ago, and the highest monthly loss has also reached a new and terrible figure. because3 liquidations! After being cut leeks countless times, I decided to switch from the Internet to the blockchain, Now it seems that it is indeed a bit ironic.

And these are prudent operations that have been established on the premise of leisure time operations, small high-frequency operations, and continuous band operations. (The author of this article, Mao Buboo: operates in the blockchain industry, is committed to researching the token economy, and is a former senior operator of Sina.)

As for the blockchain, if there is technology, there will naturally be finance, and if there is human nature, there will naturally be greed.

image description

image description

(rumored 500 times contract)

Regarding some pitfalls of the contract, I sorted them out after a round of collection on Weibo and Moments.

1. Don't trade on the delivery day.

2. Don't trade full positions.

3. Pay attention to the time points of the long and short bursts in the early morning and early morning.

4. Never take chances.

5. Do not hold positions overnight.

It seems that every contract player can tell a lot of experience at will, it seems that 3 out of every 10 contract players around him are on the way to defend their rights, and every contract player who wants to uninstall will eventually start again in one way or another.

The contract function of the centralized exchange is like a roulette wheel. Once you start to sit down, then you will never be able to leave the same as when you came. According to statistics, the proportion of users who play contracts is as high as 63.70% among the practitioners of currency speculation.

No money, no currency, and overdrawn body, these are the common characteristics of most contract players. It's not just blockchain, it's more about finance and humanity.

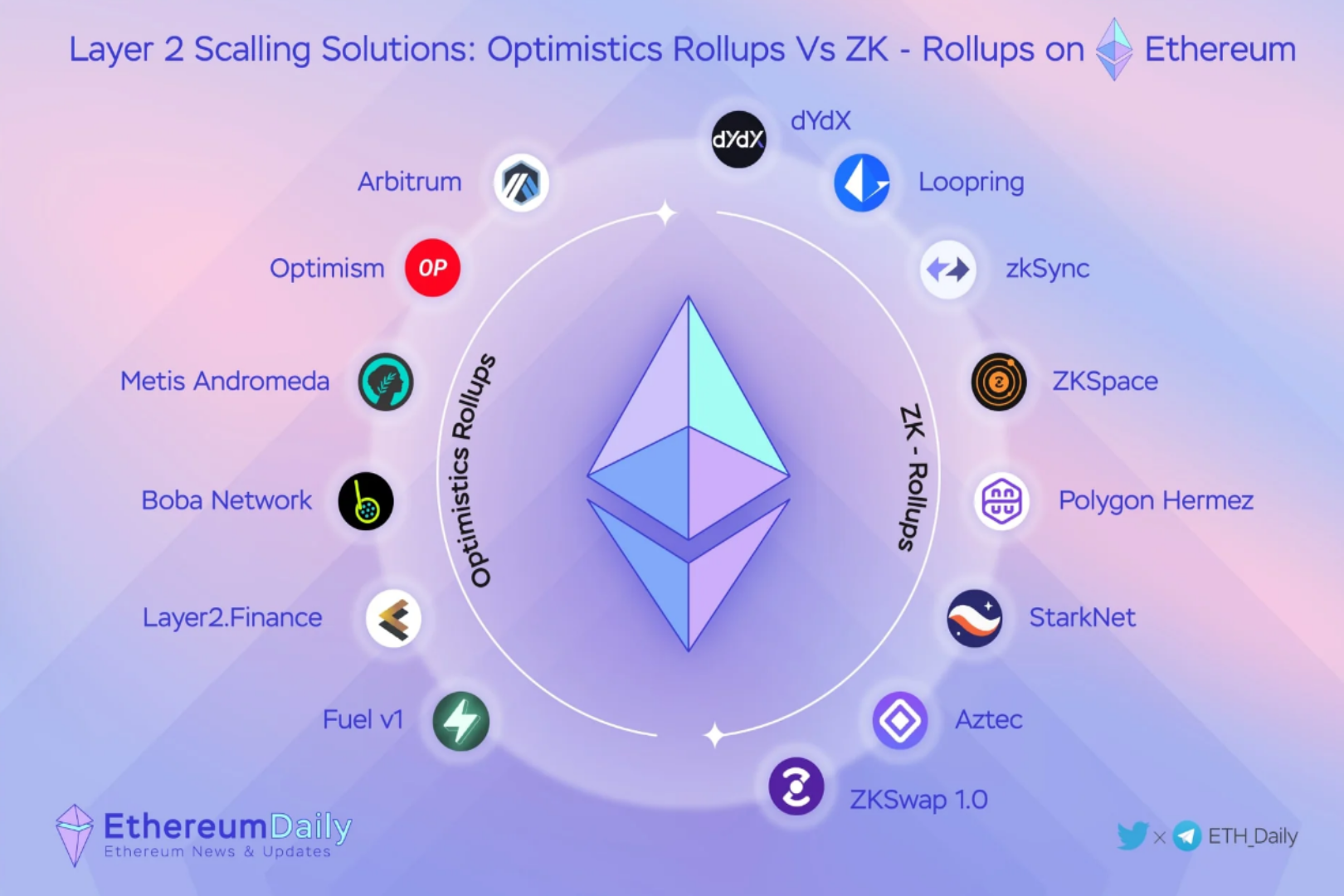

Could this be an opportunity for decentralized exchanges?

Don't rush to place orders, don't follow orders blindly, and don't call orders at will.